FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Need help with this financial accounting question

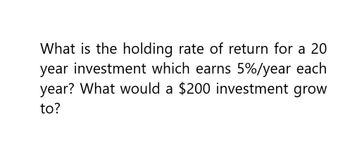

Transcribed Image Text:What is the holding rate of return for a 20

year investment which earns 5%/year each

year? What would a $200 investment grow

to?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What is the internal rate of return (IRR) of an investment that requires an initial investmen of $11,000 today and pays $15,400 in one year's time?arrow_forwarda) If you invest $5 and will receive $8 next year, what is your simple return? b) If you invest $5 and will receive $8 next year, what is your holding rate of return for each month? What is average monthly rate of return?arrow_forwardIf PV=$100, i=2%, n=5 years, and the investment compounds annually, what is the equation for Future Value?arrow_forward

- What is the present value of an investment that will pay $1,000 in one year's time, and $1,000 every year after that, when the interest rate is 8%?arrow_forwardWhat is the present value of an investment that pays $190 at the end of year 1, $107 at the year of year 2, and $235 at the end of year 3 if this investment earns 5% annually? your answer should be to the nearest dollar. For example, if your answer is id=mce_marker50, then input as 150.arrow_forwardSuppose you have an investment offer that guarantees an average investment gain of $1,000 per year. (a) What is the average rate of change (in dollars per year) of this investment? $? per year (b) If the value of the investment today is $10,000, what will be the value (in dollars) of the investment in 2 years? $?arrow_forward

- Suppose you invest $3,000 today and receive $10,000 in 25 years. a. What is the internal rate of return (IRR) of this opportunity? b. Suppose another investment opportunity also requires $3,000 upfront, but pays an equal amount at the end of each year for the next 25 years. If this investment has the same IRR as the first one, what is the amount you will receive each year? a. What is the internal rate of return (IRR) of this opportunity? The IRR of this opportunity is%. (Round to two decimal places.) b. Suppose another investment opportunity also requires $3,000 upfront, but pays an equal amount at the end of each year for the next 25 years. If this investment has the same IRR as the first one, what is the amount you will receive each year? The periodic payment that gives the same IRR is $ (Round to the nearest cent.)arrow_forwardYou have an investment opportunity that requires an initial investment of $5,000 today and will pay $6,000 in one year. What is the rate of return of this opportunity? The rate of return for this opportunity is ____%.arrow_forwardYou have an opportunity to invest $ 50 comma 900 now in return for $ 59 comma 900 in one year. If your cost of capital is 7.6 %, what is the NPV of this investment?arrow_forward

- What is the value of today of an investment that will pay $100 per year for 5 years. Assume first payment is made 1 year from today and the interest rate is 7%?arrow_forwardIf money is invested at 6% per year, after approximately how many years will the interest earned be equal to the original investment?arrow_forwardWhat is effevtive interest rate per year for an investment of $50 at an interest rate of $5 per week?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education