EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

General accounting

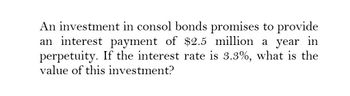

Transcribed Image Text:An investment in consol bonds promises to provide

an interest payment of $2.5 million a year in

perpetuity. If the interest rate is 3.3%, what is the

value of this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Quick answer of this accounting questionsarrow_forwardExplain the nature of the potential lending losses associated with each of the following: default risk, liquidity risk, and maturity risk. What would you pay for an annuity paying $3,000 per year for 12 years if the interest rate is 10%?arrow_forwardWhich of the following investments that pay will $18,500 in 8 years will have a higher price today? The security that earns an interest rate of 8.50%. The security that earns an interest rate of 12.75%.arrow_forward

- YTMarrow_forwardD4) What is the interest income in dollars on a $10 million art financing loan priced at 8% collateralized by $15 million at the beginning of the year if the value of the collateral falls to $12 million at the end of the year?arrow_forwardEvaluate the net present value of following streams of income: a. $1000 per year at an interest rate of 5% in perpetuity. b. $1000 per year at an interest rate of 5% in perpetuity. c. $1 million per year at an interest rate of 5% in perpetuity. |d. $1 million per year in perpetuity, but not beginning until year t=5 at an interest rate of 15%.arrow_forward

- what;s the present value of perpetuity that pays % 1, 563 per year if the appropriate interest rate is 6.8% ?arrow_forwardou can assume that all payments are made at the beginning of the period and use "1" for the "type" argument in the formula. A. Suppose you invest $ 11,400 today. What is the future value of the investment in 29 years, if interest at 7% is compounded annually? B B. Suppose you invest $ 11,400 today. What is the future value of the investment in 29 years, if interest at 7% is compounded quarterly? 4 5 6 27 28 29 C. Suppose you invest St $ 570 monthly. What is the future value of the investment in 29 years, if interest at 5% is compounded monthly? Question 1 Question 2 + Ready Accessibility: Investigate MAR 17 A W +arrow_forwardCalculate the capital recovery factor (in percent) given that the nominal rate for a 12year-semi-quarterly compounded rate is 10.97% in an ordinary annuity. Need it asap plsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT