Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

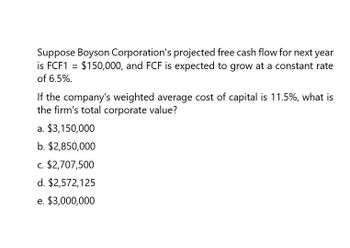

Transcribed Image Text:Suppose Boyson Corporation's projected free cash flow for next year

is FCF1 = $150,000, and FCF is expected to grow at a constant rate

of 6.5%.

If the company's weighted average cost of capital is 11.5%, what is

the firm's total corporate value?

a. $3,150,000

b. $2,850,000

c. $2,707,500

d. $2,572,125

e. $3,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardNeed helparrow_forwardGive true calculationarrow_forward

- Finance A firm's expected free cash flows in year 1, 2, and 3 are $30 million, $35 million, and $40 million respectively. Beyond year 3 the growth is constant at 5%. The cost of equity is 11% and the Weighted average cost of capital is 9%. What is the value of the firm in year 3 (Horizon value)?arrow_forwardIntro Exavior Inc.'s free cash flow during the current year is $140 million, which is expected to grow at a constant rate of 4% in the future. The weighted average cost of capital is 9%. Part 1 What is the firm's total corporate value (in $ million)? 0+ decimals Submitarrow_forwardProvide answer the following requirements on these general accounting questionarrow_forward

- Intro Nickelon's free cash flow during the current year is $150 million, which is expected to grow at a constant rate of 5% in the future. The weighted average cost of capital is 11%. Part 1 What is the firm's total corporate value (in $ million)? 0+ decimals Submitarrow_forwardYou are given the following information for a firm: EBIT this period = $18.7 million Depreciation = $2.5 million Net Working Capital Increase = $0 Asset Beta = 1.4 Capital Expenditures = $3.2 million Growth Rate of FCF = 3% Risk Free Rate = 3% Market Risk Premium = 6.3% Using the above data, what is the present value of all FCF?arrow_forwardCompute the value of a firm with free cash flows of $1,000, $2,500, and $3,000 over the next three years, a terminal firm value of $40,000 after three years, and the unlevered cost of capital is 15%. Assume that the interest rate tax shield is zero. O a. $26,191 O b. $27,234 Oc. $31,033 O d. $39,343arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you