Financial Management: Theory & Practice

16th Edition

ISBN: 9781337909730

Author: Brigham

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Give true calculation

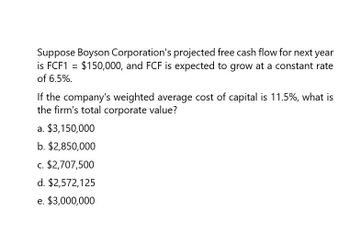

Transcribed Image Text:Suppose Boyson Corporation's projected free cash flow for next year

is FCF1 = $150,000, and FCF is expected to grow at a constant rate

of 6.5%.

If the company's weighted average cost of capital is 11.5%, what is

the firm's total corporate value?

a. $3,150,000

b. $2,850,000

c. $2,707,500

d. $2,572,125

e. $3,000,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Ogier Incorporated currently has $800 million in sales, which are projected to grow by 10% in Year 1 and by 5% in Year 2. Its operating profitability ratio (OP) is 10%, and its capital requirement ratio (CR) is 80%? What are the projected sales in Years 1 and 2? What are the projected amounts of net operating profit after taxes (NOPAT) for Years 1 and 2? What are the projected amounts of total net operating capital (OpCap) for Years 1 and 2? What is the projected FCF for Year 2?arrow_forwardSuppose Boyson Corporation's projected free cash flow for next year is FCF1 = $150,000, and FCF is expected to grow at a constant rate of 6.5%. If the company's weighted average cost of capital is 11.5%, what is the firm's total corporate value? a. $3,150,000 b. $2,850,000 c. $2,707,500 d. $2,572,125 e. $3,000,000arrow_forwardNeed helparrow_forward

- If you give me wrong answer, I will give you unhelpful ratearrow_forwardA company forecasts a free cash flow of $55 million in Year 3, i.e., at t = 3, and it expects FCF to grow at a constant rate of 5.5% thereafter. If the weighted average cost of capital (WACC) is 10.0% and the cost of equity is 15.0%, then what is the horizon, or continuing, value in millions at t = 3? Group of answer choices $1,083 $1,148 $1,289 $1,186 $1,212arrow_forward13. The firm's free cash flow during the just-ended year (t = 0) was P 100 million, and FCF is expected to grow at a constant rate of 5% in the future. If the weighted average cost of capital is 15%, what is the firm's value of operations, in millions? a. 948 d. 1,103 c. 1,050 f. 1,987 b. 998 e. 1,158 14. The projected cash flow for the next year is P 1,000,000, and FCF is expected to grow at a constant rate of 6%. If the company's weighted average cost of capital is 12%, what is the value of its operations? b. 16,666,667 e. 2,100,000 a. 1,714,750 d. 2,000,000 с. 8,833,333 f. 8,333,333arrow_forward

- Mooradian Corporation's free cash flow during the just-ended year (t = 0) was $300 million, and its FCF is expected to grow at a constant rate of 7.5% in the future. Assume the firm has zero non-operating assets. If the weighted average cost of capital is 12.5%, what is the firm's total corporate value, in millions? a. $4,300 million b. $6,000 million c. $2,400 million d. $2,580 million e. $6,450 millionarrow_forwardAn analyst is trying to estimate the intrinsic value of VN Co. that has a weighted average cost of capital at 10%. The estimated free cash flows for the company for the following years are: · Year 1 P3,000 · Year 2 P4,000 · Year 3 P5,000 The analyst estimates that after three years, free cash flow will grow at a constant annual percentage of 6%. What is the total intrinsic value of the company’s common stock if combined debt and preferred stock has a P25,000 market value? A. 98,556 B. 109,339 C. 78,310 D. 84,339arrow_forwardFinance A firm's expected free cash flows in year 1, 2, and 3 are $30 million, $35 million, and $40 million respectively. Beyond year 3 the growth is constant at 5%. The cost of equity is 11% and the Weighted average cost of capital is 9%. What is the value of the firm in year 3 (Horizon value)?arrow_forward

- BC Corporation has a weighted average cost of capital of 16%. What is its value if it will provide earnings to investors of P100,000 for the first year, P200,000 for the second year and P250,000 for every year onwards. a. P1,396,031.51 b. P1,225,861.02 c. P1,797,339.48 d. P1,617,271.54 e. None among the other choicesarrow_forwardIntro Exavior Inc.'s free cash flow during the current year is $140 million, which is expected to grow at a constant rate of 4% in the future. The weighted average cost of capital is 9%. Part 1 What is the firm's total corporate value (in $ million)? 0+ decimals Submitarrow_forwardIntro Nickelon's free cash flow during the current year is $150 million, which is expected to grow at a constant rate of 5% in the future. The weighted average cost of capital is 11%. Part 1 What is the firm's total corporate value (in $ million)? 0+ decimals Submitarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you