EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Hi expart Provide solution

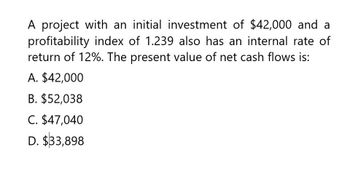

Transcribed Image Text:A project with an initial investment of $42,000 and a

profitability index of 1.239 also has an internal rate of

return of 12%. The present value of net cash flows is:

A. $42,000

B. $52,038

C. $47,040

D. $33,898

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume a project has cash flows of -$54,300, $18,200, $37,300, and $14,300 for Years 0 to 3, respectively. What is the profitability index given a required return of 12.6 percent? 1.02 .95 .98 1.06 ☐ 1.00arrow_forwardSolve this problem witharrow_forwardThe following table contains the estimated cash flows of a project. Assume the appropriate discount rate (hurdle rate) is 14%. Answer the following questions: Year Operating Cash Flow 0 -$20,000 1 $7,000 2 $8,000 3 $9,000 4 $4,000 b. What is the NPV of project 1?arrow_forward

- You are given the following information about the cash flows for Projects A and B: Project B $12,643.00 $6,264.00 $5.119.00 $4,284.00 $3,265.00 $2,884.00 Year 0 1 2 3 4 5 Given this information, and assuming a risk-adjusted discount rate of 14.0 percent for both projects, determine the internal rate of return (IRR) for the project with the highest net present value (NPV). 26.0818% 25.6301% 25.1784% Project A -$10,356.00 $2,185.00 $4,294.00 $4,642.00 $6,360.00 $3,125.00 O24.2750%arrow_forwardThe following table contains the estimated cash flows of a project. Assume the appropriate discount rate (hurdle rate) is 14%. Answer the following questions: Year Operating Cash Flow 0 -$20,000 1 $7,000 2 $8,000 3 $9,000 4 $4,000 c. What is the IRR of project 1?arrow_forwardConsider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forward

- Consider the cash flows for the following investment projects: (a) For Project A. find the value of X that makes the equivalent annual receiptsequal the equivalent annual disbursement at i = 13%.(b) Would you accept Project Bat i = 15% based on the AE criterion?arrow_forwardWhich of the following comes closest to the net present value (NPV) of a project whose initial investment is $5 and which produces two cash flows: the first at the end of year 2 of $3 and the second at the end of year 4 of $7? The required rate of return is 13%? Select one: a. $1.84 b. $0 c. $1.64 d. $2.05 e. $2.26arrow_forwardA project yields the following set of cash flows. What is the internal rate of return of this project? Assume the required rate of return is 5%. оо O Year Cash Flows ($) 0 -9,250 12 1 1,500 2 1,300 3 2,500 4 2,600 567 2,600 2,600 2,600 a. 13.58% b. 14.80% C. 10.92% d. 12.29% e. 8.58%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT