Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Solve Please Give Correct answer

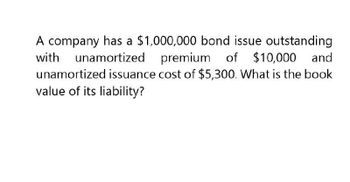

Transcribed Image Text:A company has a $1,000,000 bond issue outstanding

with unamortized premium of $10,000 and

unamortized issuance cost of $5,300. What is the book

value of its liability?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Financial Accounting Question please need helparrow_forwardBonds Payable has a balance of $1,091,000 and Discount on Bonds Payable has a balance of $13,092. If the issuing corporation redeems the bonds at 98, what is the amount of gain or loss on redemption?arrow_forwardBonds Payable has a balance of $802,000 and Discount on Bonds Payable has a balance of $9,624. If the issuing company redeems the bonds at 98, what is the amount of gain or loss on redemption?arrow_forward

- If the Bonds Payable account has a balance of $700,000 and the Discount on Bonds Payable account has a balance of $36,000, what is the carrying value of the bonds? Carrying value of the bonds $arrow_forwardA $276,000 bond was redeemed at 98 when the carrying amount of the bond was $271,860. What amount of gain or loss would be recorded as part of this transaction?arrow_forwardBrazzle Inc. issued $ 200,000 face value bonds at a discount and received $ 185,000 . At the end of 2021 , the balance in the Discount on Bonds Payable account is $ 10,000 . This year's balance sheet will show a net liability of: A. $ 180,000 B. $ 185,000 C. $ 195,000 D. $ 200,000arrow_forward

- If the bonds payable account has a balance of $100,000 and the premium on bonds payable account has a balance of $10,000, what is the carrying amount of the bonds? $110,000 $100,000 $90,000 There is no way to determine.arrow_forwardDevin Company computes the following bond interest amortization table for bonds issued on January 1, 2021. Use the information on this table to answer the questions below. Interest Cash Payment Payment Interest Decrease in Вook Date Amount Discount Value Expense $441,068 $444,310 $447,683 $451,190 $454,838 $458,631 $462,577 $466,680 $470,947 $475,385 Discount $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $81,068 $84,310 $87,683 $91,190 $94,838 $98,631 $102,577 $106,680 $110,947 $115,385 $892,240 $807,929 $720,247 $629,056 $534,219 $435,587 $333,011 $226,331 $115,385 $0 $11,107,760 $11,192,071 $11,279,753 $11,370,944 $11,465,781 $11,564,413 $11,666,989 $11,773,669 $11,884,615 $12,000,000 June 30, 2021 Dec 31, 2021 June 30, 2022 Dec 31, 2022 June 30, 2023 Dec 31, 2023 June 30, 2024 Dec 31, 2024 June 30, 2025 Dec 31, 2025arrow_forwardKeystone Corporation's balance sheet showed the following liability and stockholders' equity amounts: Current Liabilities, $100,000; Bonds Payable, $150,000; Long-Term Lease Obligations, $20,000; Deferred Income Tax Liability, $5,000; and total stockholders' equity, $500,000. The debt-to-equity ratio is Oa. 0.35. Оb. 0.20. Ос. 1.22. Od. 0.55.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning