EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

What is the firm's expected ROE?

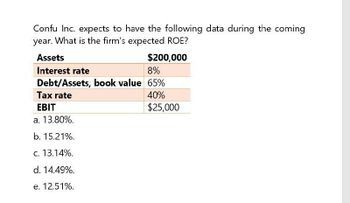

Transcribed Image Text:Confu Inc. expects to have the following data during the coming

year. What is the firm's expected ROE?

Assets

Interest rate

$200,000

8%

Debt/Assets, book value 65%

Tax rate

EBIT

40%

$25,000

a. 13.80%.

b. 15.21%.

c. 13.14%.

d. 14.49%.

e. 12.51%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Confu Inc. expects to have the following data during the coming year. What is the firm's expected ROE?arrow_forwardHernandez Corporation expects to have the following data during the coming year. What is Hernandez's expected ROE? (Show your work) Assets = $200,000 D/A = 65% EBIT = $25,000 Interest rate = 8% Tax rate = 40%arrow_forwardTechnology Inc. expects to have the following data during the coming year. What is Hernandez's expected ROE? Also, discuss the importance of the ROE to a company and to shareholders. $200,000 Interest rate 65% Tax rate Assets 8% D/A 40% EBIT $25,000arrow_forward

- 1. Given the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all current asset accounts, Net PPE, intangibles, other assets, and accounts payable increase spontaneously with sales. Calculate the pro forma value for total assets for FY24 if the firm operates at full capacity and no new debt or equity is issued. (Enter percentages as decimals and round to 4 decimals) 2. Given the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all…arrow_forwardGlobal Corp. expects sales to grow by 7% next year. Using the percent of sales method and the data provided in the given tables LOADING... , forecast: a. Costs except depreciation b. Depreciation c. Net income d. Cash e. Accounts receivable f. Inventory g. Property, plant, and equipment h. Accounts payable (Note: Interest expense will not change with a change in sales. Tax rate is 26%.) The Tax Cuts and Jobs Act of 2017 temporarily allows 100% bonus depreciation (effectively expensing capital expenditures). However, we will still include depreciation forecasting in this chapter and in these problems in anticipation of the return of standard depreciation practices during your career. Income Statement Net Sales 185.3Costs Except Depreciation -175.4EBITDA 9.9Depreciation and Amortization -1.2EBIT 8.7Interest Income (expense) -7.7Pretax Income 1Taxes (26%) -0.3Net Income 0.7 Balance Sheet Assets Cash 23.4Accounts…arrow_forwardSuppose that Gyp Sum Industries currently has the balance sheet shown below, and that sales for the year just ended were $9.9 million. The firm also has a profit margin of 30 percent and a retention ratio of 20 percent, and expects sales of $7.9 million next year. AssetsLiabilities and EquityCurrent assets$ 1,741,000Current liabilities$ 1,401,840Fixed assets4,100,000Long-term debt1,550,000 Equity2,889,160Total assets$ 5,841,000Total liabilities and equity$ 5,841,000 If all assets and current liabilities are expected to shrink with sales, what amount of additional funds will Gyp Sum need from external sources to fund the expected growth?arrow_forward

- 2. 1. 1. Given the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all current asset accounts, Net PPE, intangibles, other assets, and accounts payable increase spontaneously with sales. Calculate the pro forma value for total assets for FY24 if the firm operates at full capacity and no new debt or equity is issued. (Enter percentages as decimals and round to 4 decimals) 2. Given the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio…arrow_forwardGiven the most recent financial statements for FY2023. Sales for FY2024 are expected to grow by 10 percent. The following assumption must be held in the pro forma financial statements. The tax rate (percentage), the interest expense ($ amount), and the dividend payout ratio (percentage) will remain constant. COGS, SGA, Depreciation, all current asset accounts, Net PPE, intangibles, other assets, and accounts payable increase spontaneously with sales. Calculate the internal growth rate if the firm operates at full capacity and no new debt or equity is issued. (Enter percentages as decimals and round to 4 decimals) MSFT ($ in millions, shares in millions) Income Statement Sales COGS Gross Profit Research and Dev. SGA FY2023 211,915 65,863 146,052 27,195 16653 Depreciation 13681 Operating Income, EBIT 88,523 Interest Expense 1968 Pretax income, EBT 86,555 Taxes 16950 Net income 69,605 32,902 36,703 Retained Earnings Dividends Price per share Shares outstanding 330.24 7,430 Balance Sheet…arrow_forwardFor the next fiscal year, you forecast net income of $ 50, 700 and ending assets $500, 300. Your firm's payout ratio is 9.8 %. Your beginning stockholders' equity is $298, 400, and your beginning total liabilities are $ 120, 800. Your non - debt liabilities, such as accounts payable, are forecasted to increase by $10,200. What will be your net new financing needed for next year? rounded to the nearest dollararrow_forward

- For the next fiscal year, you forecast net income of $51,900 and ending assets of $508,000. Your firm's payout ratio is 10.2%. Your beginning stockholders' equity is $295.900, and your beginning total liabilities are $120,800. Your non-debt liabilities, such as accounts payable, are forecasted to increase by $9,800. What will be your net new financing needed for next year? The net financing required will be $ (Round to the nearest dollar)arrow_forward(B) Based on the following information, how much does the company need in external funds for the upcoming fiscal year? The company has Sales $ 5,700, Costs 4,200, Current assets 3,900, Fixed assets 8,100, Current liabilities 2,200, Long-term debt 3,750, and Equity 6,050. Sales increase 15% for the upcoming fiscal year. Payout ratio is 40% and Tax rate is 34%.arrow_forwardFor the next fiscal year, you forecast net income of $51,100 and ending assets of $506,900. Your firm's payout ratio is 10.2%. Your beginning stockholders' equity is $298,800, and your beginning total liabilities are $120,700. Your non-debt liabilities, such as accounts payable, are forecasted to increase by $10,000. What will be your net new financing needed for next year? The net financing required will be $. (Round to the nearest dollar.) Carrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT