SWFT Comprehensive Volume 2019

42nd Edition

ISBN: 9780357233306

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

needed help please provide help with this question

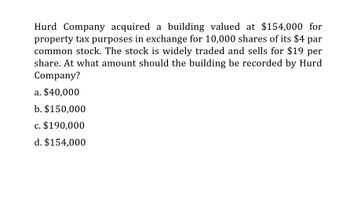

Transcribed Image Text:Hurd Company acquired a building valued at $154,000 for

property tax purposes in exchange for 10,000 shares of its $4 par

common stock. The stock is widely traded and sells for $19 per

share. At what amount should the building be recorded by Hurd

Company?

a. $40,000

b. $150,000

c. $190,000

d. $154,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Kansas Company acquired a building valued at $158,000 for property tax purposes in exchange for 12,000 shares of its $3 par common stock. The stock is widely traded and selling for $19 per share. At what amount should the building be recorded by Kansas Company? a. $228,000 b. $36,000 OC. $158,000 Od. $191,500arrow_forwardSteak Company acquired a building valued at $176,400 for property tax purposes in exchange for 10,400 shares of its $8 par common stock. The stock is widely traded and selling for $16 per share. At what amount should the building be recorded by Steak Company? O a. $176,400 O b. $166,400 O C. S83,200 O d. $239,200arrow_forwardKansas Company acquired a building valued at $210,000 for property tax purposes in exchange for 12,000 shares of its $5 par common stock. The stock is widely traded and selling for $15 per share. At what amount should the building be recorded by Kansas Company? Group of answer choices $60,000 $180,000 $210,000 $120,000arrow_forward

- The Stone Inn earned $167,284 in taxable income for the year. How much tax does the company owe on this income? TxableIncome 60.000 Tox Rale 18% 50.001- 75.000 75.001-100.000 100.001- 35.000 335.001- 10,000,000 a. $46,311.02 b. $48,490.76 c. $54,519.27 d. $65,240.76arrow_forwardanswer must be in table or i will give down votearrow_forwardfinancial accountarrow_forward

- Rochester inc had pretax accounting income of 2,700,000 and a tax rate of 20% in 2025 during its first year of operation. Following transactions Received advance rent from pack co for 2026: $96000 Received municipal bond interest $120000 Claimed depreciation for tax purposes in excess of book depreciation $60000 Reported installment sales rev on financial statements in 2025; not recognized for tax purposes until received in 2026: $162000 How much is current tax expense for 2025?arrow_forwardIf the beginning balance in Swan, Inc.’s OAA is $6,700 and the following transactions occur, what is Swan’s ending OAA balance? Depreciation recapture income $ 21,600Payroll tax penalty (4,200) Tax-exempt interest income 4,012Nontaxable life insurance proceeds 100,000 Life insurance premiums paid (nondeductible) (3,007)arrow_forwardA28arrow_forward

- On 1 November 2020, Bermuda Ltd acquired all the assets and liabilities (other than cash) of Triangle Ltd. The details on the assets and liabilities of Triangle Ltd were as follows: Carrying Amount Fair Value Cash 30,000 30,000 Equipment 120,000 140,000 Accounts Receivable 25,000 25,000 Furniture 35,000 25,000 Accounts Payable 10,000 10,000 Income tax Payable 19,000 19,000 Annual Leave Payable 14,000 14,000 In addition to the above items, Triangle Ltd had an internally generated brand name with a fair value of $75,000 that was not recognized in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition-related costs. The tax rate is 30%. Required: Conduct an acquisition analysis for Bermudaarrow_forwardOn 1 November 2020, Bermuda Ltd acquired all the assets and liabilities (other than cash) of Triangle Ltd. The details on the assets and liabilities of Triangle Ltd were as follows: Carrying Amount Fair Value Cash 30,000 30,000 Equipment 120,000 140,000 Accounts Receivable 25,000 25,000 Furniture 35,000 25,000 Accounts Payable 10,000 10,000 Income tax Payable 19,000 19,000 Annual Leave Payable 14,000 14,000 In addition to the above items Triangle Ltd had an internally generated brand name with a fair value of $75,000 that was not recognised in its accounts. The consideration Bermuda Ltd paid to Triangle Ltd was $80,000 cash and 20,000 shares. The fair value of each Bermuda Ltd share is $10. Bermuda Ltd paid $20,000 in acquisition related costs. Tax rate is 30%.arrow_forwardD. Star Company purchases Stripe Inc. for $13,985,000 cash on January 1, 2024. The book value of Stripe Inc. net assets reported on its December 31, 2023 statement of financial position was $12,620,000. Star’s December 31, 2023 analysis indicated that the fair value of Stripe’s tangible assets exceeded the book value by $560,000, and the fair value of identifiable intangible assets exceeded book value by $245,000. How much goodwill should be recognized by Star Company when recording the purchase of Stripe Inc.? $ E. Benz Co. incurred research and development costs in 2024 as follows: Materials used in research and development projects $ 450,000 Equipment acquired that will have alternate future uses in future research and development projects 3,000,000 Depreciation for 2024 on above equipment 300,000 Personnel costs of persons involved in research and development projects 750,000 Consulting fees paid to outsiders for research and development…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning