FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Step by step answer

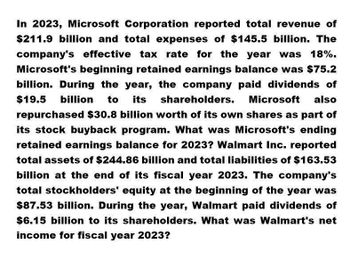

Transcribed Image Text:In 2023, Microsoft Corporation reported total revenue of

$211.9 billion and total expenses of $145.5 billion. The

company's effective tax rate for the year was 18%.

Microsoft's beginning retained earnings balance was $75.2

billion. During the year, the company paid dividends of

$19.5 billion to its shareholders. Microsoft also

repurchased $30.8 billion worth of its own shares as part of

its stock buyback program. What was Microsoft's ending

retained earnings balance for 2023? Walmart Inc. reported

total assets of $244.86 billion and total liabilities of $163.53

billion at the end of its fiscal year 2023. The company's

total stockholders' equity at the beginning of the year was

$87.53 billion. During the year, Walmart paid dividends of

$6.15 billion to its shareholders. What was Walmart's net

income for fiscal year 2023?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Amazon.com, Inc. is preparing its financial statements for the fiscal year ending December 31, 2023. The company's preliminary income statement shows net sales of $514 billion, cost of sales of $320 billion, operating expenses of $160 billion, and other income of $2 billion. Amazon's effective tax rate for the year is 21%. The company had 10.2 billion weighted average shares outstanding during the year and 10.3 billion shares outstanding at year-end. Calculate Amazon's basic earnings per share (EPS) for the fiscal year 2023, and determine if it has improved from the previous year when the basic EPS was $1.25. The Walt Disney Company is evaluating its financial performance for the fiscal year ending September 30, 2023. The company reported total revenues of $82.7 billion, cost of revenues of $52.3 billion, and operating expenses of $21.5 billion. Disney's interest expense for the year was $1.2 billion, and its effective tax rate was 25%. The company had 1.83 billion weighted average…arrow_forwardConcord Corporation had net sales of $2,429,400 and interest revenue of $34,300 during 2025. Expenses for 2025 were cost of goods sold $1,454,500, administrative expenses $214,500, selling expenses $299,000, and interest expense $48,800. Concord's tax rate is 30%. The corporation had 109,600 shares of common stock authorized and 62,566 shares issued and outstanding during 2025. Prepare a condensed multiple-step income statement for Concord Corporation (Round earnings per share to 2 decimal places, e.g. 1.48.) CONCORD CORPORATION Income Statement $ $arrow_forwardSunland Corporation earned net income of $363,460 in 2025 and had 100,000 shares of common stock outstanding throughout the year. Also outstanding all year was $800,000 of 5% bonds, which are convertible into 17,000 shares of common. Sunland's tax rate is 20 percent. Compute Sunland's 2025 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forward

- Marigold Corporation had net sales of $2,400,900 and interest revenue of $37,400 during 2020. Expenses for 2020 were cost of goods sold $1,466,300, administrative expenses $221,700, selling expenses $298,700, and interest expense $45,300. Marigold’s tax rate is 30%. The corporation had 100,000 shares of common stock authorized and 74,370 shares issued and outstanding during 2020. Prepare a single-step income statement for the year ended December 31, 2020. (Round earnings per share to 2 decimal places, e.g. 1.48.)arrow_forwardEdna Recording Studios, Inc., reported earnings available to common stock of $4,200,000last year. From those earnings, the company paid a dividend of $1.28 on each of its 1,000,000 common shares outstanding. The capital structure of the company includes 30% debt, 15% preferred stock, and 55% common stock. It is taxed at a rate of 21%. a. If the market price of the common stock is $46 and dividends are expected to grow at a rate of 6% per year for the foreseeable future, what is the company's cost of retained earnings financing? b. If underpricing and flotation costs on new shares of common stock amount to $7 per share, what is the company's cost of new common stock financing? c. The company can issue $2.01 dividend preferred stock for a market price of $34 per share. Flotation costs would amount to $4 per share. What is the cost of preferred stock financing? d. The company can issue $1,000-par-value, 8% annual coupon, 5-year bonds that can be sold for…arrow_forwardIn 2022, Cullumber Corporation had net sales of $600,000 and cost of goods sold of S 353,000. Operating expenses were $149, 000, and interest expense was $5,500. The corporation's tax rate is 20%. The corporation declared preferred dividends of $11,500 in 2022, and its average common stockholders' equity during the year was $182, 000. Prepare an income statement for Cullumber Corporation.arrow_forward

- Rizzo Co. has Net Income of $279,000 for 2024. Over the past two years, the company had outstanding 125,000 shares of common stock. During the year, the company paid dividends on preferred stock in the amount of $45,000. The company has outstanding all year 20,000 shares of cumulative preferred stock. Each share of preferred stock is convertible into 4 shares of common stock. The company's tax rate is 20 percent. What is the company's diluted earnings per share?arrow_forwardRizzo Co. has Net Income of $279,000 for 2024. Over the past two years, the company had outstanding 125,000 shares of common stock. During the year, the company paid dividends on preferred stock in the amount of $45,000. The company has outstanding all year 20,000 shares of cumulative preferred stock. Each share of preferred stock is convertible into 4 shares of common stock. The company's tax rate is 20 percent. What is the company's basic earnings per share?arrow_forwardBonita Corporation earned net income of $443,000 in 2025 and had 110,000 shares of common stock outstanding throughout the year. Also outstanding all year was $700,000 of 5% bonds, which are convertible into 15,000 shares of common. Bonita's tax rate is 30 percent. Compute Bonita's 2025 diluted earnings per share. (Round answer to 2 decimal places, e.g. 3.55.) Diluted earnings per share $arrow_forward

- At the beginning of 2025, Bridgeport Industries had 26,000 shares of common stock issued and outstanding and 500 of $1,000, 6% bonds (issued at par), each convertible into 10 shares of common stock. During 2025, Bridgeport had revenues of $152,000 and expenses other than interest and taxes of $111,000. Assume that the tax rate is 20%. None of the bonds was converted or redeemed. (a) Compute diluted earnings per share for 2025. (Round answer to 2 decimal places, e.g. 2.55.) Earnings per share $ (b) Assume the same facts as those assumed for part (a), except that the 500 bonds were issued on September 1, 2025 (rather than in a prior year), and none have been converted or redeemed. Compute diluted earnings per share for 2025. (Round answer to 2 decimal places, e.g. 2.55.) Earnings per share $ 1.06 Earnings per share $ 1.04 (c) Assume the same facts as assumed for part (a), except that 100 of the 500 bonds were actually converted on July 1, 2025. Compute diluted earnings per share for…arrow_forwardAt the end of 2021, PT. Wardah International announced a gross profit of $1 million. The costs incurred during the year are as follows: $345,000 in operating expenses and $125,000 in interest expenses. 21% corporate tax and declared $57,000 total preferred stock dividends. Calculate: (a) Compute the earnings available for common stockholders? (b) Calculate the increase in retained earnings for 2021 If the firm provides $4.25 common stock dividend. The company has 15,000 shares of common stock outstanding.arrow_forwardNash Corporation had net sales of $2,416,400 and interest revenue of $33,800 during 2020. Expenses for 2020 were cost of goods sold $1,458,000, administrative expenses $215,200, selling expenses $291,000, and interest expense $52,500. Nash’s tax rate is 30%. The corporation had 103,000 shares of common stock authorized and 73,570 shares issued and outstanding during 2020. Prepare a single-step income statement for the year ended December 31, 2020. (Round earnings per share to 2 decimal places, e.g. 1.48.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education