FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

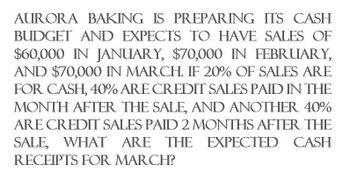

Transcribed Image Text:AURORA BAKING IS PREPARING ITS CASH

BUDGET AND EXPECTS TO HAVE SALES OF

$60,000 IN JANUARY, $70,000 IN FEBRUARY,

AND $70,000 IN MARCH. IF 20% OF SALES ARE

FOR CASH, 40% ARE CREDIT SALES PAID IN THE

MONTH AFTER THE SALE, AND ANOTHER 40%

ARE CREDIT SALES PAID 2 MONTHS AFTER THE

SALE, WHAT ARE THE EXPECTED CASH

RECEIPTS FOR MARCH?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Limitless Styles has a 45 day accounts payable period. The firm has expected sales of $900, $1,200, $1,900, and $2,600, respectively, by quarter for the next calendar year. The cost of goods sold for a quarter is equal to 70% of the next quarter sales. The firm has a beginning payables balance of $600 as of quarter one. What is the amount of the projected cash disbursements for accounts payable for Quarter 3 of the next year? Assume that a year has 360 days. A)$1,195 B)$1,085 C)$1,575arrow_forwardHere is a forecast of sales by National Bromide for the first 4 months of 2022 (figures in thousands of dollars): Month: Cash sales Sales on credit 1 23 140 Month 3 Month 4 On average, 50% of credit sales are paid for in the current month, 30% in the next month, and the remainder in the month after that. What are the expected cash collections in months 3 and 4? Note: Enter your answers in whole dollars not in thousands of dollars. $ $ 2 3 32 26 160 130 > Answer is complete but not entirely correct. Expected Cash Collections 4 22 110 191,000 X 172,000 Xarrow_forwardHere is a forecast of sales by National Bromide for the first 4 months of 2022 (figures in thousands of dollars): Month: Cash sales Sales on credit 1 2 3 4 27 36 30 26 160 180 150 130 On average, 50% of credit sales are paid for in the current month, 30% in the next month, and the remainder in the month after that. What are the expected cash collections in months 3 and 4? Note: Enter your answers in whole dollars not in thousands of dollars. Month 3 Month 4 Expected Cash Collectionsarrow_forward

- Your projected sales for the first 3 months of next year are as follows:January, $15,000; February, $20,000; and March, $25,000. Based on lastyear’s data, cash sales are 20 percent of total sales for each month. Of theaccounts receivable, 60 percent are collected in the month after the sale and40 percent are collected in the second month following the sale. Sales forNovember of the current year are $15,000 and for December are $17,000.You have the following estimated payments: January, $4,500; February,$5,500; and March, $5,200.a. Using the format from the pro forma cash budget in Table 6–8, what is yourmonthly cash budget for January, February, and March?b. What will your accounts receivable be for the beginning of April?c. Will your company have any borrowing requirements for any month duringthis 3-month period?arrow_forwardBrandeis, Inc has a 45-day accounts payable period. The firm has expected quarterly sales of $2,400, $2,800, $3,600, and $4,200, respectively, for the next calendar year. The cost of goods sold for a quarter is equal to 70% of the next quarter sales. The firm has a beginning payables balance of $1,200 as of quarter one. What is the amount of the projected cash disbursements for accounts payable for quarter 3 of the next year? Each quarter has 90 days. Multiple Choice $3,900 $2,730 $2,240 $2,870 $3,060arrow_forwardBruno Industries expects credit sales for January, February, and March to be $200,000, $260,000, and $300,000, respectively. It is expected that 55% of the sales will be collected in the month of sale, 35% will be collected in the following month, and 10% will be collected in the second month after the sales. How much will the closing balance of Accounts Receivable at the end of March be? 3. In the beginning of the period, XYZ Ltd. expects to sell 15,000 units for $10 each. Its standard cost card shows the total cost of production per unit is $8. At the end of the period, the company reported actual sales revenue at $120,000 for 16,000 units sold. What was the sale price variance?arrow_forward

- Worthington Company expects that cash sales will be 20% of total sales, credit card sales will be 50% of total sales, and account sales will be 30% of total sales. Credit card sales are collected in the month following the sale, net a 3% credit card fee. This means that if the sale is $100, the credit card company's fee is $3, and Worthington receives $97. Account sales will be collected as follows: 40% in the first month following the sale, 50% in the second month following the sale, 8% in the third month following the sale, and 2% never collected. The following table identifed the projected sales for the first year of operations: Month Sales Month January $12,369,348 July Sales $21,747,839 February 15,936,293 August 14,908,534 March 13,294,309 September 11,984,398 April 19,373,689 October 18,894,535 May 20,957,566 November 21,983,545 June 18,874,717 December 20,408,367 Complete the following statement showing the cash expected each month from the collections of these sales. Round all…arrow_forwardHawaii Inc. has projected sales to be P260,000 in June, P 270,000 in July and P300,000 in August. Hawaii collects 30% of a month’s sales in the month of sale, 50% in the month following the sale and 20% in the second month following the sale. What is the accounts receivable balance on August 31?arrow_forwardHow to solve for the 3rd and 4th month.arrow_forward

- Here is a forecast of sales by National Bromide for the first 4 months of 2019 (figures in thousands of dollars): Month: 1 2 3 4 Cash sales 19 28 22 18 Sales on credit 120 140 110 90 On average, 50% of credit sales are paid for in the current month, 30% in the next month, and the remainder in the month after that. What are the expected cash collections in months 3 and 4? (Enter your answers in whole dollars not in thousands of dollars.)arrow_forwardWilson, the banker, will finance construction if the firm can present an acceptable three-month financial plan for January through March. The following are actual and forecast sales figures: Actual November December Sales Credit sales $ 600,000 January 620,000 February March Cash sales One month after sale Two months after sale Total cash receipts Of the firm's sales, 50 percent are for cash and the remaining 50 percent are on credit. Of credit sales, 50 percent are paid in the month after sale and 50 percent are paid in the second month after the sale. Materials cost 30 percent of sales and are purchased and received each month in an amount sufficient to cover the following month's expected sales. Materials are paid for in the month after they are received. Labor expense is 40 percent of sales and is paid for in the month of sales. Selling and administrative expense is 20 percent of sales and is paid in the month of sales. Overhead expense is $38,000 in cash per month. Forecast…arrow_forwardHere is a forecast of sales by National Bromide for the first 4 months of 2022 (figures in thousands of dollars): Month: 1 2 3 4 Cash sales 34 43 37 33 Sales on credit 195 215 185 165 On average, 60% of credit sales are paid for in the current month, 20% in the next month, and the remainder in the month after that. What are the expected cash collections in months 3 and 4? Note: Enter your answers in whole dollars not in thousands of dollars.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education