FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

None

Transcribed Image Text:17

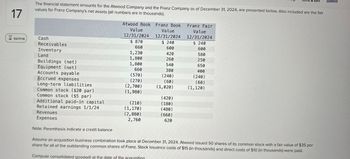

The financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2024, are presented below. Also included are the fair

values for Franz Company's net assets (all numbers are in thousands).

Atwood Book Franz Book

Franz Fair

Value

12/31/2024

Value

12/31/2024

Value

12/31/2024

02:17:14

Cash

$ 870

$ 240

$ 240

Receivables

660

600

600

Inventory

1,230

420

580

Land

1,800

260

250

Buildings (net)

1,800

540

650

Equipment (net)

660

380

400

Accounts payable

(570)

(240)

(240)

Accrued expenses

Long-term liabilities

(270)

(60)

(2,700)

(1,020)

(60)

(1,120)

Common stock ($20 par)

(1,980)

Common stock ($5 par)

(420)

Additional paid-in capital

(210)

(180)

Retained earnings 1/1/24

(1,170)

(480)

Revenues

(2,880)

(660)

Expenses

2,760

620

Note: Parenthesis indicate a credit balance

Assume an acquisition business combination took place at December 31, 2024. Atwood issued 50 shares of its common stock with a fair value of $35 per

share for all of the outstanding common shares of Franz. Stock issuance costs of $15 (in thousands) and direct costs of $10 (in thousands) were paid.

Compute consolidated goodwill at the date of the acquisition

Submit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Provide a Conclusion and Recommendation for the company.arrow_forwardThe financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands). Atwood Franz Co. Franz Co. Book Value Book Value Fair Value 12/31/2021 12/31/2021 12/31/2021 Cash $ 870 $ 240 $ 240 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570 ) (240 ) (240 ) Accrued expenses (270 ) (60 ) (60 ) Long-term liabilities (2,700 ) (1,020 ) (1,120 ) Common stock ($20 par) (1,980 ) Common stock ($5 par) (420 ) Additional paid-in capital (210 ) (180 ) Retained earnings 1/1/18 (1,170 ) (480 ) Revenues (2,880 ) (660 )…arrow_forwardThe financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands). Atwood Franz Co. Franz Co. Book Value Book Value Fair Value 12/31/2021 12/31/2021 12/31/2021 Cash $ 870 $ 240 $ 240 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570 ) (240 ) (240 ) Accrued expenses (270 ) (60 ) (60 ) Long-term liabilities (2,700 ) (1,020 ) (1,120 ) Common stock ($20 par) (1,980 ) Common stock ($5 par) (420 ) Additional paid-in capital (210 ) (180 ) Retained earnings 1/1/18 (1,170 ) (480 ) Revenues (2,880 ) (660 )…arrow_forward

- 11 and 12 plsssarrow_forwardThe financial statement amounts for the Atwood Company and the Franz Company as of December 31, 2021, are presented below. Also included are the fair values for Franz Company's net assets (all numbers are in thousands). Atwood Franz co. Franz Co. Particular Book Value Book Value fair Value 12/31/2021 12/31/2021 12/31/2021 Cash 870 240 240 Receivables 660 600 600 Inventory 1,230 420 580 Land 1,800 260 250 Buildings (net) 1,800 540 650 Equipment (net) 660 380 400 Accounts payable (570 (240 (240 Accrued expenses (270 (60 (60 Long-term liabilities (2,700 (1,020 (1,120 Common stock ($20 par) (1,980 Common stock ($5 par) (420 Additional paid-in capital (210 (180 Retained earnings 1/1/18 (1,170 (480 Revenues (2,880 (660 Expenses 2,760 620 Note: Parenthesis indicates a credit balance. Assume an acquisition business combination took place on December 31, 2021. Atwood issued 50 shares of its common stock with a fair value of $35 per…arrow_forwardGenatron Manufacturing Corporatio Balancs Sh出出t 2017 216 ASSETS Cach $41,752 $51,878 Accts. recelvable 260, 499 200,543 Inventory 450,460 Total current assets B02, 735 702,181 Fixed asset, nct 300, 100 $1,202, 735 $1,002, 381 LIABILITIES AND EQUITY Accts. paysble $172,648 $131,068 Bank loan 91,013 91,013 Accrusis 70,000 50, 000 Total current Isbllties 333,661 272.081 Long-term deot, 12% 398,220 290,301 Common stock, $10 par 300,000 Capital surplus 44,555 44,555 Retained crninga 126,299 95,444 Total liabiliiti &oulty 51.202,735 51,002,381 2017 2016 Net sales Cost of peocS So0 388,411 Gross profit E72.274 Experses: General ancasm nistrative 50.000 Market ng cod ost rer cs 44.5E5 Ceprec at cn v (a) Calculate Genatron's dollar amount of net working capital in each year. Interest E5.024 Earnings tetsre taxes 267.055 227.266 2017 2016 Incometaxes 75 145 Net working capital et ncome %24arrow_forward

- ect Assignment The preliminary 2024 income statement of Alexian Systems, Incorporated, is presented below: ALEXIAN SYSTEMS, INCORPORATED Income Statement. For the Year Ended December 31, 2024 ($ in millions, except earnings per share) Revenues and gains: Sales revenue Interest revenue Other income Total revenues and gains. Expenses: Cost of goods sold Selling and administrative expense Income tax expense Total expenses Net Income Earnings per share $ 435 6 128 569 247 158 41 446 $123 $ 12.30 Saved Help Additional information: 1. Selling and administrative expense includes $28 million in restructuring costs. 2. Included in other income is $120 million in income from a discontinued operation. This consists of $90 million in operating income and a $30 million gain on disposal. The remaining $8 million is from the gain on sale of investments. 3. Cost of Goods Sold in 2024 includes an increase of $10 million to correct an understatement of Cost of Goods Sold in 2023. The amount is material.…arrow_forwardeBook Question Content Area Horizontal Analysis of Income Statements Consolidated income statements for Cooper Manufacturing follow. Cooper ManufacturingConsolidated Income Statements(in thousands except per share amounts) Three fiscal years ended December 31 2023 2022 2021 Sales $10,088,322 $7,976,954 $7,086,542 Costs and expenses: Cost of goods sold $6,844,915 $5,107,113 $4,003,989 Research and development 592,001 664,564 602,135 Selling, general, and administrative 1,384,111 1,550,857 1,642,770 Restructuring costs and other (126,855) 320,856 50,000 $8,694,172 $7,643,390 $6,298,894 Operating income $1,394,150 $333,564 $787,648 Interest and other income, net (21,988) 29,321 49,634 Income before income taxes $1,372,162 $362,885 $837,282 Provision for income taxes 381,525 50,104 285,430 Net…arrow_forwardPlease give me answer general accounting questionarrow_forward

- The following are selected account balances from Penske Company and Stanza Corporation as of December 31, 2024: Revenues Accounts Cost of goods sold Depreciation expense Investment income Dividends declared Retained earnings, 1/1/24 Current assets Copyrights Royalty agreements Penske $ (812,000) 289,200 223,000 Not given 80,000 (708,000) 448,000. 978,000 626,000 Stanza $ (680,000) 170,000 204,000 0 60,000 (270,000) 632,000 378,500 Investment in Stanza Liabilities Common stock Additional paid-in capital 1,048,000 Not given (506,000) 0 (1,262,500) (600,000) ($20 par) (150,000) (200,000) ($10 par) (80,000) Note: Parentheses indicate a credit balance. On January 1, 2024, Penske acquired all of Stanza's outstanding stock for $762,000 fair value in cash and common stock. Penske also paid $10,000 in stock issuance costs. At the date of acquisition, copyrights (with a six-year remaining life) have a $466,000 book value but a fair value of $622,000. Required: a. As of December 31, 2024, what is…arrow_forwardQuestion The financial statements of Harry Ltd and its subsidiary Olivia Ltd have been extracted from their financial records at 30 June 2023 and are presented below. Harry Ltd$ Olivia Ltd$Sales 839 250 725 000Cost of goods sold (580 000) (297 500)Gross profit 259 250 427 500Dividends received 116 250 -Management fee revenue 33 125 Gain on sale of plant 43 750 Less Expenses Administration (38 500) (48 375)Depreciation (30 625) (71 000)Management fee - (33 125)Other expenses (126 375) (96 250)Profit before tax 256 875 178 750Tax expense (76 875) (52 750)Profit after tax 180 000 126 000Retained earnings 1 July 2022 399 250 299 000 579 250 425 000Dividends paid (171 750) (116 250)Retained earnings 30 June 2023 407 500 308 750 Statement of financial position Harry Ltd$ Olivia Ltd$Shareholders’ equity Retained earnings 407 500 308 750Share capital 437…arrow_forwardThe condensed financial statements of Carla Vista Co. for the years 2021 and 2022 are presented below. CARLA VISTA CO.Balance SheetsDecember 31 (in thousands)20222021Current assets Cash and cash equivalents$330$360 Accounts receivable (net)590520 Inventory640570 Prepaid expenses130160 Total current assets1,6901,610Property, plant, and equipment (net)410380Investments130130Intangibles and other assets530510 Total assets$2,760$2,630Current liabilities$940$910Long-term liabilities660560Stockholders’ equity—common1,1601,160 Total liabilities and stockholders’ equity$2,760$2,630 CARLA VISTA CO.Income StatementsFor the Year Ended December 31 (in thousands)20222021Sales revenue$3,980$3,640Costs and expenses Cost of goods sold1,0901,010 Selling & administrative expenses2,4002,330 Interest expense1020 Total costs and expenses3,5003,360Income before income taxes480280Income tax expense192112Net income$ 288$ 168 Compute the following ratios for 2022 and 2021.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education