FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

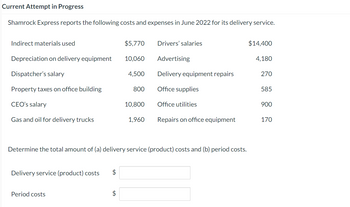

Transcribed Image Text:Current Attempt in Progress

Shamrock Express reports the following costs and expenses in June 2022 for its delivery service.

Indirect materials used

Depreciation on delivery equipment

Dispatcher's salary

Property taxes on office building

CEO's salary

Gas and oil for delivery trucks

Delivery service (product) costs $

Period costs

+A

$5,770

$

10,060

4,500

800

10,800

1,960

Drivers' salaries

Determine the total amount of (a) delivery service (product) costs and (b) period costs.

Advertising

Delivery equipment repairs

Office supplies

Office utilities

Repairs on office equipment

$14,400

4,180

270

585

900

170

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1) Grant's Ironhorse Company manufactures model railroad cars. At the end of October, 2019 the accounting records showed the following: Inventories: Beginning: Ending: Direct Materials $10,000 $5,000 Work-in-Process 15,000 20,000 Finished Goods 0 5,800 Other Information: Direct Materials Purchases 40,000 Plant maintenance services 6,800 Plant supervisor's salary 31,500 Sales salaries 12,700 Delivery costs 3,100 Sales revenue 236,000 Utilities for plant 10,500 Rent on plant 23,000 Advertising 8,000 Direct labor 30,000 (a) Prepare a schedule of cost of goods manufactured for Grant's Ironhorse Company and (b) Prepare an income statement for Grant's Ironhorse Company for the year ended October 31, 2019arrow_forwardplease explain in stepsarrow_forwardMetlock Company reports the following costs and expenses in May. Factory utilities Depreciation on factory equipment Depreciation on delivery trucks Indirect factory labor Indirect materials Direct materials used Factory manager's salary From the information $13,300 10.870 3,340 Manufacturing overhead 42,120 69,440 118,480 7,000 Direct labor Sales salaries Property taxes on factory building Repairs to office equipment Factory repairs Advertising Office supplies used Determine the total amount of manufacturing overhead.. $59,480 39,820 2.150 1,130 1,720 12.900 2,260 suarrow_forward

- Presented below are incomplete 2022 manufacturing cost data for Sunland Corporation. Determine the missing amounts. Direct Total Work in Materials Direct Manufacturing Manufacturing Process Used Labor Overhead Costs (1/1) $35,720 $75,200 $45,120 $112,800 (b) $140,060 $49,820 $84,600 $274,480 2$ (c) $49,820 $109,040 $113,740 $272,600 $378,820arrow_forwardDuring 2025, Oriole Company started a construction job with a contract price of $1,590,000. The job was completed in 2027. The following information is available. Costs incurred to date Estimated costs to complete Billings to date Collections to date (a) 2025 $396,000 $806,600 594,000 301,000 268,000 2026 Gross profit recognized in 2025 $ Gross profit recognized in 2026 $ 283,400 892,000 816,000 2027 $1,080,000 -0- 1,590,000 Compute the amount of gross profit to be recognized each year, assuming the percentage-of-completion method is used. 1,427,000arrow_forwardOnly typed solutionarrow_forward

- Please do not give image formatarrow_forwardJake's Roof Repair has provided the following data concerning its costs: Cost per Repair-Hour Fixed Cost per Month $ Wages and salaries Parts and supplies Equipment depreciation $ Truck operating expenses $ Rent $ Administrative expenses $ 21,100 2,750 5,780 4,660 3,840 $ 16.00 $ 7.20 $ 0.55 $ 1.70 $ 0.40 For example, wages and salaries should be $21,100 plus $16.00 per repair-hour. The company expected to work 2,600 repair-hours in May, but actually worked 2,500 repair-hours. The company expects its sales to be $48.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Need to make sure my notes coincide with this example problem from video. please include how you calculated each part. Thank youarrow_forwardCan you please give answerarrow_forward

- The following selected account balances are as at the end of the current period. Manufacturing direct labour $140,000 Direct materials purchased Variable manufacturing overhead Depreciation on plant equipment and building Sales commissions Direct materials used Head office overhead costs Marketing costs What are the conversion costs for the period? O $300,000 O $420,000 O $120,000 O $215,000 150,000 75,000 85,000 35,000 120,000 110,000 90,000arrow_forwardIndirect materials used Depreciation on delivery equipment Dispatcher's salary Property taxes on office building CEO's salary Gas and oil for delivery trucks Delivery service (product) costs $ Period costs $6,940 LA 12,040 5,400 980 12,960 2,320 Drivers' salaries Advertising Delivery equipment repairs Office supplies Determine the total amount of (a) delivery service (product) costs and (b) period costs. Office utilities Repairs on office equipment $17,280 5,080 324 702 1,080 206arrow_forwardMarin Express reports the following costs and expenses in June 2022 for its delivery service. Indirect materials used Depreciation on delivery equipment Dispatcher's salary Property taxes on office building CEO's salary Gas and oil for delivery trucks Delivery service (product) costs Period costs eTextbook and Media $5,380 $ 9,400 4,200 740 10,080 1,840 Drivers' salaries Determine the total amount of (a) delivery service (product) costs and (b) period costs. Advertising Delivery equipment repairs Office supplies Office utilities Repairs on office equipment $13,440 3,880 252 546 840 158arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education