Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Give me correct answer with explanation please.f

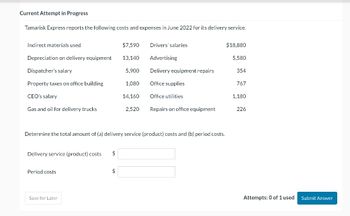

Transcribed Image Text:Current Attempt in Progress

Tamarisk Express reports the following costs and expenses in June 2022 for its delivery service.

Indirect materials used

$7,590

Drivers' salaries

$18,880

Depreciation on delivery equipment

13,140

Advertising

5,580

Dispatcher's salary

5,900

Delivery equipment repairs

354

Property taxes on office building

1,080

Office supplies

767

CEO's salary

14,160

Office utilities

1,180

Gas and oil for delivery trucks

2,520

Repairs on office equipment

226

Determine the total amount of (a) delivery service (product) costs and (b) period costs.

Delivery service (product) costs

Period costs

Save for Later

Attempts: 0 of 1 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jake's Roof Repair provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour Wages and salaries Parts and supplies Equipment depreciation $ 21,200 $ 15.00 $ 7.10 $ 2,770 $ 0.45 Truck operating expenses Rent $ 5,720 $ 1.60 $ 4,640 $ 3,880 $ 0.50 Administrative expenses For example, wages and salaries should be $21,200 plus $15.00 per repair-hour. The company expected to work 2,800 repair-hours in May but actually worked 2,700 repair-hours. The company expects its sales to be $54.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (I.e., zero variance). Input all amounts as positive values. Revenue Expenses: Jake's Roof Repair Activity Variances For the Month Ended May 31 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expenses Net…arrow_forwardPlease help mearrow_forwardplease answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forward

- Jake's Roof Repair has provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour Wages and salaries Parts and supplies $ 21,400 $ 15.00 $ 7.20 Equipment depreciation $ 2,740 $ 0.55 Truck operating expenses Rent $ 5,720 $ 1.70 $ 4,660 $ 3,880 $ 0.70 Administrative expenses For example, wages and salaries should be $21,400 plus $15.00 per repair-hour. The company expected to work 2,700 repair-hours in May, but actually worked 2,600 repair-hours. The company expects its sales to be $47.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Revenue Expenses: Jake's Roof Repair Activity Variances For the Month Ended May 31 Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net…arrow_forwardJake's Roof Repair provided the following data concerning its costs: Fixed Cost Cost per per Month Repair-Hour Wages and salaries Parts and supplies Equipment depreciation $ 20,700 $ 15.00 $ 7.70 $ 2,770 $ 0.45 Truck operating expenses Rent $ 5,780 $ 1.80 $ 4,600 $ 3,870 $ 0.40 Administrative expenses For example, wages and salaries should be $20,700 plus $15.00 per repair-hour. The company expected to work 2,800 repair-hours in May but actually worked 2,700 repair-hours. The company expects its sales to be $51.00 per repair-hour. Required: Compute the company's activity variances for May. Note: Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values. Answer is not complete. Jake's Roof Repair Activity Variances For the Month Ended May 31 Revenue U Expenses: Wages and salaries F ✓ Parts and supplies F Equipment depreciation F Truck operating expenses F Rent None…arrow_forwardscreenshots includedarrow_forward

- Jake's Roof Repair has provided the following data concerning its costs: Fixed Coat Cost per Repair-Hour $15.00 97.40 per Month $21,200 Wagon and salarion Parts and supplies Equipment depreciation Truck operating expensea Rent Administrative expenses $ 2,710 * 5,740 3 4,640 8 3,840 $0.60 9 1.50 8 0.00 For example, wages and salaries should be $21,200 plus $15.00 per repair-hour he company expected to work 2,800 repair-hours in May, but actually worked 2,700 repair-hours. The company expects its sales to be $53.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (I.e., zero variance). Input all amounts as positive values.) Jake's Roof Repair Activity Variances For the Month Ended May 31 Revenue Expenses: Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net operating…arrow_forwardGive solution to this questionarrow_forwardJake's Roof Repair has provided the following data concerning its costs: Fixed Cost per Month Cost per Repair-Hour $ Wages and salaries Parts and supplies Equipment depreciation $ Truck operating expenses $ $ Administrative expenses $ Rent 21,200 2,770 5,760 4,680 3,840 $ 15.00 $ 7.80 $ 0.55 $ 1.50 $ 0.70 For example, wages and salaries should be $21,200 plus $15.00 per repair-hour. The company expected to work 2,500 repair-hours in May, but actually worked 2,400 repair-hours. The company expects its sales to be $50.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.)arrow_forward

- Jake's Roof Repair has provided the following data concerning its costs: Wages and salaries Parts and supplies Equipment depreciation Fixed Cost per Month $20,500 Cost per Repair-Hour $15.00 $ 7.50 $ 2,770 $ 0.35 Truck operating expenses Rent $ 5,740 $ 1.70 $ 4,650 Administrative expenses $ 3,860 $ 0.70 For example, wages and salaries should be $20,500 plus $15.00 per repair-hour. The company expected to work 2,800 repair-hours in May, but actually worked 2,700 repair-hours. The company expects its sales to be $50.00 per repair-hour. Required: Compute the company's activity variances for May. (Indicate the effect of each variance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (i.e., zero variance). Input all amounts as positive values.) Revenue Jake's Roof Repair Activity Variances For the Month Ended May 31 Expenses: Wages and salaries Parts and supplies Equipment depreciation Truck operating expenses Rent Administrative expenses Total expense Net…arrow_forwardDinesh bhaiarrow_forwardGive me correct answer with explanation.vkarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning