Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct answer

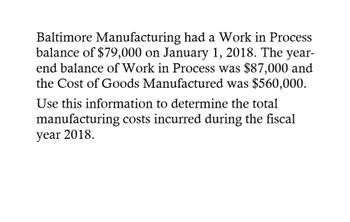

Transcribed Image Text:Baltimore Manufacturing had a Work in Process

balance of $79,000 on January 1, 2018. The year-

end balance of Work in Process was $87,000 and

the Cost of Goods Manufactured was $560,000.

Use this information to determine the total

manufacturing costs incurred during the fiscal

year 2018.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Baltimore Manufacturing had a Work in Process balance of $64,000 on January 1, 2018. The year-end balance of Work in Process was $51,000 and the Cost of Goods Manufactured was $500,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2018.arrow_forwardGive me answerarrow_forwardCan you please give answerarrow_forward

- Need answerarrow_forwardKansas Plating Company reported a cost of goods manufactured of P260,000, with the firm's year-end balance sheet revealing work in process and finished goods of P35,000 and P67,000, respectively. If supplemental information disclosed raw materials used in production of P40,000, direct labor of P70,000, and manufacturing overhead of P120,000, 1) how much was the total production cost incurred during the period? 2) how much was the company's beginning work in process? Case B For the year just ended, Cole Corporation's manufacturing costs (raw materials used, direct labor, and manufacturing overhead) totaled P1,500,000. Beginning and ending work-in-process inventories were P60,000 and P90,000, respectively. Cole's balance sheet also revealed respective beginning and ending finished-goods inventories of P250,000 and P180,000. On the basis of this information, 3) how much would the company report as cost of goods manufactured (CGM)?, and 4) cost of goods sold (CGS)? Case C For each of…arrow_forwardThe following data summarizes in part the results of operations for 2021 of Place Company. Of the total cost of goods manufactured for 2021, 38% was for materials used, 30% for direct labor, and 32% for manufacturing overhead. During 2021, the company paid 90% of the materials purchased, leaving P293,000 of unpaid invoices for materials at year end. The company commenced 2021 operations with materials inventory of P421,000. All materials were purchased FOB company's plant. The company disbursed P2,101,500 for direct labor during 2021. As of December 31, 2021, the accrued liability for direct labor amounted to P144,000, which was twice as much as last year's accrual. The inventory of finished goods on December 31, 2021, was 10% of the cost of the units finished during the year, and goods in process on that date were one-half the finished goods inventory. This year's finished goods inventory was 150% of last year. There are no in process last year. The manufacturing overhead, except for…arrow_forward

- The following data summarizes in part the results of operations for 2021 of Diamond Company. Of the total cost of goods manufactured for 2021, 38% was for materials used, 30% for direct labor, and 32% for manufacturing overhead. During 2021, the company paid 90% of the materials purchased, leaving P293,000 of unpaid invoices for materials at year end.The company commenced 2021 operations with materials inventory of P421,000. All materials were purchased FOB company’s plant. The company disbursed P2,101,500 for direct labor during 2021. As of December 31, 2021, the accrued liability for direct labor amounted to P144,000, which was twice as much as last year’s accrual. The inventory of finished goods on December 31, 2021, was 10% of the cost of the units finished during the year, and goods in process on that date were one-half the finished goods inventory. This year’s finished goods inventory was 150% of last year. There are no in process last year. The manufacturing overhead, except for…arrow_forwardABC company had the following transactions and events during the year ended 31 March 2022. The company uses direct labor dollars as the allocation base. For the current year, the estimated overhead was $777,000 and estimated direct labor cost was $350,000. Actual costs incurred follows: a. Purchased raw materials on account, $567,000. b. 10% of raw materials purchased was requisitioned as indirect materials. c. Direct labor for production is $320,000, indirect labor is $125,000. d. Some costs for the company and their percentage for factory are shown below, with the remaining percentage for administration costs. Other costs for Total Percentage spent in factory the company Property tax 100,000 90% Utilities 90,000 89% Depreciation 150,000 75% Insurance 180,000 80% Cleaning service fee 85,000 70% Maintenance fee 50,000 90% The balances of inventory follow: Beginning Ending Raw materials Work-in-process Finished goods $8,000 $25,010 7,500 572,650 25,010 487,810 Required: a) Compute the…arrow_forwardThe Genesis Corporation has the following account balances (in millions): Prepare an income statement and a supporting schedule of cost of goods manufactured for the year ended December 31, 2013.arrow_forward

- ABC company had the following transactions and events đuring the year ended 31 March 2022. The company uses direct lahor dollars as the allocation base. For the current yeur, the estimated overhead was $777,000 and estimated direct labor cost was $350,000. Actual costs incurred follows: a. Purchased raw materials on account, $567,000. b. 10% of raw materials purchased was requisitioned as indirect materials. c. Direct labor for production is $320,000, indirect labor is $125,000. d. Some costs for the company and their percentage for factory are shown below, with the remaining percentage for administration costs. Other costs for Total $ Percentage spent in factory the company Property tax 100,000 90% Utilities 90,000 89% Depreciation 150,000 75% Insurance 180,000 80% | Cleaning service fee 85,000 70% |Maintenance fee 50,000 90% The bulances of inventory follow: Beginning Ending Raw materials $8,000 $25,010 Work-in-process Finished goods 7,500 572,650 25,010 487,810 Required: d) Prepare…arrow_forwardIn addition, the following transactions occurred in 2022: 1. 2. 3. 4. 5. (a) Raw materials purchased on account, $70,500. Incurred factory labor, $75,200, all is direct labor. Incurred the following overhead costs during the year: utilities $6,392, depreciation on manufacturing machinery $7,520, manufacturing machinery repairs $8,648, factory insurance $8,460 (Credit Accounts Payable and Accumulated Depreciation). Assigned $75,200 of factory labor to jobs. Applied $33,840 of overhead to jobs. Journalize the above transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.)arrow_forwardBoston Company has the following balances as of the year ended December 31, 2018. Direct Materials Inventory=$15,000 Dr WIP Inventory =34,500 Dr Finished Goods Inventory=49,500 Dr Cost of Goods Sold = 74,500 Dr Additional information is as follows: Cost of direct materials purchased during 2018 = $41,000 Cost of direct materials requisitioned in 2018= 47,000 Cost of goods completed during 2018= 102,000 Factory overhead applied (120% of direct labour) = 48,000 Underapplied factory overhead = 4,000 Required: Compute beginning direct materials inventory. Compute beginning WIP inventory.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning