FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

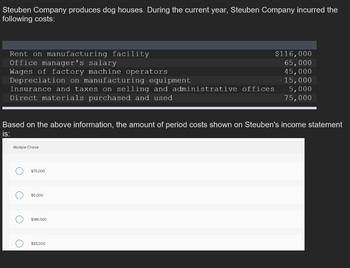

Transcribed Image Text:Steuben Company produces dog houses. During the current year, Steuben Company incurred the

following costs:

Rent on manufacturing facility

Office manager's salary

Wages of factory machine operators

Depreciation on manufacturing equipment

Insurance and taxes on selling and administrative offices

Direct materials purchased and used

Multiple Choice

Based on the above information, the amount of period costs shown on Steuben's income statement

is:

O

$70,000

$5,000

$186,000

$116,000

65,000

45,000

15,000

$65,000

5,000

75,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of the year, the company had actually incurred the following: attached in 2 ss's below thanksarrow_forwardDayton, Inc. manufactured 15,000 units of product last month and identified the following costs associated with the manufacturing activity. Variable costs: Direct materials used Direct labor $1,100,000 2,060,000 236, 000 213,000 Indirect materials and supplies Power to run plant equipment Fixed costs: Supervisory salaries Plant utilities (other than power to run plant equipment) Depreciation on plant and equipeent (straight-line, tine basis) Property taxes on building 906,000 287,000 141,000 199, e00 Required: Unit variable costs and total fixed costs are expected to remain unchanged next month Calculate the unit cost and the total cost if 21,000 units are produced next month. (Round "Unit costs" to 2 decimal places.) Total variable costs Total fixed costs Total costs Unit costsarrow_forwardPlease help mearrow_forward

- 1. FAN Company has the following data for the year 2021 (in thousand) January 1, 2021 December 31, 2021 Raw Materials Inventory $16,300 $15,000 Work-in-process Inventory $40,000 $40,110 Finished Goods Inventory $49,600 $44,256 During 2021 the amount of raw material purchased was $21,700 and direct labor costs incurred were $10,100. The finance department also provides the following additional data : Factory Machinery Rent 1,840 Indirect Materials $ 3,400 Delivery Expense $ 760 Factory Utilities $ 1,200 Depreciation on Factory Building 3,500 Sales Commissions $ 340 Administrative Expense $ 1,620 Factory Insurance $ 1,266 Sales Revenue $ 98,600 Factory Manager's Salary $ 2,240 Indirect Labor $ 5,670 Instructions: a. Prepare a cost of goods manufactured schedule for FAN Company for 2021! %24arrow_forwardQuestion: Alton Company produces metal belts. During the current month, the company incurred the following product costs: Raw materials $84,000 Direct labor $52,000 Electricity used in the Factory $22,000 Factory foreperson salary $3,100 Maintenance of factory machinery $2,000 What are Alton Company's direct product costs?arrow_forward1) The following cost data relate to the manufacturing activities of the Kamas Company during the most recent year: Manufacturing overhead costs incurred during the year: $1,600 2,600 5,100 Property taxes Utilities, factory Indirect labour Depreciation, factory Insurance, factory Total actual costs Other costs incurred during the year: Purchases of raw materials Direct labour cost Inventories: 13,000 2,500 $24,800 Raw materials, beginning Raw materials, ending Work in process, beginning Work in process, ending $15,000 22,000 $5,000 4,400 3,500 4,500 The company uses a predetermined overhead rate to charge overhead cost to production. The rate for the year just completed was $4.00 per machine hour; a total of 6,000 machine hours were recorded for the year. Required: a. Compute the amount of under- or overapplied overhead cost for the year just ended. b. Prepare a schedule of cost of goods manufactured for the year. (Disclose ALL supporting calculation steps)arrow_forward

- Crane incurred the following costs while manufacturing its product: Materials used in production, $144000; factory depreciation, $84000; property taxes on the administrative offices, $36000; labor costs of assembly-line workers, $119000; factory supplies used, $32000; advertising expense, $37000; property taxes on the factory, $44000; delivery expense, $47000; salaries of the sales staff, $77000; and sales commissions, $41000. The total product costs for Crane are O $583000. O $459000. O $661000. O $423000. Toxtbook and Mediaarrow_forwardA review of Plunkett Corporation's accounting records for last year disclosed the following selected Variable costs Direct materials used $ 56,000 Direct labor $179,100 Manufacturing overhead $154,000 Selling costs $108,400 Fixed costs Manufacturing overhead $267,000 Selling costs $121,000 Administrative costs $235,900 In addition, the company suffered a $27,700 uninsured factory fire loss during the year. What were Plunkett's product costs and period costs for last yeararrow_forwardClaire Corporation's trial balance includes the following expenses: Raw materials used in production Raw materials purchased General manager salary Sales manager salary Direct labor incurred General liability insurance premium Factory rent Office lease Factory utilities Depreciation on factory equipment Assuming that this list represents all expenses for the year, what amount should Claire report as a period (non-product) expense? Select one: $5,500 6,500 50,000 30,000 130,000 a. $101,000 b. $107,500 c. $83,000 d. $74,000 3,000 24,000 18,000 12,000 14,000arrow_forward

- Custom Creations Furniture Company manufactures furniture at its Akron, Ohio, factory. Some of its costs from the past year include: Depreciation on sales office $ 9,800 Depreciation on factory equipment 16,700. Factory supervisor salary Sales commissions Lubricants used in factory equipment Insurance costs for factory Wages paid to maintenance workers Fabric used to upholster furniture Freight-in (on raw materials) Costs of delivery to customers Wages paid to assembly-line workers Lumber used to build product 50,200 23,400 3,800 21,400 115,600 10,900 3,200 9,200 A. $261,800. OB. $131,700. OC. $236,600. D. $325,100. 115,100 82,100 54,100 26,900 Utilities in factory Utilities in sales office Manufacturing overhead costs for Custom Creations Furniture Company totaledarrow_forwardUse the table below and record the amount in the appropriate column category. Cost Item Cost Prime cost Conversion Cost Factory Overhead Period Costs Rent on Factory equipment 11,000 Insurance on factory building 1,500 Raw materials 75,000 Sales Commissions 10,000 Utility costs for factory 900 Supplies for general office 300 Wages for assembly line workers 58,000 Depreciation on office equipment 800 Miscellaneous materials (Glue etc.) 1,100 Factory manager’s salary 5,700 Property taxes on factory building 400 Advertising for the laptops 14,000 Office Supervisor Salary 16,000 Depreciation of factory building 1,500arrow_forward9arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education