Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

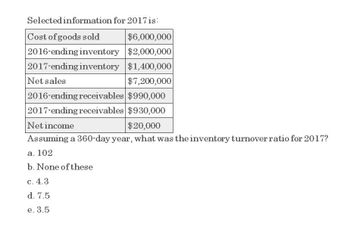

What was the inventory turnover ratio for 2017 on these financial accounting question?

Transcribed Image Text:Selected information for 2017 is:

Cost of goods sold

$6,000,000

2016-ending inventory $2,000,000

2017-ending inventory $1,400,000

Net sales

$7,200,000

2016-ending receivables $990,000

2017-ending receivables $930,000

Net income

$20,000

Assuming a 360-day year, what was the inventory turnover ratio for 2017?

a. 102

b. None of these

c. 4.3

d. 7.5

e. 3.5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the following information relating to Clover Company to calculate the inventory turnover ratio, gross margin, and the number of days sales in inventory ratio, for years 2022 and 2023.arrow_forwardUse the following information relating to Medinas Company to calculate the inventory turnover ratio, gross margin, and the number of days sales in inventory ratio, for years 2022 and 2023.arrow_forwardAssume your company uses the periodic inventory costing method, and the inventory count left out an entire warehouse of goods that were in stock at the end of the year, with a cost value of $222,000. How will this affect your net income in the current year? How will it affect next years net income?arrow_forward

- Last year, Nikkola Company had net sales of 2,299,500,000 and cost of goods sold of 1,755,000,000. Nikkola had the following balances: Refer to the information for Nikkola Company above. Required: Note: Round answers to one decimal place. 1. Calculate the average inventory. 2. Calculate the inventory turnover ratio. 3. Calculate the inventory turnover in days. 4. CONCEPTUAL CONNECTION Based on these ratios, does Nikkola appear to be performing well or poorly?arrow_forwardFinancial statement data for years ending December 31 for Holland Company follow: a. Determine the inventory turnover for 20Y4 and 20Y3. b. Determine the days sales in inventory for 20Y4 and 20Y3. Use 365 days and round to one decimal place. c. Does the change in inventory turnover and the days sales in inventory from 20Y3 to 20Y4 indicate a favorable or an unfavorable trend?arrow_forwardOn January 1, Pope Enterprises inventory was 625,000. Pope made 950,000 of net purchases during the year. On its year-end income statement, Pope reported cost of goods sold of 1,025,000. Calculate Popes December 31 ending inventory.arrow_forward

- The following information is available for Bridgeport Corp. for three recent fiscal years. 2015 $325.447 1,285,838 965,338 2017 Inventory $554,103 Net sales - 1,965,543 Cost of goods sold 1.572,196 Calculate the inventory turnover, days in inventory, and gross profit rate for 2017 and 2016. (Round Inventory turnover to 1 decimal place, e.g. 5.2, days in inventory to O decimal places, eg. 125 and gross profit rate to 1 decimal place, e.g. 5.2%) Inventory Turnover Days in Inventory 2016 $572,288 1.739,520 1.307,512 Gross Profit Rate 2017 times days 2016 times daysarrow_forwardThe following information is available for Canadian Tire Corporation (in $ millions): 2018 2017 2016 Inventory $ 1,997.5 $ 1,769.8 $ 1,710.7 Cost of goods sold 8,863.8 8,398.9 7,898.4 (a) Calculate the inventory turnover and days in inventory ratios for 2018 and 2017. (Round inventory turnover to 1 decimal place, e.g. 15.2. Round days in inventory to nearest day, e.g. 15. Use 365 days for calculation.) 2018 2017 Inventory Turnover times times Days in Inventory days days eTextbook and Media Save for Later Attempts: 0 of 3 used Submit Answer (b)arrow_forwardCompute the Days-in-Inventory for the Year End Dec-31-2016, given the Following; Cost of Goods Sold for 12-31-2016= 150,000 Cost of Goods Sold for 12-31-2015= 200,000 Ending Inventory 12-31-2016 = 60,000 Ending Inventory 12-31-2015 = 20,000 Sales Revenues 12-31-2016 $750,000 Sales Revenues 12-31-2015 = $900,000 = Inventory Turnover Ratio = COGS / Average Inventory Days-in-Inventory = 365/ Inventory Turnover Ratio None of These Choices 97 Days 48 Days 49 Days 146 Daysarrow_forward

- The following data were taken from the income statements of Cullumber Company. 2022 2021 Sales revenue $6,420,000 $6,271,000 Beginning inventory 942,400 840,500 Purchases 4,836,000 4,691,000 Ending inventory 1,174,000 942,400 Compute the inventory turnover for each year. (Round answers to 1 decimal place, e.g. 12.5.) 2022 2021 Inventory turnover Enter inventory turnover in times rounded to 1 decimal place times Enter inventory turnover in times rounded to 1 decimal place times Compute days in inventory for each year. (Round answers to 0 decimal places, e.g. 124. Use 365 days for calculation.) 2022 2021 Days in inventory Enter days in inventory rounded to 0 decimal places days Enter days in inventory rounded to 0 decimal placesarrow_forwardCalculate activity measures The following information was available for the year ended December 31, 2016:Net sales $365,000Cost of goods sold 292,000Average accounts receivable for the year 14,600Accounts receivable at year-end 16,000Average inventory for the year 73,000Inventory at year-end 78,400Required:Calculate the inventory turnover for 2016.Calculate the number of days’ sales in inventory for 2016, using year-end inventories.Calculate the accounts receivable turnover for 2016.Calculate the number of days’ sales in accounts receivable for 2016, using year-end accounts receivable.arrow_forwardThe following information is available for cullumber company for three recent fiscal years. 2022 2021 2020 Inventory 532,000 580,000 330,000 Net Sales 1,920,000 1,750,000 1,315,000 Cost of goods sold 1,334,400 1,137,000 943,000 Calculate the inventory turnover, days in inventory, and gross profit rate for 2022 and 2021. (Round inventory turnover to 1 decimal place, e.g. 5.2, days in inventory to 0 decimal places, e.g. 125 and gross profit rate to 1 decimal place, e.g. 5.2%.) 2022 2021 Inventory Turnover enter an inventory turnover times enter an inventory turnover times Days in Inventory enter a number of days days enter a number of days days Gross Profit Rate enter percentages % enter percentages %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning