FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Please given correct answer

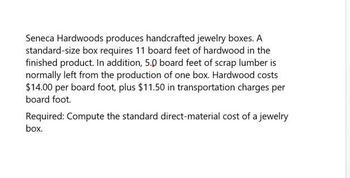

Transcribed Image Text:Seneca Hardwoods produces handcrafted jewelry boxes. A

standard-size box requires 11 board feet of hardwood in the

finished product. In addition, 5.0 board feet of scrap lumber is

normally left from the production of one box. Hardwood costs

$14.00 per board foot, plus $11.50 in transportation charges per

board foot.

Required: Compute the standard direct-material cost of a jewelry

box.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Cayuga Hardwoods produces handcrafted jewelry boxes. A standard-size box requires 14 board feet of hardwood in the finished product. In addition, 8.0 board feet of scrap lumber are normally left from the production of one box. Hardwood costs $5.00 per board foot, plus $2.50 in transportation charges per board foot. Required: Compute the standard direct-material cost of a jewelry box. (Do not round intermediate calculations. Round your final answer to 2 decimal places.) Standard direct-material costarrow_forwardFinancial accountingarrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,320 remotes is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total Cost $ 67,080 $ 56,760 $ 30,960 $ 51,600 $ 206,400 Frannie is approached by Lincoln Company, which offers to make the remotes for $18 per unit. Required: 1. Compute the difference in cost per unit between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 2. Compute the difference in cost per unit between making and buying the remotes if $20,640 of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 3. What is the change in net income if fixed cost of $20,640 can be avoided and Frannie could rent out the factory space no longer in use for $20,640?arrow_forward

- Rundle Electronics currently produces the shipping containers it uses to deliver the electronics products it sells. The monthly cost of producing 9,300 containers follows. Unit-level materials. Unit-level labor Unit-level overhead Product-level costs* Allocated facility-level costs One-third of these costs can be avoided by purchasing the containers. Russo Container Company has offered to sell comparable containers to Rundle for $2.60 each. Required a. Calculate the total relevant cost. Should Rundle continue to make the containers? b. Rundle could lease the space it currently uses in the manufacturing process. If leasing would produce $11,600 per month, calculate the total avoidable costs. Should Rundle continue to make the containers? Answer is complete but not entirely correct. $ a. Total relevant cost a. Should Rundle continue to make the containers? b. Total avoidable cost b. Should Rundle continue to make the containers? 190.650,000 Yes $24,180,000 $ 5,200 6,100 4,000 7,800…arrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,280 remotes is as follows: Direct materials Direct labor Variable overhead Fixed overhead Total Cost $ 66,820 $56,540 $ 30,840 $ 51,400 $ 205,600 Frannie is approached by Lincoln Company, which offers to make the remotes for $18 per unit. Required: 1. Compute the difference in cost per unit between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 2. Compute the difference in cost per unit between making and buying the remotes if $20,560 of the fixed costs can be avoided. What is the change in net income, if Frannie Fans buys the remotes? 3. What is the change in net income if fixed cost of $20,560 can be avoided and Frannie could rent out the factory space no longer in use for $20,560? Complete this question by entering your answers in the tabs below. Required 1 Required 2…arrow_forwardLargo, Inc., which uses a volume-based cost system, produces cat condos, and has a gross profit margin of 66%. Direct materials cost $21 per unit, and direct labor costs $18 per unit. Manufacturing overhead is applied at a rate of 150% of direct labor cost. Nonmanufacturing costs are $34 per unit. How much does each cat condo sell for? Multiple Choice O O O O $154 $194 $248 $176arrow_forward

- 1. SportsHaven’s garden department produces bags of mulch. Fixed cost is $17,300. Each bag sells for $3.21 with a unit cost of $1.48. How many bags of mulch must be sold to breakeven?arrow_forwardSnow Ride manufactures snowboards. Its cost of making 1,900 bindings is as follows: Direct materials $ 17,590 Direct laabor 3,200 Variable overhead 2,080 Fixed overhead 6,300 Total manufacturing cost for 1,900 bindings $ 29,170 Suppose Livingston will sell bindings to Snow Ride for $13 each. Snow Ride would pay $3 per unit to transport the bindings to its manufacturing plant, where it would add its own logo at a cost of $0.50 per binding. Requirments: 1. Snow Ride's accountants predict that purchasing the bindings from livingston will enable the company to avoid $2,100 of fixed overhead. Prepare an analysis to show whether Snow Ride should make or buy the bindings. 2. The facilities freed by purchasing bindings from…arrow_forwardFrannie Fans currently manufactures ceiling fans that include remotes to operate them. The current cost to manufacture 10,040 remotes is as follows: Cost Direct materials 65, 260 55, 220 $ Direct labor Variable overhead 30,120 $ Fixed overhead 50, 200 $ 200,800 Total Frannie is approached by Lincoln Company which offers to make the remotes for $18 per unit. Required: 1. Compute the difference in cost between making and buying the remotes if none of the fixed costs can be avoided. What is the change in net income? 2. Compute the difference in cost between making and buying the remotes if $20,080 of the fixed costs can be avoided. What is the change in net income? 3. What is the change in net income if fixed cost of $20,080 can be avoided and Frannie could rent out the factory space no longer in use for $20,080?arrow_forward

- Perfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 1.55 feet of leather and predicts leather will cost $2.60 per foot. Suppose Perfect Pet made 50 collars during February. For these 50 collars, the company actually averaged 1.85 feet of leather per collar and paid $2.10 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. 6. Calculate the direct materials price and quantity variances. Required 1: Calculate the standard direct materials cost per unit. (Round your answer to 2 decimal places.) Standard Direct Materials : _________________ per collar Required 2 & 3 : 2. Without performing any calculations, determine whether…arrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 1.55 feet of leather and predicts leather will cost $2.60 per foot. Suppose Perfect Pet made 50 collars during February. For these 50 collars, the company actually averaged 1.85 feet of leather per collar and paid $2.10 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Calculate the standard direct materials cost per unit. Note: Round your answer to 2 decimal places. Standard Direct Materials per Collararrow_forwardPerfect Pet Collar Company makes custom leather pet collars. The company expects each collar to require 2.50 feet of leather and predicts leather will cost $4.50 per foot. Suppose Perfect Pet made 100 collars during February. For these 100 collars, the company actually averaged 2.65 feet of leather per collar and paid $4.10 per foot. Required: 1. Calculate the standard direct materials cost per unit. 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine whether the direct materials quantity variance will be favorable or unfavorable. 6. Calculate the direct materials price and quantity variances. Complete this question by entering your answers in the tabs below. Req 1 Req 2 and 3 Req 6 2. Without performing any calculations, determine whether the direct materials price variance will be favorable or unfavorable. 3. Without performing any calculations, determine…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education