Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Hi expert please give me answer general accounting

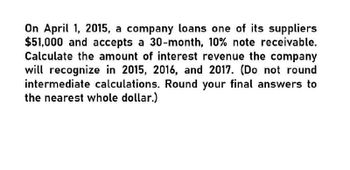

Transcribed Image Text:On April 1, 2015, a company loans one of its suppliers

$51,000 and accepts a 30-month, 10% note receivable.

Calculate the amount of interest revenue the company

will recognize in 2015, 2016, and 2017. (Do not round

intermediate calculations. Round your final answers to

the nearest whole dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Whole Leaves wants to upgrade their equipment, and on January 24 the company takes out a loan from the bank in the amount of $310,000. The terms of the loan are 6.5% annual interest rate, payable in three months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on February 24, and the entry for payment of the short-term note and final interest payment on April 24. Round to the nearest cent if required.arrow_forwardOn December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan.arrow_forwardStarlight Enterprises has net credit sales for 2019 in the amount of $2,600,325, beginning accounts receivable balance of $844,260, and an ending accounts receivable balance of $604,930. Compute the accounts receivable turnover ratio and the number of days sales in receivables ratio for 2019 (round answers to two decimal places). What do the outcomes tell a potential investor about Starlight Enterprises if the industry average is 1.5 times and the number of days sales ratio is 175 days?arrow_forward

- On December 1 of the current year, Jordan Inc. assigns 125,000 of its accounts receivable to McLaughlin Company for cash. McLaughlin Company charges a 750 service fee, advances 85% of Jordans accounts receivable, and charges an annual interest rate of 9% on any outstanding loan balance. Prepare the related journal entries for Jordan. Refer to RE6-10. On December 31, Jordan Inc. received 50,000 on assigned accounts. Prepare Jordans journal entries to record the cash receipt and the payment to McLaughlin.arrow_forwardScrimiger Paints wants to upgrade its machinery and on September 20 takes out a loan from the bank in the amount of $500,000. The terms of the loan are 2.9% annual interest rate and payable in 8 months. Interest is due in equal payments each month. Compute the interest expense due each month. Show the journal entry to recognize the interest payment on October 20, and the entry for payment of the short-term note and final interest payment on May 20. Round to the nearest cent if required.arrow_forwardOn September 1, 2021, Middleton Corp. lends cash and accepts a $1,200 note receivable that offers 6% interest and is due in six months. How much interest revenue will Middleton Corp. report during 2021? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.)arrow_forward

- During 2018, LeBron Corporation accepts the following notes receivable. a. On April 1, LeBron provides services to a customer on account. The customer signs a four-month, 9% note for $5,000. b. On June 1, LeBron lends cash to one of the company's vendors by accepting a six-month, 10% note for $9,000. c. On November 1, LeBron accepts payment for prior services by having a customer with a past-due account receivable sign a three- month, 8% note for $4,000. Required: Record the acceptance of each of the notes receivable. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheetarrow_forwardOn July 1, 2021, a company loans one of its employees $23,000 and accepts a ten-month, 8% note receivable. Calculate the amount of interest revenue the company will recognize in 2021 and 2022. (Do not round intermediate calculations. Round your final answers to the nearest whole dollar.) 2021 2022 Amount of interest revenuearrow_forwardI want to correct answer general accountingarrow_forward

- On August 1, 2021, Turner Manufacturing lends cash and accepts a $24,000 note receivable that offers 10% interest and is due in nine months. How would Turner record the year-end adjustment to accrue interest in 2021? (Do not round intermediate calculations. Round your answer to the nearest dollar amount.) A. Interest Revenue 1,050 Interest Receivable 1,050 B. Interest Receivable 2,400 Interest Revenue 2,400 C. Interest Receivable 1,050 Interest Revenue 1,050 D. Interest Receivable 1,000 Interest Revenue 1,000arrow_forward(Assigning Accounts Receivable) On April 1, 2017, Rasheed Company assigns $400,000 of its accounts receivable to the Third National Bank as collateral for a $200,000 loan due July 1, 2017. The assignment agreement calls for Rasheed to continue to collect the receivables. Third National Bank assesses a finance charge of 2% of the accounts receivable, and interest on the loan is 10% (a realistic rate of interest for a note of this type).Instructions(a) Prepare the April 1, 2017, journal entry for Rasheed Company.(b) Prepare the journal entry for Rasheed’s collection of $350,000 of the accounts receivable during the period from April 1, 2017, through June 30, 2017.(c) On July 1, 2017, Rasheed paid Third National all that was due from the loan it secured on April 1, 2017. Prepare the journal entry to record this payment.arrow_forwardOn September 1, 2015, Newtown borrowed $250,000 from First National Bank, and signed a 9% note payable due in one year. Interest on the note is due at maturity. Required: Please show calculations Part a. Prepare the journal entry to record the borrowing transaction. Part b. Prepare the required adjusting entry on December 31, 2015. Part c. Prepare the journal entry to record the payment of the interest on September 1, 2016. Part d. Prepare the journal entry to record the payment of the note on September 1, 2016.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT  Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning