Auditing: A Risk Based-Approach to Conducting a Quality Audit

10th Edition

ISBN: 9781305080577

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

Assume that Stanford CPAs encountered the following issues during its various audit engagements for issuers in 2023:

Stanford conducted the audit of Luck, a new client, this past year. Last year, Luck was audited by another CPA, who issued an unqualified opinion on its financial statements. Luck is presenting financial statements for 2022 and 2023 in comparative form.

One of Stanford’s clients is RealCo, a real estate holding company. Assume that RealCo experienced a significant decline in the value of its investment properties during the past year because of a downturn in the economy and has appropriately recognized that decline in market value under GAAP. Stanford wishes to emphasize the decline in the economy and its impact on RealCo’s financial position and results of operations for 2023 in its audit report.

For the past five years, Stanford has conducted the audits of TechTime, a company that provides technology consulting services, and has always issued unqualified opinions on its financial statements. Based on its 2023 audit, Stanford believes that an unqualified opinion is appropriate; however, Stanford did note that TechTime reported its third consecutive operating loss and has experienced negative cash flows because of the inability of some of its customers to promptly pay for services received.

Trees Inc. presents condensed financial information along with its financial statements. The condensed financial information has been derived from the complete set of financial statements that Stanford has audited (and issued an unqualified opinion on the complete financial statements). Stanford believes that the condensed financial information is fairly stated in relation to Trees’ complete financial statements.

Stanford believes that some of the verbiage in Plunkett’s Management Discussion & Analysis section is inconsistent with the firm’s financial statements. Stanford has concluded that Plunkett’s financial statements present its financial position, results of operations, and cash flows in accordance with GAAP and has decided to issue an unqualified opinion on Plunkett’s financial statements.

Oil Patch is a client in the energy industry that is required to present supplementary oil and gas reserve information. Stanford has performed certain procedures regarding this information and concluded that it is presented in accordance with FASB presentation guidelines and does not appear to depart from GAAP. Based on Stanford’s audit, it plans to issue an unqualified opinion on Oil Patch’s financial statements.

Required:

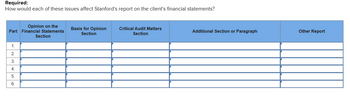

How would each of these issues affect Stanford’s report on the client’s financial statements?

Transcribed Image Text:Additional Section or Paragraph

Other Report

Required:

How would each of these issues affect Stanford's report on the client's financial statements?

Opinion on the

Part Financial Statements

Section

Basis for Opinion

Section

Critical Audit Matters

Section

1.

2.

3456

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Accounting Discuss the main types of auditing according to its objectives with giving examples for each type. Your answer for each type should include its purpose, to whom it is provided and who is eligible to conduct it. Ar Skiarrow_forwardExplain the content of each section of the AICPA audit report. Evaluate the importance of each section with respect to the users of financial reports.arrow_forwardWhich of the following engagement is covered by the Framework for Assurance Engagements?* Consulting engagements. Preparation of tax returns External financial statements audit Internal financial statements auditarrow_forward

- Who is the auditor for Target? What type of opinion are they giving on Target’s financial statements? (page 32) Refer to “Types of Auditor’s Opinions document.arrow_forwardWhat is the authoritative guidance for AU-C 540 Auditing Accounting Estimates, including Faire Value Accounting Estimates, and Related Disclosures?arrow_forwardAuditing and Assurance Services T321 Which one of the following services provides a moderate level of assurance about the client's financial statements? Select one: O a. review O b. forecasts and projections O c. compliance O d. auditarrow_forward

- Which of the following parties is responsible for the fairness of the representations made in financial statements? * O Audit committee. Client's management. AICPA. OIndependent auditor. TOSHIBAarrow_forwardIn which of the following paragraphs of an auditor's report for a nonissuer does an auditor communicate the nature of the engagement and the specific financial statements covered by the audit? A. Scope Paragraph B. opinion paragraph C. Introductory paragraph D. Emphasis-of-matter paragrapharrow_forwardResponsibility for the preparation of the financial statements as per applicable financial reporting framework is required to be disclosed under which of the following sections in the auditor's report? O a. Under auditor's responsibility O b. Under management's responsibility paragraph O c. Under basis for opinion paragraph O d. Under opinion paragrapharrow_forward

- Communicating Key Audit Matters in the audit report is : A. Additional communication to provide transparency in the auditor’s professional judgment, B. An assistance for financial statement users to better understand the entity and areas of significant management juudgments C. A substitute for disclosures in the financial statements that the applicable financial reporting framework requires management to make D. A separate additional opinion on individual matters Seçimimi temizlearrow_forwardFinancial audit Q&A What terms that must be included in the document prepared by the client?arrow_forwardWhat are the types of evidence would you normally look during the performance of your Financial Statement audit?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning