Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

General Accounting

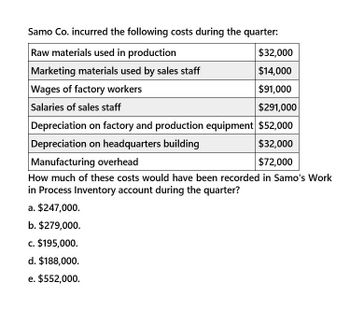

Transcribed Image Text:Samo Co. incurred the following costs during the quarter:

Raw materials used in production

$32,000

Marketing materials used by sales staff

$14,000

Wages of factory workers

$91,000

Salaries of sales staff

$291,000

Depreciation on factory and production equipment $52,000

Depreciation on headquarters building

Manufacturing overhead

$32,000

$72,000

How much of these costs would have been recorded in Samo's Work

in Process Inventory account during the quarter?

a. $247,000.

b. $279,000.

c. $195,000.

d. $188,000.

e. $552,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Lamont Company produced 80,000 machine parts for diesel engines. There were no beginning or ending work-in-process inventories in any department. Lamont incurred the following costs for May: Required: 1. Calculate the costs transferred out of each department. 2. Prepare the journal entries corresponding to these transfers. Also, prepare the journal entry for Grinding that reflects the costs added to the transferred-in goods received from Molding. 3. What if the Grinding Department had an ending WIP of 12,000? Calculate the cost transferred out and provide the journal entry that would reflect this transfer. What is the effect on finished goods calculated in Requirement 1, assuming the other two departments have no ending WIP?arrow_forwardRoper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forwardThe following product Costs are available for Haworth Company on the production of chairs: direct materials, $15,500; direct labor, $22.000; manufacturing overhead, $16.500; selling expenses, $6,900; and administrative expenses, $15,200. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 7,750 equivalent units are produced, what is the equivalent material cost per unit? If 22,000 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- The cost of direct materials transferred into the Rolling Department of Kraus Company is 3,000,000. The conversion cost for the period in the Rolling Department is 462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardA production department within a company received materials of $10,000 and conversion costs of $10,000 from the prior department. It added material of $27,200 and conversion costs of $53,000. The equivalent units are 20,000 for material and 18,000 for conversion. What is the unit cost for materials and conversion?arrow_forwardCullumber Corporation incurred the following costs while manufacturing its product: Materials used in product Depreciation on plant Property taxes on warehouse Labour costs of assembly-line workers Factory supplies used Calculate the cost of goods manufactured. Cost of goods manufactured $120,100 $ 65,000 8,430 110,000 25,500 Advertising expense Property taxes on plant Delivery expense Sales commissions Salaries paid to sales clerks $45,250 19,300 21,700 Work in process inventory was $10,600 at January 1 and $14,600 at December 31. Finished goods inventory was $60,600 at January 1 and $51,300 at December 31. 35,300 50,100arrow_forward

- Ryan Corporation incurred the following costs while manufacturing its product. Materials used in product Depreciation on plant Property taxes on store Labor costs of assembly-line workers Factory supplies used Instructions $100,000 60,000 7,500 110,000 13,000 Advertising expense Property taxes on plant Delivery expense Sales commissions Salaries paid to sales clerks $45,000 14,000 21,000 35,000 50,000 (a) Identify each of the above costs as direct materials, direct labor, manufacturing overhead, or period costs. (b) Explain the basic difference in accounting for product costs and period costs.arrow_forwardPharoah Company manufactured 6,720 units of a component part that is used in its product and incurred the following costs: Direct materials $39,200 Direct labor 16,800 Variable manufacturing overhead 11,200 Fixed manufacturing overhead 22,400 $89,600 Another company has offered to sell the same component part to the company for $13 per unit. The fixed manufacturing overhead consists mainly of depreciation on the equipment used to manufacture the part and would not be reduced if the component part was purchased from the outside firm. If the component part is purchased from the outside firm, Pharoah Company has the opportunity to use the factory equipment to produce another product which is estimated to have a contribution margin of $24,640.Prepare an incremental analysis report for Pharoah Company which can serve as informational input into this make or buy decision.arrow_forwardWithin the costing system of Asempa manufacturing company the following types of expense are incurred. GHȼCost of oils used to lubricate production machinery 20,000Motor vehicle licences for lorries 50,000Depreciation of factory plant and equipment 40,000Cost of chemicals used in the laboratory 10,000Commission paid to sales representatives 25,000Salary of the secretary to the finance director 22,000Trade discount given to customers 12,000Holiday pay of machine operatives 32,000Salary of security guard in raw material warehouse 15,000Fees to advertising agency 8,000Rent of finished goods…arrow_forward

- ABC, Inc. has the following information available regarding costs at various levels of monthly production: Production volume 8,000 12,000 Direct materials $75,000 $70,000 Direct labor 56,000 80,000 Packaging materials 22,000 30,000 Supervisors' salaries 14,000 14,000 Depreciation on plant and equipment 11,000 11,000 Maintenance 31,000 45,000 Utilities 15,000 21,000 Insurance on plant and equipment 2,600 2,600 Property taxes on plant and equipment…arrow_forwardThe following cost data relate to the manufacturing activities of Chang Company during the just completed year: Manufacturing overhead costs incurred: Indirect materials $ 15,200 Indirect labor 132,000 Property taxes, factory 8,200 Utilities, factory 72,000 Depreciation, factory 152,400 Insurance, factory 10,200 Total actual manufacturing overhead costs incurred $ 390,000 Other costs incurred: Purchases of raw materials (both direct and indirect) $ 402,000 Direct labor cost $ 62,000 Inventories: Raw materials, beginning $ 20,200 Raw materials, ending $ 30,200 Work in process, beginning $ 40,200 Work in process, ending $ 70,200 The company uses a predetermined overhead rate of $20 per machine-hour to apply overhead cost to jobs. A total of 19,900 machine-hours were used during the year. Required: 1. Compute the amount of underapplied or overapplied overhead cost for the year. 2. Prepare a schedule of cost of…arrow_forwardGiven the following costs incurred in a recent period: Direct materials - P33,000 Depreciation on factory equipment - P12,000 Factory janitor’s salary - P23,000 Direct labor - P28,000 Utilities for factory - P9,000 Selling expenses - P16,000 Production supervisor’s salary - P34,000 Administrative expenses - P21,000. Determine the following values: • period cost • product cost • operating expensesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub