Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

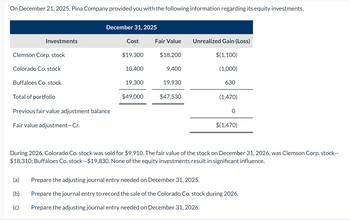

Transcribed Image Text:On December 21, 2025, Pina Company provided you with the following information regarding its equity investments.

December 31, 2025

Investments

Cost

Fair Value

Unrealized Gain (Loss)

Clemson Corp. stock

$19,300

$18,200

$(1,100)

Colorado Co. stock

10,400

9,400

(1,000)

Buffaloes Co. stock

19,300

19,930

630

Total of portfolio

$49,000

$47,530

(1,470)

Previous fair value adjustment balance

0

Fair value adjustment-Cr.

$(1,470)

During 2026, Colorado Co. stock was sold for $9,910. The fair value of the stock on December 31, 2026, was Clemson Corp. stock-

$18,310; Buffaloes Co. stock-$19,830. None of the equity investments result in significant influence.

(a)

Prepare the adjusting journal entry needed on December 31, 2025.

(b)

Prepare the journal entry to record the sale of the Colorado Co. stock during 2026.

(c)

Prepare the adjusting journal entry needed on December 31, 2026.

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Monty, Inc. had the following equity investment portfolio at January 1, 2020. Evers Company Rogers Company Chance Company Equity investments @ cost Fair value adjustment Equity investments @ fair value During 2020, the following transactions took place. 1. 2. 3. 1,050 shares @ $15 each 890 shares @ $22 each 490 shares @ $8 each 4. $15,750 19,580 3,920 39,250 (7,510 ) $31,740 During 2021, the following transactions took place. 5. 6. 7. On March 1, Rogers Company paid a $2 per share dividend. On April 30, Monty, Inc. sold 300 shares of Chance Company for $12 per share. On May 15, Monty, Inc. purchased 90 more shares of Evers Company stock at $16 per share. At December 31, 2020, the stocks had the following price per share values: Evers $17, Rogers $21, and Chance $7. 8. On February 1, Monty, Inc. sold the remaining Chance shares for $7 per share. On March 1, Rogers Company paid a $2 per share dividend. On December 21, Evers Company declared a cash dividend of $3 per share to be paid in…arrow_forwardCullumber Company's equity securities portfolio which is appropriately included in current assets is as follows: Catlett Corp. Lyman, Inc. O O $-7440. O $-20400. O $0. O $-130740. December 31, 2021 Cost O $23000 loss. O $14000 loss. - $0. O $9000 gain. $150000 Cash $296000 146000 Cash Ignoring income taxes, what amount should be reported as a charge against income in Cullumber's 2021 income statement if 2021 is Cullumber's first year of operation? Debt Investments Premium on Bonds Cash Current Attempt in Progress Sunland Company purchased $2700000 of 9%, 5-year bonds from Cheyenne, Inc. on January 1, 2021, with interest payable on July 1 and January 1. The bonds sold for $2830740 at an effective interest rate of 8%. Using the effective-interest method, Sunland Company decreased the Available-for-Sale Debt Securities account for the Cheyenne, Inc. bonds on July 1, 2021 and December 31, 2021 by the amortized premiums of $10020 and $10380, respectively. Debt Investments Eair Value $127000…arrow_forwardThe following data pertains to Kyne Co.’s investments in marketable equity securities: Market value Cost 12/31/22 12/31/23XYZ Stock 150,000 $155,000 $100,000ABC Stock $150,000 130,000 120,000 What amount should Kyne include as unrealized holding loss in its 2023 Net Income?a) $50,000b) $55,000c) $60,000d) $65,000e) $5,000arrow_forward

- a. Define the equity method b. Use the following example to describe the equity method Presume that Company A bought 30% of Company B’s outstanding common stocks at $400,000 (cash) on 01/01/2020 During 2020, Company B earned net income of $200,000 and paid dividends of $40,000 Provide the journal entries for this equity investment in fiscal year 2020 What is the balance for this equity investment on 12/31/2020? Explain why the accounting numbers obtained using the equity method are misleadingarrow_forward10, please answer the question. thanksarrow_forwardanswer with must must explanation ,narrations, computation for each parts and steps answer in text form no copy from other answerarrow_forward

- solve please with steps computation explanation formula thanksarrow_forwardOriole Company has the following portfolio of trading investments at December 31, 2022. Per Share Investment Quantity Percent Interest Cost Market Frank, Inc. 2,100 shares 8% $11 $16 Ellis Corp. 5,400 shares 14% 23 19 Mendota Company 4,200 shares 2% 31 24 On December 31, 2023, Oriole's portfolio of trading investments consisted of the following investments. Per Share Investment Ellis Corp. Quantity Percent Interest Cost Market 5,400 shares 14% $23 $28 Mendota Company 4,200 shares 2% 31 23 Mendota Company 2,100 shares 1% 25 23 At the end of year 2023, Oriole Company changed the classification of its investment in Frank, Inc. to non-trading when the shares were selling for $8 per share.arrow_forwardPlease help with D calculations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning