Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Hello tutor give correct calculation

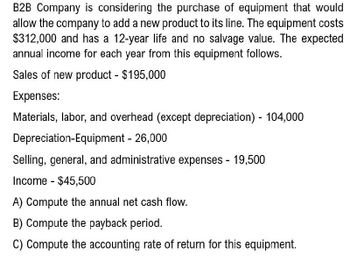

Transcribed Image Text:B2B Company is considering the purchase of equipment that would

allow the company to add a new product to its line. The equipment costs

$312,000 and has a 12-year life and no salvage value. The expected

annual income for each year from this equipment follows.

Sales of new product - $195,000

Expenses:

Materials, labor, and overhead (except depreciation) - 104,000

Depreciation-Equipment - 26,000

Selling, general, and administrative expenses - 19,500

Income $45,500

-

A) Compute the annual net cash flow.

B) Compute the payback period.

C) Compute the accounting rate of return for this equipment.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting machine. Two new models are available: Machine 190-3, which has a cost of $190,000, a 3-year expected life, and after-tax cash flows (labor savings and depreciation) of $87,000 per year; and Machine 360-6, which has a cost of $360,000, a 6-year life, and after-tax cash flows of $98,300 per year. Knitting machine prices are not expected to rise because inflation will be offset by cheaper components (microprocessors) used in the machines. Assume that Filkins’ cost of capital is 14%. Should the firm replace its old knitting machine? If so, which new machine should it use? By how much would the value of the company increase if it accepted the better machine? What is the equivalent annual annuity for each machine?arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one the company expects the truck to be driven for 26,000 miles; in year two, 30,000 miles; and in year three, 40,000 miles. Consider how the purchase of the truck will impact Montellos depreciation expense each year and what the trucks book value will be each year after depreciation expense is recorded.arrow_forwardUtica Machinery Company purchases an asset for 1,200,000. After the machine has been used for 25,000 hours, the company expects to sell the asset for 150,000. What is the depreciation rate per hour based on activity?arrow_forward

- Dauten is offered a replacement machine which has a cost of 8,000, an estimated useful life of 6 years, and an estimated salvage value of 800. The replacement machine is eligible for 100% bonus depreciation at the time of purchase- The replacement machine would permit an output expansion, so sales would rise by 1,000 per year; even so, the new machines much greater efficiency would cause operating expenses to decline by 1,500 per year The new machine would require that inventories be increased by 2,000, but accounts payable would simultaneously increase by 500. Dautens marginal federal-plus-state tax rate is 25%, and its WACC is 11%. Should it replace the old machine?arrow_forwardMontello Inc. purchases a delivery truck for $25,000. The truck has a salvage value of $6,000 and is expected to be driven for 125,000 miles. Montello uses the units-of-production depreciation method, and in year one it expects to use the truck for 26,000 miles. Calculate the annual depreciation expense.arrow_forwardTalbot Industries is considering launching a new product. The new manufacturing equipment will cost $17 million, and production and sales will require an initial $5 million investment in net operating working capital. The company’s tax rate is 25%. What is the initial investment outlay? The company spent and expensed $150,000 on research related to the new product last year. What is the initial investment outlay? Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for $1.5 million after taxes and real estate commissions. What is the initial investment outlay?arrow_forward

- Depreciation Jensen Inc., a graphic arts studio, is considering the purchase of computer equipment and software for a total cost of $18,000. Jensen can pay for the equipment and software over three years at the rate of $6,000 per year. The equipment is expected to last 10 to 20 years, but because of changing technology, Jensen believes it may need to replace the system in as soon as three to five years. A three-year lease of similar equipment and software is available for $6,000 per year. Jensens accountant has asked you to recommend whether the company should purchase or lease the equipment and software and to suggest the length of time over which to depreciate the software and equipment if the company makes the purchase. Required Ignoring the effect of taxes, would you recommend the purchase or the lease? Why or why not? Referring to the definition of depreciation, what appropriate useful life should be used for the equipment and software?arrow_forwardREPLACEMENT ANALYSIS St. Johns River Shipyards is considering the replacement of an 8-year-old riveting machine with a new one that will increase earnings from 24,000 to 46,000 per year. The new machine will cost 80,000, and it will have an estimated life of 8 years and no salvage value. The new riveting machine is eligible for 100% bonus depreciation at the time of purchase. The applicable corporate tax rate is 25%, and the firms WACC is 10%. The old machine has been fully depreciated and has no salvage value. Should the old riveting machine be replaced by the new one? Explain your answer.arrow_forwardAverage rate of returncost savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of 125,000 with a 15,000 residual value and an eight-year life. The equipment will replace one employee who has an average wage of 28,000 per year. In addition, the equipment will have operating and energy costs of 5,150 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment.arrow_forward

- Urquhart Global purchases a building to house its administrative offices for $500,000. The best estimate of the salvage value at the time of purchase was $45,000, and it is expected to be used for forty years. Urquhart uses the straight-line depreciation method for all buildings. After ten years of recording depreciation, Urquhart determines that the building will be useful for a total of fifty years instead of forty. Calculate annual depreciation expense for the first ten years. Determine the depreciation expense for the final forty years of the assets life, and create the journal entry for year eleven.arrow_forwardTalbot Industries is considering launching a new product. The new manufacturing equipment will cost 17 million, and production and sales will require an initial 5 million investment in net operating working capital. The companys tax rate is 40%. a. What is the initial investment outlay? b. The company spent and expensed 150,000 on research related to the new product last year. Would this change your answer? Explain. c. Rather than build a new manufacturing facility, the company plans to install the equipment in a building it owns but is not now using. The building could be sold for 1.5 million after taxes and real estate commissions. How would this affect your answer?arrow_forwardB2B Company is considering the purchase of equipment that would allow the company to add a new product to its line. The equipment costs $240,000 and has a 12-year life and no salvage value. The expected annual income for each year from this equipment follows. Sales of new product $ 150,000 Expenses Materials, labor, and overhead (except depreciation) 80,000 Depreciation—Equipment 20,000 Selling, general, and administrative expenses 15,000 Income $ 35,000 (a) Compute the annual net cash flow.(b) Compute the payback period.(c) Compute the accounting rate of return for this equipment.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENTPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning