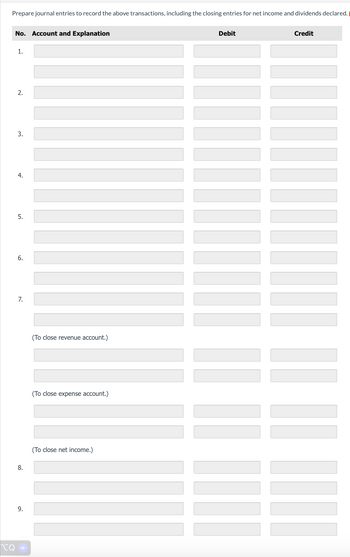

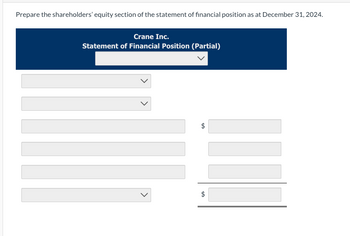

Crane Ltd. began operations on January 2, 2024. During the year, the following transactions affected shareholders' equity:

1. Crane's articles of incorporation authorize the issuance of 2.5 million common shares and the issuance of 253,000

2. A total of 303,000 common shares were issued for $6 a share,

3.

A total of 35,000 preferred shares were issued for $10 per share.

4. The full annual dividend on the preferred shares was declared.

5. The dividend on the preferred shares was paid.

6. A dividend of $0.12 per share was declared on the common shares but was not yet paid.

7. The company had net income of $170,000 for the year. (Assume sales of $500,000 and total operating expenses of $330,000.)

8. The dividends on the common shares were paid.

9. The closing entry for the Dividends Declared account was prepared.

Step by stepSolved in 3 steps

- The annual report for Sneer Corporation disclosed that the company declared and paid preferred dividends in the amount of $170,000 in the current year. It also declared and paid dividends on common stock in the amount of $2.70 per share. During the current year, Sneer had 1 million common shares authorized; 370,000 shares had been issued; and 163,000 shares were in treasury stock. The opening balance in Retained Earnings was $870,000 and Net Income for the current year was $370,000. Required: 1. Prepare journal entries to record the declaration, and payment, of dividends on (a) preferred and (b) common stock. 2. Using the information given above, prepare a statement of retained earnings for the year ended December 31. 3. Prepare a journal entry to close the dividends account.arrow_forwardDuring the year, the following selected transactions affecting stockholders' equity occurred for Navajo Corporation: a. February 1: Repurchased 240 shares of the company's common stock at $22 cash per share. b. July 15: Sold 130 of the shares purchased on February 1 for $23 cash per share. c. September 1: Sold 100 of the shares purchased on February 1 for $21 cash per share. Required: 1. Prepare the journal entry required for each of the above transactions. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet 1 2 Repurchased 240 shares of the company's common stock at $22 cash per share. Date February 01 3 Note: Enter debits before credits. Record entry General Journal Clear entry Prev Debit 1 of 8 Credit View general journal ‒‒‒ ‒‒‒ ‒‒‒ Next > *********arrow_forwardStampede Inc. (SI) is a public company. On January 1, 2020, 65,000 common shares were issued and outstanding. During the year: 15,000 additional common shares were issued on April 1. 20,000 preferred shares were issued on June 1; these shares are non-cumulative and carry an annual dividend entitlement of $2 per share. No dividends were declared. Net income was $2,000,000. What is the basic EPS for SI for its fiscal 2020 year end? Question 23 options: a) $22.75 b) $25.00 c) $25.70 d) $26.23arrow_forward

- The corporate charter of Alpaca Co. authorized the issuance of 10 million, $1 par common shares. During 2021, its first year of operations, Alpaca had the following transactions: January 1 sold 8 million shares at $15 per share June 3 retired 2 million shares at $18 per share December 28 sold 2 million shares at $20 per share What amount should Alpaca report as additional paid-in capital—excess of par, in its December 31, 2021, balance sheet? $116 million $112 million $122 million $74 millionarrow_forwardHammond Manufacturing Inc. was legally incorporated on January 2, 2023. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.40 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2023 Jan. Mar. Dec. 12 Issued 40,000 common shares at $4.80 each. 20 Issued 6,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $36,000. 31 Issued 80,000 common shares in exchange for land, building, and equipment, which have fair market values of $360,000, $480,000, and $48,000, respectively. 4 Purchased equipment at a cost of $8,160 cash. This was thought to be a special bargain price. It was felt that at least $10,800 would normally have had to be paid to acquire this equipment. 31 During 2023, the company incurred a loss of $96,000. The Income Summary account was closed. 2024…arrow_forwardWhen Wisconsin Corporation was formed on January 1, the corporate charter provided for 95,400 shares of $10 par value common stock. During its first month of operation, the corporation issued 8,990 shares of stock at a price of $21 per share. The journal entry for this transaction would include a a. debit to Common Stock for $95,400 b. debit to Cash for $89,900 c. credit to Paid-In Capital in Excess of Par—Common Stock for $98,890 d. credit to Common Stock for $188,790arrow_forward

- Upon submitting its corporate charter to the state, Lazer was granted permission to issue 6,000 shares of $0.30 par value common stock. Net income for the year for Lazer was $98,400. In addition, the following transactions took place during the year: January 2: March 12: Investors paid Lazer $7 each for 2,520 shares of common stock Lazer purchases 600 shares of its own common stock for $6.50 per share October 31: Lazer declared a 2-for-1 forward stock split As of December 31, how many shares are issued, and how many shares are outstanding? Select one: О a. Issued, 4,080; Outstanding, 2,520 O b. Issued, 4,080; Outstanding, 5,040 O c. Issued, 5,040; Outstanding, 1,920 о d. Issued, 5,040; Outstanding, 3,840arrow_forwardConcord Corporation is authorized to issue 49,000 shares of $5 par value common stock. During 2025, Concord took part in the following selected transactions. a. b. C. d. Issued 4,600 shares of stock at $42 per share, less costs related to the issuance of the stock totaling $6,300. Issued 1,000 shares of stock for land appraised at $49,000. The stock was actively traded on a national stock exchange a approximately $43 per share on the date of issuance. Prepare the journal entries to record these transactions using the cost method. (List all debit entries before credit entries. Credit ac titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the ac titles and enter O for the amounts.) a. Purchased 470 shares of treasury stock at $47 per share. The treasury shares purchased were issued in 2021 at $44 per share. Retired the treasury shares purchased in part (c). No. Account Titles and Explanation b. Cash Common…arrow_forwardOn December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forward

- The articles of incorporation allow for the issuance of 4,000,000 shares of common stock. The company issued 80,000 shares of common stock and repurchased 5,000 shares. What is the number of shares outstanding?arrow_forwardOn December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forwardRawhides Corporation showed the following account balances on December 31, 2022 balance sheet: Common shares, unlimited authorized shares, 660,000 shares issued and outstanding $3,980,000 Retained earnings $2,130,000 Per their incorporation documents, they are authorized to issue 100,000, $5 preferred shares. During 2023, the following selected transactions occurred: March 1 May 1 June 1 July 1 July 31 November 1 November 20 December 31 Repurchased and retired 100,500 common shares at $7.20 per share; this is the first retirement recorded by Rawhides Declared 2:1 shares split to shareholders of record on May 12, distributable May 30 The board of directors issued 15,000 preferred shares for $27 per share The board declared total cash dividends of $82,000 to shareholders of record on July 22 payable on July 31 Paid the cash dividend Declared a 10% share dividend to shareholders of record on November 10, distributable November 20. The market prices of the shares on November 1, November 10…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education