FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

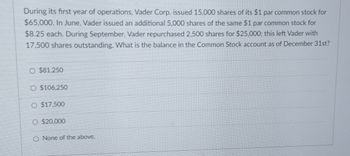

Transcribed Image Text:During its first year of operations, Vader Corp. issued 15,000 shares of its $1 par common stock for

$65,000. In June, Vader issued an additional 5,000 shares of the same $1 par common stock for

$8.25 each. During September, Vader repurchased 2,500 shares for $25,000; this left Vader with

17,500 shares outstanding. What is the balance in the Common Stock account as of December 31st?

$81.250

O $106,250

O $17,500

O $20,000

O None of the above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Waterway Corporation began business by issuing 649600 shares of $5 par value common stock for $25 per share. During its first year, the corporation sustained a net loss of $62300. The year-end balance sheet would show Common stock of $3248000. Common stock of $16240000. Total paid-in capital of $12992000. Total paid-in capital of $16177700.arrow_forwardOn January 1, Vermont Corporation had 46,400 shares of $9 par value common stock issued and outstanding. All 46,400 shares had been issued in a prior period at $22 per share. On February 1, Vermont purchased 1,010 shares of treasury stock for $24 per share and later sold the treasury shares for $22 per share on March 1. The journal entry to record the purchase of the treasury shares on February 1 would include aarrow_forwardMilo Co. had 795,000 shares of common stock outstanding as of January 1. On May 1, they issued 145,000 shares of common stock. On September 1, Milo Co. purchased 61,000 shares of treasury stock. On November 1, they issued 59,000 shares of common stock. Calculate the weighted average shares outstanding for the year.arrow_forward

- Sheffield Corporation began business by issuing 401000 shares of $5 par value common stock for $24 per share. During its first year, the corporation sustained a net loss of $39200. The year-end balance sheet would show O Common stock of $2005000. O Common stock of $9624000. O Total paid-in capital of $2044200. O Total paid-in capital of $9584800.arrow_forwardSierra Corporation engaged in the following share transactions in the first quarter of their fiscal year: 19 Issued 5,500 common shares for cash of $11.50 per share. 3 Sold 2,500 $1.50 Class A preferred shares for $14,000 cash to new investors. Received inventory valued at $30,000 and vehicles with market value of $22,000 for 5,200 common shares. Jul. Aug. 11 Sep. 15 Issued 3,500 $2.00 Class B preferred shares for $14.00 per share. Required 1. Journalize the transactions. Explanations are not required. 2. How much contributed capital did these transactions generate for Sierra Corporation? Requirement 1. Journalize the transactions. Explanations are not required. (Record debits first, then credits. Exclude explanations from journal entries.) July 19. Issued 5,500 common shares for cash of $11.50 per share. Journal Entry Date Jul. 19 Accounts Debit Creditarrow_forwardFortuna Company is authorized to issue 1,000,000 shares of $1 par value common stock. In its first year, the company has the following transactions: Jan. 31 Issued 45,000 shares at $11 share. Jun. 10 Issued 110,000 shares in exchange for land with a clearly determined value of $850,000. Aug. 3 Purchased 11,000 shares of treasury stock at $8 per share. A. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Jan. 31 fill in the blank fill in the blank fill in the blank fill in the blank fill in the blank fill in the blank Jun. 10 fill in the blank fill in the blank fill in the blank fill in the blank fill in the blank fill in the blank Aug. 3 fill in the blank fill in the blank fill in the blank fill in the blank B. Calculate how many shares of stock are outstanding at August 3. fill in the blank ________sharesarrow_forward

- CNZ Co. had 1,270,000 shares outstanding at the beginning of the year—1 June 20X8. During the year, the following transactions occurred: 1 August 20X8—5,700 share options with an exercise price of $42 per share, were exercised. 1 October 20X8—A 5:1 stock split was completed. 1 February 20X9—The company repurchased 507,000 shares for $27 each. For the year ended 31 May 20X9, the company reported net earnings of $1,726,500. Required:Compute the basic EPS for the company for the year ended 31 May 20X9. (Do not round intermediate calculations and round your answer to 2 decimal places.) Basic EPS =arrow_forwardElroy Corporation repurchased 3,800 shares of its own stock for $55 per share. The stock has a par of $5 per share. A month later Elroy resold 950 shares of the treasury stock for $63 per share. Required: What is the balance of the Treasury Stock account after these transactions are recognized?arrow_forwardOn January 1, 2022, NYC Co. had 1,191,000 shares of its $12 par value common stock outstanding. On March 1, NYC Co. sold an additional 2,382,000 shares for $48 per share. The company issued a 15% stock dividend on May 1. On August 1, NYC Co. repurchased 715,000 shares of its stock. On November 1, 1,072,500 shares were sold for $50 per share. What is the weighted- average number of shares outstanding for 2022? (NIE) 4,129,067 3,175,733 3,533,233 3,771,567arrow_forward

- On February 14, Marine Company reacquired 7,500 shares of its common stock at $30 per share. On March 15, Marine sold 4,500 of the reacquired shares at $34 per share. On June 2, Marine sold the remaining shares at $28 per share. Required: Journalize the transactions of February14, March 5, and June 2.arrow_forwardConcordia Corporation has 96,900 common shares that have been issued. It declares a 4% stock dividend on December 1 to shareholders of record on December 20. The shares are issued on January 10. The share price is $15 on December 1, $14.50 on December 20, and $14.75 on January 10. b) Provide the required journal entries on the appropriate dates to record the stock dividend. Only provide account names as the dollar amount has already been calculated in part a). (If no entry is required, select "No Entry" for the account titles.) December 1 Dividends Declared Dividends Payable Stock Dividends Distributable Common Shares Preferred Shares Retained Earnings Cash No Entryarrow_forwardTerrance Company reported $20,000 retained earnings at the beginning of the year. The company repurchased 200 shares at $50 per share during the year for the first time. Later, during the year the company sold 100 shares of these treasury shares for $45 per share. Terrance earned $15,000 net income during the year. The company also declared and paid dividends on 500 outstanding 4% preferred stock with $100 par value. Based on this information alone, compute the retained earnings balance at the end of the year. O $34,500 O $35,000 O $32,500 O $32,000 O $37,500arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education