FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

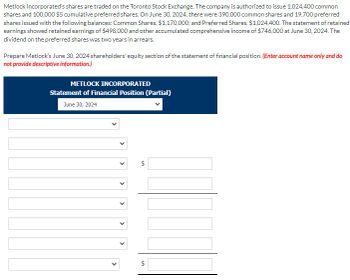

Transcribed Image Text:Metlock Incorporated's shares are traded on the Toronto Stock Exchange. The company is authorized to issue 1,024,400 common

shares and 100,000 $5 cumulative preferred shares. On June 30, 2024, there were 390,000 common shares and 19,700 preferred

shares issued with the following balances: Common Shares, $1,170,000; and Preferred Shares, $1,024,400. The statement of retained

earnings showed retained earnings of $498,000 and other accumulated comprehensive income of $746,000 at June 30, 2024. The

dividend on the preferred shares was two years in arrears.

Prepare Metlock's June 30, 2024 shareholders' equity section of the statement of financial position. (Enter account name only and do

not provide descriptive information.)

METLOCK INCORPORATED

Statement of Financial Position (Partial)

June 30, 2024

>

<

>

<

SA

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Flounder Corporation was organized on January 1, 2022. It is authorized to issue 14,000 shares of 8 %, $100 par value preferred stock, and 505,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 77,000 shares of common stock for cash at $6 per share. Issued 5,800 shares of preferred stock for cash at $105 per share. Issued 25,000 shares of common stock for land. The asking price of the land was $88,000. The fair value of the land was $81,000. Mar. 1 Apr. 1 1 May Aug 1. Sept. 1 Nov. 1 Issued 76,000 shares of common stock for cash at $4.25 per share. Issued 10,500 shares of common stock to attorneys in payment of their bill of $36,000 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $5 per share. Issued 3,000 shares of preferred stock for cash at $112 per share. Post to the stockholders' equity accounts. (Post entries in the…arrow_forwardDekalb Resorts has been in business since 1987.The stockholders' equity section of Dekalb's balance sheet on January 1, 2019 is as follows: Common Stock (Par value $25.00 per share; 50,000 shares authorized; 28,000 shares issued and outstanding) Additional Paid-in Capital on Common Stock Preferred Stock (Par value $5.00 per share; 5,000 shares authorized; 3,000 shares issued and outstanding) Additional Paid-in Capital on Preferred Stock Retained Earnings Total Stockholders' Equity Stockholders' Equity Section as of January 1, 2019 Date July 15, 2019 700,000 100,000 15,000 7,000 560.000 1,382,000 Required: 1. Prepare the journal entries for the following three transactions: On July 15, 2019, Dekalb issues 600 shares of its preferred stock, receiving $15.00 per share. Accounts debits credits On December 31, 2019, Dekalb declares annual dividends on preferred stock. Dividends are to be paid on the shares of preferred stock outstanding on December 31, 2019. Each share of preferred stock…arrow_forwardDakota Corporation had the following shareholders' equity account balances at December 31, 2018: Transactions during 2019 and other information relating to the shareholders' cquity accounts were as follows:1. Dakota's preferred and common shares are traded on the over-the-counter market. At December 31, 2018,Dakota had 100,000 authorized shares of $100 par, 10%, cumulative preferred stock; and 3,000,000 autho-rized shares of no-par common stock with a stated value of $5 per share.2. On January 9, 2019, Dakota formally retired all 30,000 shares of its treasury common stock and had them revert to an unissued basis. The treasury stock had been acquired on January 20, 2018. The shares were originally issued at $10 per share,3. Dakota owned 10,000 shares of Bush Inc, common stock purchased in 2016 for $750,000. The Bush stock was included in Dakota's short-term marketable securities portfolio at the end of 2018 at a value of $650,000.On February 13, 2019, Dakota declared a dividend in kind…arrow_forward

- Zakaryan Corporation was organized on January 1, 2020. The corporation's governing documents authorized the issue of 100,000 shares of $1 par common stock. During 2020, Zakaryan had the following transactions relating to stockholders' equity: Issued 10,000 shares of common stock at $14 per share. Issued 20,000 shares of common stock at $16 per share. Reported a net income of $200,000. Paid dividends of $100,000. Purchased 3,000 shares of treasury stock at $20 (part of the 20,000 shares issued at $16). What is total shareholders' equity at the end of 2020? O $600,000. O $540,000. O $500,000. O $400,000. 4arrow_forwardKnapp Industries began business on January 1, 2018 by issuing all of its 1,000,000 authorized shares of its $1 par value common stock for $40 per share. On June 30, Knapp declared a cash dividend of $2 per share to stockholders of record on July 31. Knapp paid the cash dividend on August 30. On November 1, Knapp reacquired 200,000 of its own shares of stock for $50 per share. On December 22, Knapp resold 100,000 of these shares for $60 per share. Required: Prepare the stockholders' equity section of the balance sheet as of December 31, 2018 assuming that the net income for the year was $6,000,000.arrow_forwardWildhorse Corporation was organized on January 1, 2020. It is authorized to issue 9,300 shares of 8%, $ 100 par value preferred stock, and 503,100 shares of no-par common stock with a stated value of $ 1 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 80,560 shares of common stock for cash at $ 7 per share. Mar. 1 Issued 5,680 shares of preferred stock for cash at $ 112 per share. Apr. 1 Issued 24,570 shares of common stock for land. The asking price of the land was $ 90,100; the fair value of the land was $ 80,560. May 1 Issued 80,560 shares of common stock for cash at $ 9 per share. Aug. 1 Issued 9,300 shares of common stock to attorneys in payment of their bill of $ 46,000 for services rendered in helping the company organize. Sept. 1 Issued 9,300 shares of common stock for cash at $ 11 per share. Nov. 1 Issued 1,090 shares of preferred stock for cash at $ 117 per share. Prepare the journal…arrow_forward

- Crane Corporation was organized on January 1, 2027. It is authorized to issue 19,800 shares of 7%, $50 par value preferred stock and 462,000 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 1 Issued 71,000 shares of common stock for cash at $5 per share. Issued 11,600 shares of preferred stock for cash at $56 per share. Issued 116,000 shares of common stock for cash at $8 per share. May Sept. 1 Nov. 1 Issued 5,200 shares of common stock for cash at $6 per share. Issued 3,200 shares of preferred stock for cash at $58 per share. (a) Prepare a tabular summary to record the transactions. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Assets Liabilities Jan. 10 $ Mar. 1 Cash 1 $ Common Stock Paid-in-Capit Stated…arrow_forwardOn December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forwardOn December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forward

- Mechforce, Incorporated had net income of $150,000 for the year ended December 31, 2022. At the beginning of the year, 17,000 shares of common stock were outstanding. On April 1, an additional 19,000 shares were issued. On October 1, the company purchased 4,000 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Mechforce paid the annual dividend on the 8,000 shares of 4.60%, $100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2022. Note: Do not round intermediate calculations. Round your answer to 2 decimal places. Answer is complete but not entirely correct. Earnings per share $ 0.74 xarrow_forwardWaterway Inc. uses a calendar year for financial reporting. The company is authorized to issue 8,210,000 shares of $12 par common stock. At no time has Waterway issued any potentially dilutive securities. Listed below is a summary of Waterway's common stock activities. 1. 2. 3. 4. (a) Number of common shares issued and outstanding at December 31, 2018 Shares issued as a result of a 12% stock dividend on September 30, 2019 Shares issued for cash on March 31, 2020 Number of common shares issued and outstanding at December 31, 2020 A 2-for-1 stock split of Waterway's common stock took place on March 31, 2021 Your Answer Correct Answer Your answer is correct. 2,116,800 1,890,000 shares 226,800 2,100,000 Compute the weighted-average number of common shares used in computing earnings per common share for 2019 on the 2020 comparative income statement. 4,216,800arrow_forwardPronghorn Corp. was organized on January 1, 2022. It is authorized to issue 19,800 shares of 7%, $50 par value preferred stock and 462,000 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 71,000 shares of common stock for cash at $5 per share. Mar. 1 Issued 1,220 shares of preferred stock for cash at $56 per share. May 1 Issued 116,000 shares of common stock for cash at $8 per share. Sept. 1 Issued 5,200 shares of common stock for cash at $6 per share. Nov. 1 Issued 3,200 shares of preferred stock for cash at $58 per share. Prepare the paid-in capital portion of the stockholders’ equity section at December 31, 2022. PRONGHORN CORP.Partial Balance Sheetchoose the accounting periodchoose the accounting period December 31, 2022For the Month Ended December 31, 2022For the Year Ended…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education