FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

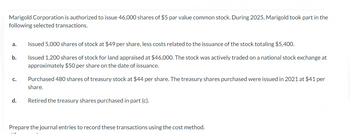

Transcribed Image Text:Marigold Corporation is authorized to issue 46,000 shares of $5 par value common stock. During 2025, Marigold took part in the

following selected transactions.

a.

b.

C.

d.

Issued 5,000 shares of stock at $49 per share, less costs related to the issuance of the stock totaling $5,400.

Issued 1,200 shares of stock for land appraised at $46,000. The stock was actively traded on a national stock exchange at

approximately $50 per share on the date of issuance.

Purchased 480 shares of treasury stock at $44 per share. The treasury shares purchased were issued in 2021 at $41 per

share.

Retired the treasury shares purchased in part (c).

Prepare the journal entries to record these transactions using the cost method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Oriole Corporation has 100000 shares of $10 par common stock authorized. The following transactions took place during 2025, the first year of the corporation's existence: Sold 20700 shares of common stock for $14.50 per share. Issued 20400 shares of common stock in exchange for a patent valued at $306000. At the end of Oriole's first year, total paid-in capital was $300150. $606150. $306000. O $120700.arrow_forwardDonahue Corporation is authorized by its charter from the state of Illinois to issue 750 shares of preferred stock with a 7% dividend rate and a par value of $50 per share and 22,000 shares of common stock with a par value of $0.01 per share. On January 1, 2019, Donahue Corporation issues 250 shares of preferred stock at $55 per share and 12,900 shares of common stock at $13 per share. Required: Prepare the journal entry to record the issuance of the stock. 2019 Jan. 1 (Record sale of preferred and common stock)arrow_forwardOverland Corporation is authorized to issue 250,000 shares of $1 par value common stock. During 2020, Overland Corporation took part in the following selected transactions. Prepare journal entry(entries) for following independent event. a. Purchased 6,000 shares of treasury stock at $70 per share. The treksury shares purchased were issued in 2018 at $46 per share. Assuming Overland uses the retirement method to prepare entry and before this transaction the company had $100,000 credit balance of Paid-in capital- shares repurchase and $800,000 retained earnings b. The board votes a 4-for-1 stock split. At the date, the market value is $80 c. The board votes a 150% stock dividend. At the date, the market value is $80, assuming the company treats the distribution as "large" stock dividends effected in the form of a stock dividend and before this transaction the company has 54,000 shares of common stockarrow_forward

- Baez Corp. began operations on Jan. 1, 2023. Baez Corp. is authorized to issue 150,000 shares of it's 6%, $40 par value preferred stock. The company is authorized to issue 650,000 shares of the common stock with a par value of $2 per share. On January 5, 2023, the company issued 225,000 shares of common stock for cash at $13 per share. What is the journal entry to record the issuance of the common stock shares?arrow_forwardAlpesharrow_forwardOn January 5, 2020, Bramble Corporation received a charter granting the right to issue 4,600 shares of $100 par value, 8% cumulative and nonparticipating preferred stock, and 49,800 shares of $10 par value common stock. It then completed these transactions. Jan. 11 Issued 19,300 shares of common stock at $16 per share. Feb. 1 Issued to Sanchez Corp. 3,600 shares of preferred stock for the following assets: equipment with a fair value of $50,600; a factory building with a fair value of $153,000; and land with an appraised value of $290,000. July 29 Purchased 2,000 shares of common stock at $19 per share. (Use cost method.) Aug. 10 Sold the 2,000 treasury shares at $15 per share. Dec. 31 Declared a $0.45 per share cash dividend on the common stock and declared the preferred dividend. Dec. 31 Closed the Income Summary account. There was a $162,500 net income. Record the journal entries for the transactions listed above. (Credit account…arrow_forward

- Kress Products' corporate charter authorized the firm to sell 800,000 shares of $10 par common stock. At the beginning of 2019, Kress sold 262,900 shares and reacquired 1,650 of those shares. The reacquired shares were held as treasury stock. During 2019, Kress sold an additional 16,300 shares and purchased 3,100 more treasury shares. Required: Determine the number of issued and outstanding shares at December 31, 2019. Issued shares shares Outstanding shares sharesarrow_forwardEdward Corporation is authorized to issue 100,000 shares of $1 par value common stock. During 2021, Edward Corporation took part in the following selected transactions. Prepare journal entry(entries) for following independent event. 1. Purchased 10,000 shares of treasury stock at $50 per share. The treasury shares purchased were issued in 2019 at $31 per share. Assuming Edward uses the retirement method to prepare entry and before this transaction the company had $120,000 credit balance of Paid-in capital – shares repurchase and $1,500,000 retained earnings. 2. The board votes a 3-for-1 stock split. At the date, the market value is $52. 3. The board votes a 120% stock dividend. At the date, the market value is $55, assuming the company treats the distribution as "large" stock dividends effected in the form of a stock dividend and before this transaction the company has 330,000 shares of common stock.arrow_forwardOn April 1, 2019, Kelly Corporation began operations and authorized 100,000 shares of $5 par value common stock. The company engaged in the following transactions:April 1 Issued 20,000 shares of common stock for $200,000.April 15 Issued 10,000 shares of common stock for $125,000.May 12 Purchased 2,500 shares of common stock for $75,000.June 30 The board of directors declared a $0.20 per share cash dividend to be paid on July 15 to shareholders of record on July 51. Prepare journal entries for the above transactions.2. Prepared the stockholders’ equity section of Kelly Corporation’s balance sheet as of June 30, 2019. Net income for the period April 1 through June 30 was $150,000.3. What effect, if any, will the cash dividend declaration on June 30 have on Kelly Corporation’s net income, retained earnings, and cash flows?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education