FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

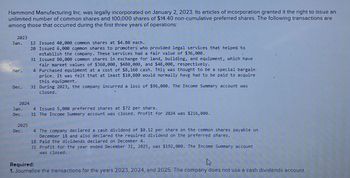

Transcribed Image Text:Hammond Manufacturing Inc. was legally incorporated on January 2, 2023. Its articles of incorporation granted it the right to issue an

unlimited number of common shares and 100,000 shares of $14.40 non-cumulative preferred shares. The following transactions are

among those that occurred during the first three years of operations:

2023

Jan.

Mar.

Dec.

12 Issued 40,000 common shares at $4.80 each.

20 Issued 6,000 common shares to promoters who provided legal services that helped to

establish the company. These services had a fair value of $36,000.

31 Issued 80,000 common shares in exchange for land, building, and equipment, which have

fair market values of $360,000, $480,000, and $48,000, respectively.

4 Purchased equipment at a cost of $8,160 cash. This was thought to be a special bargain

price. It was felt that at least $10,800 would normally have had to be paid to acquire

this equipment.

31 During 2023, the company incurred a loss of $96,000. The Income Summary account was

closed.

2024

Jan.

Dec.

2825

Dec.

4 Issued 5,000 preferred shares at $72 per share.

31 The Income Summary account was closed. Profit for 2024 was $216,000.

4 The company declared a cash dividend of $0.12 per share on the common shares payable on

December 18 and also declared the required dividend on the preferred shares.

18 Paid the dividends declared on December 4.

31 Profit for the year ended December 31, 2025, was $192,000. The Income Summary account

was closed.

Required:

1. Journalize the transactions for the years 2023, 2024, and 2025. The company does not use a cash dividends account

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Oriole Inc. (OI) is a backyard pond design and installation company. Ol was incorporated during 2023, with an unlimited number of common shares, and 42,000 preferred shares with a $3 dividend rate authorized. Ol follows ASPE. The following transactions took place during the first year of operations with respect to these shares: Jan. 1 Jan. 15 Feb. 20 Mar. 3 May 10 Sept. 23 Nov. 28 Dec. 31 The articles of incorporation were filed and state that an unlimited number of common shares and 42,000 preferred shares are authorized. Dec. 31 25,200 common shares were sold by subscription to 3 individuals, who each purchased 8,400 shares for $42 per share. The terms require 8% of the balance to be paid in cash immediately. The balance was to be paid by December 31, 2024, at which time the shares will be issued. 58,800 common shares were sold by subscription to 7 individuals, who each purchased 8,400 shares for $42 per share. The terms require that 8% of the balance be paid in cash immediately,…arrow_forwardOn January 5, 2020, Bramble Corporation received a charter granting the right to issue 4,600 shares of $100 par value, 8% cumulative and nonparticipating preferred stock, and 49,800 shares of $10 par value common stock. It then completed these transactions. Jan. 11 Issued 19,300 shares of common stock at $16 per share. Feb. 1 Issued to Sanchez Corp. 3,600 shares of preferred stock for the following assets: equipment with a fair value of $50,600; a factory building with a fair value of $153,000; and land with an appraised value of $290,000. July 29 Purchased 2,000 shares of common stock at $19 per share. (Use cost method.) Aug. 10 Sold the 2,000 treasury shares at $15 per share. Dec. 31 Declared a $0.45 per share cash dividend on the common stock and declared the preferred dividend. Dec. 31 Closed the Income Summary account. There was a $162,500 net income. Record the journal entries for the transactions listed above. (Credit account…arrow_forwardOn June 1, 2023, Novak Company and Splish Company merged to form Blossom Inc. A total of 877,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2025, the company issued an additional 652,000 shares of stock for cash. All 1,529,000 shares were outstanding on December 31, 2025. Blossom Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2025. Each $1,000 bond converts to 44 shares of common at any interest date. None of the bonds have been converted to date. Blossom Inc. is preparing its annual report for the fiscal year ending December 31, 2025. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,444,000. (The tax rate is 20%.) Determine the following for 2025. a. The number of shares to be used for calculating: (Round answers to O decimal places, e.g. 2,500.) 1. 2. 1. Basic earnings per share 2. Diluted earnings per share Basic earnings per share b.…arrow_forward

- Hammond Manufacturing Inc. was legally incorporated on January 2, 2020. Its articles of incorporation granted it the right to issue an unlimited number of common shares and 100,000 shares of $14.0 non-cumulative preferred shares. The following transactions are among those that occurred during the first three years of operations: 2020 Jan. 12 Issued 40,300 common shares at $4.4 each. 20 Issued 6,000 common shares to promoters who provided legal services that helped to establish the company. These services had a fair value of $32,000. 31 Issued 76,000 common shares in exchange for land, building, and equipment, which have fair market values of $356,000, $476,000, and $44,000, respectively. Mar. 4 Purchased equipment at a cost of $8,120 cash. This was thought to be a special bargain price. It was felt that at least $10,400 would normally have had to be paid to acquire this equipment. Dec. 31 During 2020, the company incurred a loss of $92,000. The Income Summary account was closed. 2021…arrow_forwardIvanhoe Observation Inc. on May 1 2024, and was authorized to issue 500,000 common shares and 100,000 5%, non-participating, convertible preferred shares. During the remainder of 2024, the company entered into the following transactions: 1. Issued 32,000 common shares in exchange for $640,000. 2. Issued 5,000 preferred shares in exchange for $70,000. 3. Repurchased 3,000 common shares for $25.00 per share in the open market. The company entered into no other transactions that affected shareholders' equity during 2024. (a) Provide the journal entries for each of the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.)arrow_forwardFlint's Dance Studios Ltd. is a public company, and accordingly uses IFRS for financial reporting. The corporate charter authorizes the issuance of an unlimited number of common shares and 70,000 preferred shares with a $2 dividend. At the beginning of the December 31, 2020 year, the opening account balances indicated that 30,000 common shares had been issued for $5 per share, and no preferred shares had been issued. Opening retained earnings were $311,000. The transactions during the year were as follows: Jan. 15 Issued 12,000 common shares at $6 per share. Feb. 12 Issued 2,300 preferred shares at $56 per share. Sept. 2 Issued 5,000 common shares in exchange for land valued at $30,000. Oct. 31 Declared and paid a dividend on preferred shares of $2 per share. Nov. 1 Declared and paid a dividend on common shares of $1.20 per share. Nov. 15 Purchased and retired 500 preferred shares at $58 per share. Dec. 31 After preliminary closing entries, the Income Summary account had a credit…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education