FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

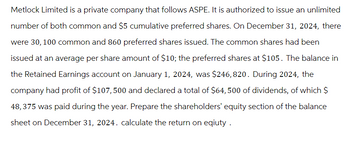

Transcribed Image Text:Metlock Limited is a private company that follows ASPE. It is authorized to issue an unlimited

number of both common and $5 cumulative preferred shares. On December 31, 2024, there

were 30, 100 common and 860 preferred shares issued. The common shares had been

issued at an average per share amount of $10; the preferred shares at $105. The balance in

the Retained Earnings account on January 1, 2024, was $246, 820. During 2024, the

company had profit of $107, 500 and declared a total of $64, 500 of dividends, of which $

48,375 was paid during the year. Prepare the shareholders' equity section of the balance

sheet on December 31, 2024. calculate the return on eqiuty.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Sheridan Company was organized on January 1, 2022. It is authorized to issue 12,500 shares of 8%, $100 par value preferred stock, and 477,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 80,500 shares of common stock for cash at $4 per share. Mar. 1 Issued 4,550 shares of preferred stock for cash at $105 per share. Issued 24,500 shares of common stock for land. The asking price of the land was $92,500. The fair value of the land was $85,000. Apr. 1 May 1 Issued 80,000 shares of common stock for cash at $5.00 per share. Issued 10,000 shares of common stock to attorneys in payment of their bill of $44,500 for services performed in helping the company organize. Aug. 1 Sept. 1 Issued 11,500 shares of common stock for cash at $7 per share. Nov. 1 Issued 2,500 shares of preferred stock for cash at $114 per share.arrow_forwardMechforce, Incorporated had net income of $171,200 for the year ended December 31, 2022. At the beginning of the year, 16,000 shares of common stock were outstanding. On April 1, an additional 17,000 shares were issued. On October 1, the company purchased 6,000 shares of its own common stock and held them as treasury stock until the end of the year. No other changes in common shares outstanding occurred during the year. During the year, Mechforce paid the annual dividend on the 8,000 shares of 3.35%, $100 par value preferred stock that were outstanding the entire year. Required: Calculate basic earnings per share of common stock for the year ended December 31, 2022. Note: Do not round intermediate calculations. Round your answer to 2 decimal places.arrow_forwardBaez Corp. began operations on Jan. 1, 2023. Baez Corp. is authorized to issue 150,000 shares of it's 6%, $40 par value preferred stock. The company is authorized to issue 650,000 shares of the common stock with a par value of $2 per share. On January 5, 2023, the company issued 225,000 shares of common stock for cash at $13 per share. What is the journal entry to record the issuance of the common stock shares?arrow_forward

- Bridgeport Corporation was organized on January 1, 2022. It is authorized to issue 15,000 shares of 8%, $100 par value preferred stock, and 504,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Mar. 1 Issued 85,000 shares of common stock for cash at $4 per share. Issued 5,150 shares of preferred stock for cash at $110 per share. Apr. 1 Issued 22.000 shares of common stock for land. The asking price of the land was $90,000. The fair value of the land was $84,000. May 1 Issued 78,000 shares of common stock for cash at $5.25 per share. Aug. 1 Sept. 1 Nov. 1 Issued 11.000 shares of common stock to attorneys in payment of their bill of $43,000 for services performed in helping the company organize. Issued 12,000 shares of common stock for cash at $7 per share. Issued 1,000 shares of preferred stock for cash at $113 per share.arrow_forwardAshvinarrow_forwardFlint's Dance Studios Ltd. is a public company, and accordingly uses IFRS for financial reporting. The corporate charter authorizes the issuance of an unlimited number of common shares and 70,000 preferred shares with a $2 dividend. At the beginning of the December 31, 2020 year, the opening account balances indicated that 30,000 common shares had been issued for $5 per share, and no preferred shares had been issued. Opening retained earnings were $311,000. The transactions during the year were as follows: Jan. 15 Issued 12,000 common shares at $6 per share. Feb. 12 Issued 2,300 preferred shares at $56 per share. Sept. 2 Issued 5,000 common shares in exchange for land valued at $30,000. Oct. 31 Declared and paid a dividend on preferred shares of $2 per share. Nov. 1 Declared and paid a dividend on common shares of $1.20 per share. Nov. 15 Purchased and retired 500 preferred shares at $58 per share. Dec. 31 After preliminary closing entries, the Income Summary account had a credit…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education