Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the

| Amount | Per Unit | |

|---|---|---|

| Sales revenue | $ 1,928,200 | $ 31.10 |

| Costs of fitting produced | 1,450,800 | 23.40 |

| Gross profit | $ 477,400 | $ 7.70 |

| Administrative costs | 337,900 | 5.45 |

| Operating profit | $ 139,500 | $ 2.25 |

Fixed costs included in this income statement are $403,000 for

Required:

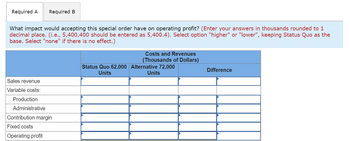

a. What impact would accepting this special order have on operating profit?

b. Should RTD accept the order?

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

- What are the expected average quarterly costs of running a consulting practice if fixed costs are expected to be $4,000 a month and variable costs are expected to be $100 per client for each quarter? Expected number of clients for the year are: Jan - March April - June July - Sep Oct - Dec 110 140 150 100 A. $12,500 B. $24, 500 C. $16, 500 D. $19,500arrow_forwardRowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 45,000 units during the quarter. RTD carries no inventories. Amount Per Unit Sales revenue $ 1,170,000 $ 26.00 Costs of fitting produced 900,000 20.00 Gross profit $ 270,000 $ 6.00 Administrative costs 207,000 4.60 Operating profit $ 63,000 $ 1.40 Fixed costs included in this income statement are $292,500 for depreciation on plant and machinery and miscellaneous factory operations and $94,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20 per unit. RTD can easily produce the 10,000 units with its existing…arrow_forwardPlease do not give solution in image format and show all calculation thankuarrow_forward

- Rowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,250, 200 958, 800 $ 291,400 220,900 $ 70,500 Per Unit $ 26,60 20.40 $6.20 4.70 $ 1.50 Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production…arrow_forwardThe PILLOW Co. manufactures two products, AA and BB. The following are projections for the coming month: AA BBSales P100,000 P150,000Costs: Variable 60,000 40,000 Fixed cost for the period is P45,000. 1. Compute for the total breakeven sales.2. Determine the sales requirement for each product to breakeven.arrow_forwardOzark Metal Company makes a single product that sells for $45.5 per unit. Variable costs are $29.1 per unit, and fixed costs total $65,355 per month. Required: a. Calculate the number of units that must be sold each month for the firm to break even. b. Assume current sales are $414,000. Calculate the margin of safety and the margin of safety ratio. c. Calculate operating income if 5,300 units are sold in a month. d. Calculate operating income if the selling price is raised to $48.5 per unit, advertising expenditures are increased by $10,000 per month, and monthly unit sales volume becomes 6,000 units. e. Assume that the firm adds another product to its product line and that the new product sells for $22 per unit, has variable costs of $16 per unit, and causes fixed expenses in total to increase to $87,000 per month. Calculate the firm's operating income if 5,300 units of the original product and 4,200 units of the new product are sold each month. For the original product, use the…arrow_forward

- The following is Pacific Limited’s contribution format income statement for January 2022: Sales $1,400,000 Variable expenses 700,000 Contribution margin 700,000 Fixed expenses 400,000 Net operating income $ 300,000 The company has no beginning or ending inventories and produced and sold 25,000 units during the month. Required (show your calculation): a. The company’s top management team is currently investigating how many units they need to sell to reach the break-even point. Also, they want to know how much revenue they need to generate to reach the break-even point. What do you think? d.d. Company’s Marketing Manager is confident that she can increase sales by 28% next year with some effort. What would be the expected percentage increase in net operating income? Use the degree of operating leverage concept to compute your answerarrow_forwardMaxim Manufacturing operations for 2022 are as follows: Per unit: $ Sales price 50 Direct material cost 18 Direct wages 4 Variable production overhead 3 Per month: Fixed production overhead 99 000 Fixed selling expenses 14 000 Fixed administration expenses 26 000 Variable selling expenses is 10% of sales value. Normal capacity was 11 000 units per month. October 2022 November 2022 Units Units Sales 10 000…arrow_forwardCrane Industries produces and sells a cell phone-operated home security control systems. Information regarding the costs and sales during May 2022 is as follows. Unit selling price $45.00 Unit variable costs $25.20 Total monthly fixed costs $124,000 Units sold 8,400 Prepare a CVP income statement for Crane Industries for the month of May. (Round per unit answers to 2 decimal places, e.g. 15.25.)arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education