FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

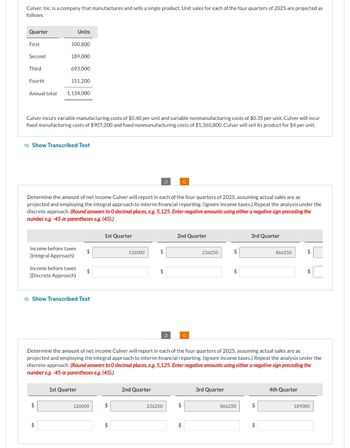

Transcribed Image Text:Culver, Inc. is a company that manufactures and sells a single product. Unit sales for each of the four quarters of 2025 are projected as

follows.

Quarter

First

Second

Third

Fourth

Annual total

100,800

189,000

Units

693,000

151,200

Culver incurs variable manufacturing costs of $0.40 per unit and variable nonmanufacturing costs of $0.35 per unit. Culver will incur

fixed manufacturing costs of $907,200 and fixed nonmanufacturing costs of $1,360,800. Culver will sell its product for $4 per unit.

1,134,000

Show Transcribed Text

$

Income before taxes

(Integral Approach)

$

Income before taxes

(Discrete Approach)

Determine the amount of net income Culver will report in each of the four quarters of 2025, assuming actual sales are as

projected and employing the integral approach to interim financial reporting. (Ignore income taxes.) Repeat the analysis under the

discrete approach. (Round answers to O decimal places, e.g. 5,125. Enter negative amounts using either a negative sign preceding the

number e.g.-45 or parentheses e.g. (45).)

Show Transcribed Text

$

1st Quarter

$

1st Quarter

126000

$

126000

$

$

2nd Quarter

$

3

236250

Ć

2nd Quarter

Determine the amount of net income Culver will report in each of the four quarters of 2025, assuming actual sales are as

projected and employing the integral approach to interim financial reporting. (Ignore income taxes.) Repeat the analysis under the

discrete approach. (Round answers to O decimal places, e.g. 5,125. Enter negative amounts using either a negative sign preceding the

number e.g. -45 or parentheses e.g. (45).)

$

$

Ĉ

236250

$

3rd Quarter

$

3rd Quarter

866250

$

866250

$

$

4th Quarter

$

189000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 1. Golf Corporation estimates that its production for the coming year will be 25,000 units, which is 90% of normal capacity, with the following units costs: Materials P50 Direct labor 90 Direct labor is paid at the rate of P25 per hour. The machine should be run 20 minutes to produce one unit. Total estimated overhead is expected to consist of P900,000 for variable overhead and P900,000 for fixed overhead. g. What is the predetermined overhead rate base on material cost using the normal capacity level? h. What is the overhead rate base on machine hours using the normal capacity activity level?arrow_forwardhe production cost information for Blossom's Salsa is as follows: Blossom's Salsa Production Costs April 2020 Production 23,000 Jars of Salsa Ingredient cost (variable) $13, 800 Labor cost (variable ) 9,660 Rent (fixed) 4, 300 Depreciation (fixed) 6,000 Other (fixed) 1,400 Total $35, 160 The company is currently producing and selling 345,000 jars of salsa annually. The jars sell for $7.00 each. The company is considering lowering the price to $6.30. Suppose this action will increase sales to 391, 000 jars. What is the incremental cost associated with producing an extra 46, 000 jars of salsa?arrow_forwardSilverstone is a company that manufactures and sells electrical engines for electrical trucks. For its 2023 budget, Silverstone estimates that unit selling price is $10,000, variable manufacturing cost per engine is $5,000. Fixed costs are $600,000 per month. Sales team incurs a flat salary of $8,000 per month, which is already included in monthly fixed cost budget. On top of that, the sales commission is 5% of selling price. Required: a. What is the contribution margin per engine? b. What is the breakeven point in units and in revenues each month? (Show your calculation steps). C. At current price level, Silverstone expects to sell 140 units of its engine. If Silverstone lowers the price by 10%, the marketing team predicts that the sales will increase to 170 units. Is it a good decision? Using the result to illustrate why. d. What is the operating leverage level if Silverstone sells 150 units per month at current price?arrow_forward

- The PILLOW Co. manufactures two products, AA and BB. The following are projections for the coming month: AA BBSales P100,000 P150,000Costs: Variable 60,000 40,000 Fixed cost for the period is P45,000. 1. Compute for the total breakeven sales.2. Determine the sales requirement for each product to breakeven.arrow_forwardAssume that 4,500 units of the halogen light have been produced and sold during the current year. Analysis of the domestic market indicates that 3,600 additional units of the halogen light are expected to be sold during the remainder of the year at the normal product price determined under the total cost concept. Twilight Lumina Company received an offer from Contech Inc. for 1,400 units of the halogen light at $202.50 each. Contech Inc. will market the units in Southeast Asia under its own brand name, and no selling and administrative expenses associated with the sale will be incurred by Twilight Lumina Company. The additional business is not expected to affect the domestic sales of the halogen light, and the additional units could be produced using existing capacity. a. Prepare a differential analysis report of the proposed sale to Contech Inc. $Revenue from sale of additional units Variable costs of additional units Differential income (loss) from accepting offerarrow_forwardAdiwele Ltd has a financial year end of 31 March. The entity manufactures Compact Discs for resale. The manufacturing cost per compact disc is R2 per unit. Finished units of the compact disc are sold at R2.5 per unit. On 31 March 2021, Adiwele Ltd had 100 500 units of compact discs in stock. To sell this products Adiwele Ltd will incur the following costs: Sales commission of 20 cents per unit, Additional designing costs of 25 cents per unit, Advertising and packaging costs of 23 cents per unit, Salaries for administrative staff of R6 000 per month. Adiwele Ltd measures inventory at lower of cost and net realisable value as per IAS 2, Inventories according to IFRS at year end. What is the value of the closing inventory on 31 March 2021 as per IAS 2? 1.251 250 2. 201 000 3. 208 035 4. 136 035 5. 244 215arrow_forward

- A manufacturer has a production facility that requires 19,111 units of component JY21 per year. Following a long-term contract, the manufacturer purchases component JY21 from a supplier with a lead time of 6 days. The unit purchase cost is $12.8 per unit. The cost to place and process an order from the supplier is $113 per order. The unit inventory carrying cost per year is 20 percent of the unit purchase cost. The manufacturer operates 250 days a year. Assume EOQ model is appropriate. What is the optimal total annual inventory and purchase cost for the manufacturer? Use at least 4 decimal places.arrow_forwardAB Company produces two Products: A and B. Product A has a contribution margin of $30 per unit. Product B has a contribution margin of $5 per unit. The sales mix is three units of product A for each two units of product B. The company total monthly fixed cost is $480,000. During the month, how many units should the company sell of each ?product to achieve a target operating income of $150,000 .units of product A and 10,600 units of product B 15,900 a O .units of product A and 5,000 units of product B 30,000 b O .18,900units of product A and 12,600 units of product B .c O None of the choices given d O .units of product A and 11,600 units of product B 17,400 .e Oarrow_forwardPale Manufacturing Company has an expected production level of 175,000 product units in 2020. Fixed factory overhead is P450,000 and the company applies factory overhead on the basis of expected production level at the rate of P5.20 per unit. The variable overhead cost per unit is * Ph 2.57 Ph 2.63 Ph 2.93 Ph 3.02arrow_forward

- Craylon Manufacturing produces a single product that sells for $100. Variable costs per unit equal $25. The company expects total fixed costs to be $60,000 for the next month at the projected sales level of 1,000 units. The operating income for the next month is : Select one: a. 15,000 b. 60,000 c. 135,000 d. 75,000arrow_forwardPlease help me. Thankyou.arrow_forwardWestern Jeans Co. has an annual plant capacity of 2,000,000 units, and current production is 1,920,000 units. Monthly fixed costs are $400,000, and variable costs are $9 per unit. The present selling price is $15 per unit. On July 6 of the current year, the company received an offer from Childs Company for 50,000 units of the product at $13 each. Childs Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of sales of Western Jeans Co. Question Content Area a. Prepare a differential analysis dated July 6 on whether to reject (Alternative 1) or accept (Alternative 2) the Childs order. If an amount is zero, enter "0". If required, use a minus sign to indicate a loss. Differential AnalysisReject (Alt. 1) or Accept (Alt. 2) OrderJuly 6 Line Item Description Reject Order(Alternative 1) Accept Order(Alternative 2) Differential Effects(Alternative 2) Revenues $Revenues…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education