FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

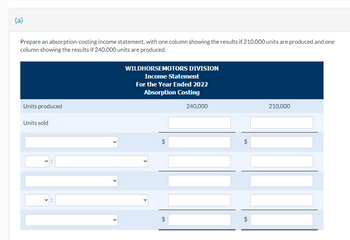

Transcribed Image Text:(a)

Prepare an absorption-costing income statement, with one column showing the results if 210,000 units are produced and one

column showing the results if 240,000 units are produced.

Units produced

Units sold

WILDHORSEMOTORS DIVISION

Income Statement

For the Year Ended 2022

Absorption Costing

$

$

240,000

$

210,000

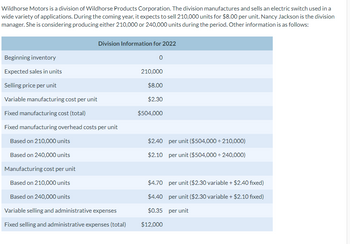

Transcribed Image Text:Wildhorse Motors is a division of Wildhorse Products Corporation. The division manufactures and sells an electric switch used in a

wide variety of applications. During the coming year, it expects to sell 210,000 units for $8.00 per unit. Nancy Jackson is the division

manager. She is considering producing either 210,000 or 240,000 units during the period. Other information is as follows:

Division Information for 2022

0

Beginning inventory

Expected sales in units

Selling price per unit

Variable manufacturing cost per unit

Fixed manufacturing cost (total)

Fixed manufacturing overhead costs per unit

Based on 210,000 units

Based on 240,000 units

Manufacturing cost per unit

Based on 210,000 units

Based on 240,000 units

Variable selling and administrative expenses

Fixed selling and administrative expenses (total)

210,000

$8.00

$2.30

$504,000

$2.40 per unit ($504,000 ÷ 210,000)

$2.10 per unit ($504,000 ÷ 240,000)

$4.70 per unit ($2.30 variable + $2.40 fixed)

$4.40 per unit ($2.30 variable + $2.10 fixed)

$0.35 per unit

$12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Meow Foods had 2,000 25-pound bags of cat food in beginning inventory. During 2020, the company manufactured 16,000 bags and sold 15,000 units. Assume the same unit costs in all years. Each bag of food is sold for $17. The company experienced the following costs: Direct materials $5.00 per unit Direct labor $2.10 per unit Variable manufacturing overhead $1.90 per unit Variable selling $1.00 per unit Fixed manufacturing overhead $48,000 Fixed selling $24,000 Fixed administrative $30,000 If the company uses variable costing, how much will be reported as inventory on the December 31, 2020, balance sheet? $27,000 $30,000 $28,500 $34,500arrow_forwardRowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 45,000 units during the quarter. RTD carries no inventories. Amount Per Unit Sales revenue $ 1,170,000 $ 26.00 Costs of fitting produced 900,000 20.00 Gross profit $ 270,000 $ 6.00 Administrative costs 207,000 4.60 Operating profit $ 63,000 $ 1.40 Fixed costs included in this income statement are $292,500 for depreciation on plant and machinery and miscellaneous factory operations and $94,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20 per unit. RTD can easily produce the 10,000 units with its existing…arrow_forwardRowe Tool and Die (RTD) produces metal fittings as a supplier to various manufacturing firms in the area. The following is the forecasted income statement for the next quarter, which is the typical planning horizon used at RTD. RTD expects to sell 47,000 units during the quarter. RTD carries no inventories. Sales revenue Costs of fitting produced Gross profit Administrative costs Operating profit Amount $ 1,250, 200 958, 800 $ 291,400 220,900 $ 70,500 Per Unit $ 26,60 20.40 $6.20 4.70 $ 1.50 Fixed costs included in this income statement are $305,500 for depreciation on plant and machinery and miscellaneous factory operations and $95,500 for administrative costs. RTD has received a request for 10,000 fittings to be produced in the next quarter from Endicott Manufacturing. Endicott has never purchased from RTD, although they have been a local company for many years. Endicott has offered to pay $20.20 per unit. RTD can easily produce the 10,000 units with its existing capacity. Production…arrow_forward

- keep costs down, CGC maintains a warehouse but no showroom or retail sales outlets. CGC has the following information for the second quarter of the year: 1. Expected monthly sales for April, May, June, and July are $180,000, $150,000, $270,000, and $50,000, respectively. 2. Cost of goods sold is 45 percent of expected sales. 3. CGC's desired ending inventory is 55 percent of the following month's cost of goods sold. 4. Monthly operating expenses are estimated to be: . Salaries: $33,000. ° Delivery expense: 8 percent of monthly sales. • Rent expense on the warehouse: $2,500. • Utilities: $500. • Insurance: $330. • Other expenses: $430. Required: 1. Compute the budgeted cost of purchases for each month in the second quarter. 2. Complete the budgeted income statement for each month in the second quarter. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the budgeted cost of purchases for each month in the second quarter. Total Cost of…arrow_forwardA shirt manufacturing company expects to be able to sell 15,000 shirts in April 2022. Sales volumes are expected to grow at 5% per month cumulatively thereafter throughout 2022. The following additional information is available. 1. The company intends to carry a stock of finished garments sufficient to meet 40% of the next month's sales. 2. The company intends to carry sufficient raw material stock to meet the following month's production. 3.Estimated costs and revenues per shirt are as follows: Sales price Per shirt K 30 Raw materials Fabric at K12 per square metre (12) Dyes and cotton Direct labour at K8 per hour Fixed overheads at K4 per hour Profit (3) (4) (2) K9 Required: Prepare the following budgets on a monthly basis for each of the three months July to September 2022: (i) A sales budget showing sales units and sales revenue; (ii) A production budget (in units); (iii) A fabric purchases budget (in square metres). (iv) Labour hours and cost budgetarrow_forwardusing this layoutarrow_forward

- Lighter Incorporated planned and manufactured 440,000 units of its single product in 2022, its first year of operations. Variable manufacturing costs were $58 per unit of production. Planned and fixed manufacturing costs were $840,000. Marketing and administrative costs (all fixed) were $640,000 in 2022. Lighter Incorporated sold 203,000 units of product in 2022 at $73 per unit. Sales for 2022 are calculated to be:arrow_forwardRuth, the owner of Crystal Clean, is planning for the next year. She uses the absorption method to determine the evaluation of employees and how much to increase their hourly wage. She has budgeted the following information: Variable operating expenses $4 per unitFixed operating expenses $211900 Variable manufacturing cost $11 per unitFixed manufacturing cost $253000 Units to be produced 25300 unitsUnit selling price $31 per unit Year 1 Year 2 Beginning inventory (units) 0 1400 Actual production (units) 23800 25800 Sales volume (units) 22400 26500 There were no price or efficiency variances for either year. Ruth writes off any fixed MOH volume variance directly to COGS. Calculate the gross margin for year 1.…arrow_forwardWashington Inc, expects to sell 50,000 custom vases for $75 each in 2020. Planned direct materials costs are $30, direct manufacturing labor is $16, and manufacturing overhead is $4 for each vase. One unit of direct material is required for one unit of finished product. The following inventory levels apply: Beginning Inventory Ending Inventory Direct materials 16,000 units 21,000 units Work-in-process inventory 0 units 0 units Finished goods inventory 9,000 units 8,000 units Required: Select the appropriate answer for both questions (1 and 2) below: 1: The amount budgeted for direct material purchases in 2020 (in dollars) is: (Choose below) A: 1,728,000 B: 1,620,000 C: 1,408,000 D: 1,472,000 E: 1,568,000 F: None 2: The amount budgeted for cost of goods manufactured in 2020 (in dollars) is A: 2,856,000 B: 3,248,000 C: 2,450,000 D: 2,744,000 E: 3,080,000 F: nonearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education