Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

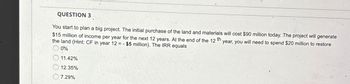

Transcribed Image Text:QUESTION 3

You start to plan a big project. The initial purchase of the land and materials will cost $90 million today. The project will generate

$15 million of income per year for the next 12 years. At the end of the 12 th

the land (Hint: CF in year 12=- $5 million). The IRR equals

0%

11.42%

year, you will need to spend $20 million to restore

12.35%

7.29%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Question 5 An investment of $50,000 is made to purchase machinery that will allow us to manufacture a new product. The annual expenses to make the product are (5,000 + 5x) and the revenues from the product are 30 x, where x = the number of products sold each year. How many products must be sold per year, x, to break even? Consider a 7 year project life and an MARR of 12%.arrow_forwardCalculate the IRR for the picture enclosedarrow_forwardvv.2arrow_forward

- Moving to another question will save this response. Question 5 XYZ is evaluating a project that would last for 3 years. The project's cost of capital is 17.20 percent, its NPV is $43,100.00 and the expected cash flows are presented in the table. What is 27 Years from today 0 1 2 3 Expected Cash Flow (in $) -53,600 71,700 -13,000 X O An amount equal to or greater than $69,384.00 but less than $75,459.00 O An amount equal to or greater than $43,100.00 but less than $52,436.00 O An amount equal to or greater than $52,436.00 but less than $63,115.00 O An amount equal to or greater than $63,115.00 but less than $69,384.00 O An amount less than $43,100.00 or an amount greater than $75,459.00arrow_forwardProblem 1. Multiple-Choice (8 2 OLf you invest $14,000 now into a projeet that will yield net evenue of $1,763 at the end of each year for 12 years, what is the IRK of your investment a) 15 b) 10% )9% d) 12 ej 7% D None of the above 02 it you invent $10,000 nuw into a project that will yield net tevenue of S1.560 the end of each year for 12 years, what is the ERR of your investment if your reinvestment rate is 9% per year a) 10% b) O d) 7% 06 012% None of the above 03. How much can you afford to pay for a 56,000 bond that pays 7% interest annually and will maturs 20 years hence if you desire to earn 10% on your investment? a)54,319 b) $2,979.8 ) $2.7435 d) $6,000 )53,227 ) None of the above Q4. A machine costs $40,000 and is expected to save $16,200 per year while in operation, If MARR - 20, what is the discounted payback period? a)6 years b) 5 years c) 4 yeap d) 3 years e) 7 years ) None of the above Q5. A piece of equipment is purchased for $20,000, will generate revenues of $4,000…arrow_forwardUrgent need pls Your firm is considering a project with a discount rate of 12%. If you start the project today, your firm will incur an initial cost of $480 and will receive cash inflows of $320 per year for 3 years with the first cashflow occurring one year from today. If you instead wait one year to start the project, the initial cost one year from today will rise to $520 and the cash flows will increase to $375 a year for the following 3 years with the first positive cashflow occurring two years from today. Would your firm be better off starting the project now or waiting to start the project in one year? What is the VALUE of the option to wait? Explain your answer clearly, including the NPVs of the two choices.arrow_forward

- Solve Problem 20.19 using Excel.arrow_forward2arrow_forward11. I need help with finance home work question A company is considering a 7-year project. At the beginning of the project, a cash outflow in the amount of $340,000 would be required. The company expects the project would generate cash inflows in the amount of $70,000 at the end of each of the project's 7 years. Assume the company requires a return of 8%. What NPV does the company expect for this project?arrow_forward

- Vishuarrow_forwardProblem 5: Calculating NPV and IRR. A project that provides annual cash flows of $1,710 for 10 years costs $7,560 today. PART 5A: The NPV is $ if the required rate of return is 10%.arrow_forward4 You are planning to invest $300 in new equipment. The equipment will generate cost savings of $300 in year 1 and $400 in year 2. The salvage value at the end of year 2 is zero. The discount rate (cost of capital) is 25% a year. Compute the net present value (NPV) of this investment. O $196 O $496 O $700 O $400 O $796arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education