Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN: 9780357033609

Author: Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

f1

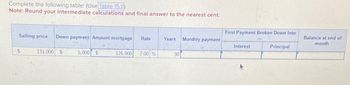

Transcribed Image Text:Complete the following table: (Use Table 15.1)

Note: Round your intermediate calculations and final answer to the nearest cent.

First Payment Broken Down Into

Selling price Down payment Amount mortgage Rate

Years

Monthly payment

Balance at end of

month

Interest

Principal

$

131,000

$

5,000 $

126,000

7.00 %

30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- rive loan is below. Payments of $1,987.26 are made monthly. Payment # Payment 1 1,987.26 2 1,987.26 3 1,987.26 Interest Debt Payment Balance 1,604.17 383.09 1,602.41 384.85 1,600.65 386.61 Provide your answer below: X Y Z Calculate the value of z, the balance of the loan at the end of month 3. Give your answer to the nearest dollar. Do not include commas or the dollar sign in your answer.arrow_forwardCalculate the table factor, the finance charge, and the monthly payment (in $) for the loan by using the APR table. (Round your answers to the nearest cent.) AmountFinanced Number ofPayments APR TableFactor FinanceCharge MonthlyPayment $700 18 16% $ $ $arrow_forwardmplete the following table: (Use Table 15.1.) te: Round your intermediate calculations and final answer to the nearest cent. Selling price Down payment Amount mortgage Rate 150,000 $ 30,000 $ 120,000 7% Years Monthly payment 30 $ First Payment Broken Down Into 798.36 $ Interest 700 $ Principal 98.36 Balance at e montharrow_forward

- Complete the following table: (Use Table 15.1.) Note: Do not round intermediate calculations. Round your answers to the nearest cent. selling price down payment amount mortgage rate years monthly payment first payment broken down into interest first payment broken down into principal Balance at end of month $236,000 47,200 $188,800 7.00% 15 Monthly payment is NOT 1694.23 first payment broken down into interest is NOT 1,101.23 first payment principal is NOT 592.90 balance at end is NOT 188,207.10 TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883 4.23854 3.69619 3.02826 2.125 0.17708 9.25743 6.49281 5.11825 4.29966 3.75902 3.09444 2.250 0.18750 9.31374 6.55085 5.17808 4.36131 3.82246 3.16142 2.375 0.19792 9.37026 6.60921 5.23834 4.42348 3.88653 3.22921 2.500 0.20833 9.42699 6.66789 5.29903 4.48617 3.95121 3.29778 2.625…arrow_forwardComplete the following table: (Use Table 15.1.) (Do not round intermediate calculations. Round your answers to the nearest cent.) First Payment Broken Down Into— Selling price Down payment Amount mortgage Rate Years Monthly payment Interest Principal Balance at end of month $221,000 $44,200 7.00 % 15arrow_forwardFind the amount (in of interest and the maturity value of the loans. Use the formula MV = P + I to find the maturity value. (Round your answers to two decimal places.) Principal Rate (%) Time $145,000 14/12/2 Need Help? Submit Answer Read It 8 months Interest Enter a number. Maturity Value LA Xarrow_forward

- The following loan was paid in full before its due date a) Find the value of h using an appropriate formula b) Use the actuarial method to find the amount of unearned interest c) Find the payoff amount Regular Monthly Payment # of Payments Remaining after Payoff APR 7.2% $247 8 What is the finance charge per $100 financed? h=$ (Round to the nearest cent)arrow_forwardNote: Round all answers to the nearest cent when necessary. Calculate the amount financed, the finance charge, and the total deferred payment price (in $) for the following installment loan. Purchase(Cash)Price DownPayment AmountFinanced MonthlyPayment Number ofPayments FinanceCharge TotalDeferredPaymentPrice $2,800 0 185.69 18arrow_forwardWhat is the apr? Please solve this question general Accounting questionarrow_forward

- Complete the following table: (Use Table 15.1.) (Do not round intermediate calculations. Round your answers to the nearest cent.) Selling price Down payment Amount mortgage Rate Years Monthly payment First Payment Broken Down Into— Interest & Principle Balance at end of month $143,000 $32,000 7.50% 30 I need help working out this problem. Please explain in detail.arrow_forward1 Complete the following table: (Use Table 15.1.) Note: Round your intermediate calculations and final answer to the nearest cent. Selling price Down payment Amount mortgage $ 132,000 $ 7,000 $ 125,000 Rate 7,50 % Years 301 Monthly payment First Payment Broken Down Into Interest Principal Balance at end of montharrow_forwardComplete the following amortization chart by using Table 15.1. (Round your answers to the nearest cent.) Selling price of home Principal (loan) Payment per $1,000 Monthly mortgage payment Rate of Down payment Years interest 182,000 60,000 6.5 % 35 Σ %24 %24arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning