Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

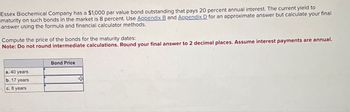

Transcribed Image Text:Essex Biochemical Company has a $1,000 par value bond outstanding that pays 20 percent annual interest. The current yield to

maturity on such bonds in the market is 8 percent. Use Appendix B and Appendix D for an approximate answer but calculate your final

answer using the formula and financial calculator methods.

Compute the price of the bonds for the maturity dates:

Note: Do not round intermediate calculations. Round your final answer to 2 decimal places. Assume interest payments are annual.

a. 40 years

b. 17 years

c. 8 years

Bond Price

+

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- (Related to Checkpoint 9.2) (Yield to maturity) Abner Corporation's bonds mature in 19 years and pay 13 percent interest annually. If you purchase the bonds for $1,225, what is your yield to maturity? Question content area bottom Part 1 Your yield to maturity on the Abner bonds is enter your response here%. (Round to two decimal places.)arrow_forwardThe Wall Street Journal reports that the current rate on 5-year Treasury bonds is 1.85 percent and on 10-year Treasury bonds is 3.35 percent. Assume that the maturity risk premium is zero. Calculate the expected rate on a 5-year Treasury bond purchased five years from today, Egrs). (Do not round intermediate calculations. Round your answer to 2 decimal places.) Expected rate- my workarrow_forwardPlease show proper steps thanks.arrow_forward

- ces Calculate the bond equivalent yield and effective annual return on a negotiable CD that is 115 days from maturity and has a quoted nominal yield of 6.74 percent. (Use 365 days in a year. Do not round intermediate calculations. Round your percentage answers to 3 decimal places. (e.g., 32.161)) Bond equivalent yield Effective annual return %arrow_forwardHaresharrow_forwardDraiman Corporation has bonds on the market with 23.5 years to maturity, a YTM of 7 percent, a par value of $1,000, and a current price of $1,051. The bonds make semiannual payments. What must the coupon rate be on these bonds? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forward

- Subject-advance mathsarrow_forwardsarrow_forwardValdez Corporation has bonds on the market with 11.5 years to maturity, a YTM of 7.2 percent, a par value of $1,000, and a current price of $1,054. The bonds make semiannual payments. What must the coupon rate be on these bonds? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. Coupon rate %arrow_forward

- Wildhorse Corp. has 18-year bonds outstanding. These bonds, which pay interest semiannually, have a coupon rate of 9.875 percent and a yield to maturity of 6.0 percent. Assume face value is $1,000. Problem 8.30(a) Your answer is incorrect. Compute the current price of these bonds. (Round answer to 2 decimal places, e.g. 15.25.) Current price $ EAarrow_forwardBarry's Steroids Company has $1,000 par value bonds outstanding at 16 percent interest. The bonds will mature in 40 years If the percent yield to maturity is 12 percent, what percent of the total bond value does the repayment of principal represent? Assume interest payments are annual Use Appendix B and Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Note: Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places. Principal as a percentage of bond pricearrow_forwardAn insurance company is analyzing the following three bonds, each with five years to maturity, annual interest payments, and is using duration as its measure of interest rate risk. What is the duration of each of the three bonds? (Do not round intermediate calculations. Round your answers to 2 decimal places. (e.g., 32.16)) a. $10,000 par value, coupon rate=9.7%, r 0.17 b. $10,000 par value, coupon rate 11.7%, r= 0.17 c. $10,000 par value, coupon rate = 13.7%, p=0.17 Duration of the bond yearsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education