Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

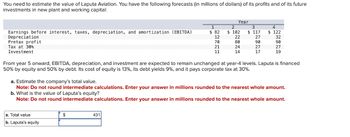

Transcribed Image Text:You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future

investments in new plant and working capital:

Year

1

2

3

4

Earnings before interest, taxes, depreciation, and amortization (EBITDA)

Depreciation

$ 82

$ 102

$ 117

$ 122

12

22

27

32

Pretax profit

70

80

90

90

21

24

27

27

Tax at 30%

Investment

11

14

17

19

From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed

50% by equity and 50% by debt. Its cost of equity is 13%, its debt yields 9%, and it pays corporate tax at 30%.

a. Estimate the company's total value.

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.

b. What is the value of Laputa's equity?

Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount.

a. Total value

$

b. Laputa's equity

431

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A startup company has a fixed capital investment of Ph 500,000 and minimum working capital. The salvage value is set at Php 15,000. Calculate the a) Return on Investment and b) the Payback Period. If the mar is 25%, is the project profitable or not? Year After Tax Earning 1 201079.1 2 49051.48 3 145381.1 4 89021.41 22509.13 221273.2 7 134490.4 8 273262 9 146166.3 10 63456.84arrow_forwardWhat is the internal rate of return of a capital investment project that has the followingafter-tax cash flows for a company that requires a 15% rate of return on the project?Time Cash Flow0 -$4,0001 5002 2,000 3 5,000arrow_forwardRagubhaiarrow_forward

- Chase Brew Inc is considering an investment with the following information: initial investment in assets = $1,600,000 to be depreciated to $0 via straight-line method over 8-year project life sales will increase by $1,750,000/year expenses will increase by $1,240,000/year firm's marginal tax rate is 28% What is the incremental after-tax cash flow (OCF) per year associated with the following project? Enter answer in dollars, rounded to the nearest dollar.arrow_forward(gnore income taxes in this problem.) Your Company is considering an investment that has the following data: Year 2 5 Investment $20,000 Cash inflow $12,000 $12,000 $15,000 $4,000 $4,000 In what year does the payback period for this investment occur? Year 2. Year 3. Year 4. Year 5.arrow_forwardImage is clear please answer and help mearrow_forward

- You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital: Year 1 2 3 4 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation $ 75 $ 95 $ 110 $ 115 15 25 30 35 Pretax profit 60 Tax at 30% 18 Investment 17 20 222 70 80 80 21 24 24 23 25 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60% by debt. Its cost of equity is 16%, its debt yields 7%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. a. Total value b. Laputa's equityarrow_forwardYou need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its future investments in new plant and working capital Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation Pretax profit Tax at 30% Investment Answer is complete but not entirely correct. Total value b. Laputa's equity $ 1 $ 81 21 60 18 10 3 Year 893 224 2 $ 101 31 70 21 13 3 16 35 种味道 $ 116 36 80 24 16 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is financed 40% by equity and 60 % by debt. Its cost of equity is 12%, its debt yields 8%, and it pays corporate tax at 30% $ 121 a. Estimate the company's total value Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the…arrow_forwardNikularrow_forward

- Revenues generated by a new fad product are forecast as follows: Year Revenues 1 $50,000 2 35,000 3 30,000 4 20,000 Thereafter 0 Expenses are expected to be 40% of revenues, and working capital required in each year is expected to be 20% of revenues in the following year. The product requires an immediate investment of $60,000 in plant and equipment. a. What is the initial investment in the product? Remember working capital. b. If the plant and equipment are depreciated over 4 years to a salvage value of zero using straight-line depreciation, and the firm’s tax rate is 20%, what are the project cash flows in each year? Assume the plant and equipment are worthless at the end of 4 years. c. If the opportunity cost of capital is 10%, what is the project's NPV? d. What is the project IRR?arrow_forwardThe company is in search of resources for a new investment of TL 3,000,000. As a financial manager,a) Find the current weighted average cost of capital according to the resource distribution below.b) Discuss, what kind of financing strategy would you propose for the investment project in question.arrow_forwardExplain how did it get the after-tax cash flow, NPV, EVA, and MVAarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education