Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

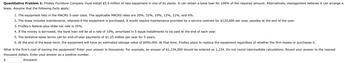

Transcribed Image Text:Quantitative Problem 1: Findley Furniture Company must install $5.9 million of new equipment in one of its plants. It can obtain a bank loan for 100% of the required amount. Alternatively, management believes it can arrange a

lease. Assume that the following facts apply:

1. The equipment falls in the MACRS 5-year class. The applicable MACRS rates are 20%, 32%, 19%, 12%, 11%, and 6%.

2. The lease includes maintenance, whereas if the equipment is purchased, it would require maintenance provided by a service contract for $120,000 per year, payable at the end of the year.

3. Findley's federal-plus-state tax rate is 35%.

4. If the money is borrowed, the bank loan will be at a rate of 10%, amortized in 5 equal installments to be paid at the end of each year.

5. The tentative lease terms call for end-of-year payments of $1.25 million per year for 5 years.

6. At the end of the lease term, the equipment will have an estimated salvage value of $950,000. At that time, Findley plans to replace the equipment regardless of whether the firm leases or purchases it.

What is the firm's cost of owning the equipment? Enter your answer in thousands. For example, an answer of $1,234,000 should be entered as 1,234. Do not round intermediate calculations. Round your answer to the nearest

thousand dollars. Enter your answer as a positive number.

$

thousand

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- a7arrow_forwardBird Wing Bedding can lease an asset for 4 years with payments of $22,000 due at the beginning of the year. The firm can borrow at a 6% rate and pays a 25% federal-plus-state tax rate. The lease qualifies as a tax-oriented lease. What is the cost of leasing?arrow_forwardJeremy Leasing purchases and then leases small aircraft to interested parties. The company is currently determining the required rental for a small aircraft that cost them $600,000. If the lease is for twenty years and annual lease payments are required to be made at the end of each year, what will be the annual rental if Jeremy wants to earn a return of 10%? a. $64,070. b. $70,476. c. $10,476. d. $30,314.arrow_forward

- please show the solutionarrow_forwardRed Sun Rising Corporation has just signed a lease for its new manufacturing facility. The lease agreement calls for annual payments of $1,850,000 for 20 years with the first payment due today. If the interest rate is 3.55 percent, what is the value of this liability today?arrow_forwardPlease help solvearrow_forward

- Auto Leasing Inc. leases an automobile with a fair value of $40,000 to a customer over a four year period with payments due annually. The first payment is due on the first day of the lease. What is the annual lease payment if Auto Leasing Inc. desires a rate of return of 10% ? Note: Do not use a negative sign with your answer. $ 0arrow_forwardQuestion: Yankee Construction agreed to lease payments of $762.79 on the construction equipment to be made at the end of each month for six years. Financing is at 15% compounded monthly. a) What is the value of the original lease contract? b) If, due to delays, the first eight payments were deferred, how much money would be needed after nine months to bring the lease payments up to date? c) How much money would be required to pay off the lease after nine months? d) If the lease were paid off after nine months, what would the total interest be? e) How much of the total interest would be due to deferring the first eight payments?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education