Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

Rich corporation purchasesd a limited solve this general accounting question

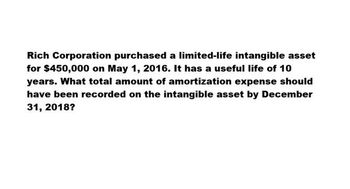

Transcribed Image Text:Rich Corporation purchased a limited-life intangible asset

for $450,000 on May 1, 2016. It has a useful life of 10

years. What total amount of amortization expense should

have been recorded on the intangible asset by December

31, 2018?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Referring to PA7 where Kenzie Company purchased a 3-D printer for $450,000, consider how the purchase of the printer impacts not only depreciation expense each year but also the assets book value. What amount will be recorded as depreciation expense each year, and what will the book value be at the end of each year after depreciation is recorded?arrow_forwardThe following intangible assets were purchased by Goldstein Corporation: A. A patent with a remaining legal life of twelve years is bought, and Goldstein expects to be able to use it for seven years. B. A copyright with a remaining life of thirty years is purchased, and Goldstein expects to be able to use it for ten years. For each of these situations, determine the useful life over which Goldstein will amortize the intangible assets.arrow_forwardWhat is the proper time or time period over which to amortize an intangible asset if there is no forseeable limit on the period of time over which the intangible assets is expected to be used in operations? a. 40 years b. 50 years c. immediately d. not amortizedarrow_forward

- An intangible asset with an estimated useful life of30 years was acquired on January 1, 2007, for $540,000.On January 1, 2017, a review was made of intangibleassets and their expected service lives, and it was determinedthat this asset had an estimated useful life of 30more years from the date of the review. What is theamount of amortization for this intangible in 2017?arrow_forwardSagararrow_forwardROSE Company purchased machinery on January 1, 2020. It has an estimated useful life of four years and a residual value of ₱500,000. The machine is being depreciated using SYD Method. The depreciation applicable to this fixed asset for 2021 is ₱1,200,000. What was the acquisition cost of the machinery? *arrow_forward

- On January 3, 2019, Soju Co. purchased machinery. The machinery has an estimated useful life of eight years and an estimated salvage value of P30,000. The depreciation applicable to this machinery was P65,000 for 2021, computed by the sum-of-the-years'-digits method. The acquisition cost of the machinery was ? a. P360,000 b. P390,000 c. P420,000 d. P468,000arrow_forwardManjiarrow_forwardOn January 1, 2017, RIP Isabel Granada Company purchased a machinery for P600,000, with an estimated economic useful life of 12 years. Straight line method of depreciation is to be used. On December 31, 2020, it was properly determined that the fair value less cost of disposal is P235,000, while the value in use is P240,000. On January 1, 2023, it was properly computed that the recoverable amount of the asset is P250,000. 8) How much is the impairment loss on December 31, 2020? A. 0 B. 110,000 C. 165,000 D. 160,000 9) How much is impairment recovery should be reported on January 1, 2023? A. 50,000 B. 70,000 C. 120,000 D. 0 10) Assuming the recoverable value on January 1, 2023 is P330,000, how much is the recovery from impairment and revaluation surplus, respectively, on January 1, 2023 using the cost model. Recovery from impairment Revaluation Surplus Recovery from impairment Revaluation Surplus A. 120,000 150,000 C. 120,000 30,000 B. 120,000 0 D. 150,000 0 12) Assuming the recoverable…arrow_forward

- Coachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,000. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value of P4,500,000. On January 1, 2027, the asset had a recoverable value of P1,375,000. The amount of revaluation surplus on January 1, 2024 is:arrow_forwardCoachwhip Corporation purchased a machinery on January 1, 2022 for P5,000,000. The same had an expected useful life of 8 years. Straight line depreciation method is in place for similar items. On January 1, 2024, the asset is appraised as having a sound value of P4,500,000. On January 1, 2027, the asset had a recoverable value of P1,375,000. The amount of revaluation surplus on January 1, 2024 is:arrow_forwardWhat is the carrying value of the asset of December 31, 2018?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning