Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Last year burch corporation cash account decrease solution general accounting

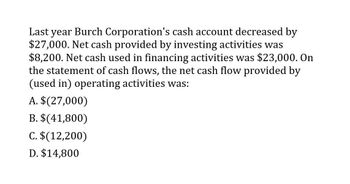

Transcribed Image Text:Last year Burch Corporation's cash account decreased by

$27,000. Net cash provided by investing activities was

$8,200. Net cash used in financing activities was $23,000. On

the statement of cash flows, the net cash flow provided by

(used in) operating activities was:

A. $(27,000)

B. $(41,800)

C. $(12,200)

D. $14,800

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Statement of Cash Flows The following are Mueller Companys cash flow activities: a. Net income, 68,000 b. Increase in accounts receivable, 4,400 c. Receipt from sale of common stock, 12,300 d. Depreciation expense, 11,300 e. Dividends paid, 24,500 f. Payment for purchase of building, 65,000 g. Bond discount amortization, 2,700 h. Receipt from sale of long-term investments at cost, 10,600 i. Payment for purchase of equipment, 8,000 j. Receipt from sale of preferred stock, 20,000 k. Increase in income taxes payable, 3,500 l. Payment for purchase of land, 9,700 m. Decrease in accounts payable, 2,900 n. Increase in inventories, 10,300 o. Beginning cash balance, 18,000 Required: Prepare Mueller Company's statement of cash flows.arrow_forwardSwasey Company earned net income of 1,800,000 in 20X2. Swasey provided the following information: Required: Compute the financing cash flows for the current year.arrow_forwardChasse Building Supply Inc. reported net cash provided by operating activities of $243,000, capital expenditures of $112,900, cash dividends of $35,800, and average maturities of long-term debt over the next 5 years of $122,300. What is Chasses free cash flow and cash flow adequacy ratio? a. $94,300 and 0.77, respectively c. $130,100 and 1.06, respectively b. $94,300 and 0.82, respectively d. $165,900 and 1.36, respectivelyarrow_forward

- In the current year, Harrisburg Corporation collected 100,000 from its customers and paid out 30,000 to suppliers, 20,000 to employees, and 8,000 for income taxes. Using the direct method, prepare the operating activities section of its statement of cash flows based on this information.arrow_forwardSmoltz Company reported the following information for the current year: cost of goods sold, $252,500; increase in inventory, $21,700; and increase in accounts payable, $12,200. What is the amount of cash paid to suppliers that Smoltz would report on its statement of cash flows under the direct method? a. $218,600 c. $262,000 b. $243,000 d. $286,400arrow_forwardLast year Burch Corporation's cash account decreased by $25,000. Net cash provided by investing activities was $8,000. Net cash used in financing activities was $22,000. On the statement of cash flows, the net cash flow provided by (used in) operating activities was:arrow_forward

- Last year mayne Corporation's cash account decreased by $22,000. Net cash provided by investing activities was $8,000. Net cash used in financing activities was $18,000. On the statement of cash flows, the net cash flow provided by (used in) operating activities was:arrow_forwardLast year print corp. cash account decreased by $30,000. Net cash provided by investing activities was $7,500. Net cash used in financing activities was $15,000. On the statement of cash flows, the net cash flow provided by (used in) operating activities was:arrow_forwardLast year Burch Corporation's cash account decreased by $21,000. Net cash provided by (used in) investing activities was $7,600. Net cash provided by (used in) financing activities was $(19,000). On the statement of cash flows, the net cash provided by (used in) operating activities was: Multiple Choice $(32,400) $11,400 $(21,000) $(9,600)arrow_forward

- Cash Flow RatiosSpencer Company reports the following amounts in its annual financial statements: Cash flow from operating activities $90,000 Capital expenditures $59,500* Cash flow from investing activities (68,000) Average current assets 136,000 Cash flow from financing activities (8,500) Average current liabilities 102,000 Net income 42,500 Total assets 255,000 * This amount is a cash outflowa. Compute Spencer's free cash flow.b. Compute Spencer's operating-cash-flow-to-current-liabilities ratio.c. Compute Spencer's operating-cash-flow-to-capital-expenditures ratio. Round ratios to two decimal points. a. Free cash flow Answer b. Operating-cash-flow-to-current-liabilities ratio Answer c. Operating-cash-flow-to-current-expenditures ratio Answerarrow_forwardLast year Lawsby Company reported sales of P120,000 on its income statement. During the year, accounts receivable increased by P10,000 and accounts payable increased by P15,000. The company uses the direct method to determine the net cash provided by operating activities on the statement of cash flows. The sales revenue adjusted to a cash basis for the year would be:arrow_forwardAnalysis reveals that a company had a net increase in cash of $21,540 for the current year. Net cash provided by operating activities was $19,400; net cash used in investing activities was $10,700 and net cash provided by financing activities was $12,840. If the year-end cash balance is $26,100, the beginning cash balance was: $47,640. $16,980. $4,560. $42,080. $43,080.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub