Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Question

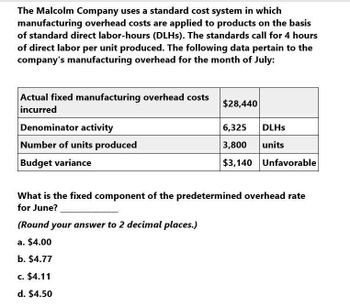

Transcribed Image Text:The Malcolm Company uses a standard cost system in which

manufacturing overhead costs are applied to products on the basis

of standard direct labor-hours (DLHs). The standards call for 4 hours

of direct labor per unit produced. The following data pertain to the

company's manufacturing overhead for the month of July:

Actual fixed manufacturing overhead costs

incurred

Denominator activity

Number of units produced

$28,440

6,325

DLHS

3,800

units

$3,140 Unfavorable

Budget variance

What is the fixed component of the predetermined overhead rate

for June?

(Round your answer to 2 decimal places.)

a. $4.00

b. $4.77

c. $4.11

d. $4.50

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Foamy Inc. manufactures shaving cream and uses the weighted average cost method. In November, production is 14,800 equivalent units for materials and 13,300 units for labor and overhead. During the month, materials, labor, and overhead costs were as follows: Beginning work in process for November had a cost of 11,360 for materials, 11,666 for labor, and 9,250 for overhead. Compute the following: a. Weighted average cost per unit for materials b. Weighted average cost per unit for labor c. Weighted average cost per unit for overhead d. Total unit cost for the montharrow_forwardQueen Bees Honey, Inc., estimated its annual overhead to be $110,000 and based its predetermined overhead rate on 27,500 direct labor hours. At the end of the year, actual overhead was $106,000 and the total direct labor hours were 29,000. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Coops Stoops estimated its annual overhead to be $85,000 and based its predetermined overhead rate on 24,286 direct labor hours. At the end of the year, actual overhead was $90,000 and the total direct labor hours were 24,100. What is the entry to dispose of the over applied or under applied overhead?arrow_forwardAbbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardOverhead application rate Creole Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,400 direct labor hours. Actual activity for October follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forward

- Primera Company produces two products and uses a predetermined overhead rate to apply overhead. Primera currently applies overhead using a plantwide rate based on direct labor hours. Consideration is being given to the use of departmental overhead rates where overhead would be applied on the basis of direct labor hours in Department 1 and on the basis of machine hours in Department 2. At the beginning of the year, the following estimates are provided: Actual results reported by department and product during the year are as follows: Required: 1. Compute the plantwide predetermined overhead rate and calculate the overhead assigned to each product. 2. Calculate the predetermined departmental overhead rates and calculate the overhead assigned to each product. 3. Using departmental rates, compute the applied overhead for the year. What is the under- or overapplied overhead for the firm? 4. Prepare the journal entry that disposes of the overhead variance calculated in Requirement 3, assuming it is not material in amount. What additional information would you need if the variance is material to make the appropriate journal entry?arrow_forwardComacho Chemical Co. recorded costs for the month of 18,900 for materials, 44,100 for labor, and 26,250 for factory overhead. There was no beginning work in process, 8,000 units were finished, and 3,000 units were in process at the end of the period, two-thirds completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forward

- Business Specialty, Inc., manufactures two staplers: small and regular. The standard quantities of direct labor and direct materials per unit for the year are as follows: The standard price paid per pound of direct materials is 1.60. The standard rate for labor is 8.00. Overhead is applied on the basis of direct labor hours. A plantwide rate is used. Budgeted overhead for the year is as follows: The company expects to work 12,000 direct labor hours during the year; standard overhead rates are computed using this activity level. For every small stapler produced, the company produces two regular staplers. Actual operating data for the year are as follows: a. Units produced: small staplers, 35,000; regular staplers, 70,000. b. Direct materials purchased and used: 56,000 pounds at 1.5513,000 for the small stapler and 43,000 for the regular stapler. There were no beginning or ending direct materials inventories. c. Direct labor: 14,800 hours3,600 hours for the small stapler and 11,200 hours for the regular stapler. Total cost of direct labor: 114,700. d. Variable overhead: 607,500. e. Fixed overhead: 350,000. Required: 1. Prepare a standard cost sheet showing the unit cost for each product. 2. Compute the direct materials price and usage variances for each product. Prepare journal entries to record direct materials activity. 3. Compute the direct labor rate and efficiency variances for each product. Prepare journal entries to record direct labor activity. 4. Compute the variances for fixed and variable overhead. Prepare journal entries to record overhead activity. All variances are closed to Cost of Goods Sold. 5. Assume that you know only the total direct materials used for both products and the total direct labor hours used for both products. Can you compute the total direct materials and direct labor usage variances? Explain.arrow_forwardDublin Brewing Co. uses the process cost system. The following data, taken from the organizations books, reflect the results of manufacturing operations during October: Production Costs Work in process, beginning of period: Costs incurred during month: Production Data: 13,000 units finished and transferred to stockroom Work in process, end of period, 2,000 units one-half completed Required: Prepare a cost of production summary for October.arrow_forwardA company calculated the predetermined overhead based on an estimated overhead of $70.000, and the activity for the cost driver was estimated as 2,500 hours. If product A utilized 1,350 hours and product 8 utilized 1,100 hours, what was the total amount of overhead assigned to the products? A. $35000 B. $30.800 C. $37,800 D. $68,600arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,