EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please provide correct answer financial accounting

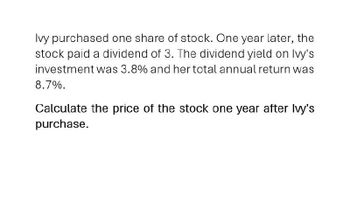

Transcribed Image Text:Ivy purchased one share of stock. One year later, the

stock paid a dividend of 3. The dividend yield on Ivy's

investment was 3.8% and her total annual return was

8.7%.

Calculate the price of the stock one year after Ivy's

purchase.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Meg bought a stock for $120/share. One year later, she sold the stock for $126.50, just after it paid an annual dividend of $3.50/share. What was Meg's total return over the 1-year holding period? 11.3% 8.3% 2.9% 10.4%arrow_forwardAmelia Earhart purchased a stock at a price of $54.82. The stock paid a dividend of $1.95 per share and the stock price at the end of the year was $61.24. What was the total return for the year?arrow_forwardJane purchased 100 shares of Acme Consolidated 1 year ago at $58.80 per share. During the year, Acme paid a dividend of $1.12 per share. Currently, the stock is selling for $52.33 per share. What is Jane's realized rate of return for the year from the stock? Answer as a percentage, 2 decimal places (e.g., 12.34% as 12.34).arrow_forward

- You purchased 10 shares of common stock in Abigail's Café at the beginning of this year for $38.00 per share and held the stock for one year. The stock paid a dividend of $2/share during the year. You were able to sell the stock for $40 per share. What was your holding period return?arrow_forwardTom bought a stock at $62.97 per share and sold it a year later for $75.28 per share. During the year, the stock paid dividends of $2.65 per share. What is the total return? 23.76% 19.87% 15.34% 16.35% 19.55%arrow_forwardGary purchased 250 shares of PAC stock for $37 per share and sold this same stockone year later for $44 per share. He paid commissions of $15 when he purchased thestock and $10 when he sold the stock. Dividends of $1.50 per share were paid duringthe year. The total rate of return on this investment was ?arrow_forward

- One year ago, Jeff purchased 1 share of Buy-Mart stock. A share of Buy-Mart is currently priced at $205.25. Buy-Mart just paid an annual dividend of $8.53 per share. If the stock's percentage return was -5.56% over the past year (from one year ago to today), what was the price of the Buy-Mart share when Jeff bought it? O $217.33 (plus or minus $1) O $208.30 (plus or minus $1) O $226.37 (plus or minus $1) O $196.72 (plus or minus $1) O none of the answers are within $1 of the correct answerarrow_forwardSarah and James Hernandez purchased 220 shares of Macy's stock at $39 a share. One year later, they sold the stock for $75.00 a share. They paid a broker a commision of $8 when they purchased the stock and a commision of $12 when they sold the stock. During the 12-month period the couple owned the stock, Macy's paid dividends that totaled $1.75 a share. Calculate the Hernandez total return for this investment. (Do not round intermediate calculations. Round your answer to 2 decimal places.) Total returnarrow_forwardAn investor bought 100 shares of Omega common stock for $14,000. He held the stock for 9 years. For the first 4 years he received annual end-of-year dividends of $800. For the next 4 years he received annual dividends of $400. He received no dividend for the ninth year. At the end of the ninth year he sold his stock for $6000. What rate of return did he receive on his investment?arrow_forward

- Nancy Cotton bought 400 shares of NeTalk for $15 per share. One year later, Nancy sold the stock for $21 per share, just after she received a $0.90 cash dividend from the company. a. What is the total dollar return earned by Nancy for the year? b. What is the rate of return earned by Nancy?arrow_forwardJames purchased Eastern Industry's stock for $56.85 per share and sold it 18 months later for $59.95 after receiving a cumulative dividend of $2.75 at the end of the 18 months. What was James' holding period return (HPR), Simple Annualized Return, and Compound Annualized Return, respectively? O A. 10.29%, 6.86%, 4.52% O B. 6.86%, 6.75%, 10.29% OC. 6.75%, 6.86%, 10.29% O D. 10.29%, 6.75%, 6.86%arrow_forwardAn investor bought 100 shares of stock at a cost of $10 per share. He held thestock for 15 years and then sold it for a total of $4,000. For the first three years, he received no dividends. For each of the next seven years, he received total dividends of $50 per year. For the remaining period, he received total dividends of $100 per year. What rate of return did he make on the investment?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT