Auditing: A Risk Based-Approach (MindTap Course List)

11th Edition

ISBN: 9781337619455

Author: Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

Transcribed Image Text:Part 1 of 5

05

pints

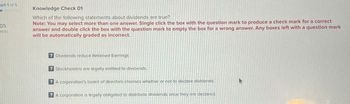

Knowledge Check 01

Which of the following statements about dividends are true?

Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct

answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark

will be automatically graded as incorrect.

? Dividends reduce Retained Earnings

? Stockholders are legally entitled to dividends.

A corporation's board of directors chooses whether or not to declare dividends.

? A corporation is legally obligated to distribute dividends once they are declared.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Please help me. Thankyou.arrow_forwardFor each of the following statements regarding dividends, indicate whether it is true or false. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect.) The date of payment reflects the date a cash dividend is paid to stockholders. ? A stock dividend Increases the number of outstanding shares. ? The account Pald-in Capital in Excess of Par Value is always credited when a large stock dividend is declared. ? A large stock dividend is a distribution of more than 25% of previously outstanding shares.arrow_forward2arrow_forward

- CHOICES A. Only Statement I is correctB. Only Statement II is falseC. Statements II and III are falseD. Only Statement III is falseE. All statements are correctarrow_forwardTrue or False: Dividends declared and paid result in a decrease to the common stock's account balance. Select one: True Falsearrow_forwardShow Attempt History Current Attempt in Progress X Your answer is incorrect. The effect of a stock dividend is to O change the composition of stockholders' equity. O decrease total assets and stockholders' equity. O increase the book value per share of common stock. O decrease total assets and total liabilities. eTextbook and Media Assistance Used Save for Later Attempts: 1 of 2 used Submit Answer %24 %6 3 4. d barrow_forward

- which one is correct please confirm? QUESTION 26 Under dividend reinvestment plans, shareholders can automatically ____. a. transfer from retained earnings accounts to equity accounts. b. use dividends to purchase additional shares c. reduce their taxable income d. increase their cash inflowsarrow_forwardS1: A reduction in dividends distributed to shareholders from one year to the next can lead to loss of investor confidence and reduced market prices for the stock. S2: The entry to record the payment of a cash dividend includes a debit to Retained Earnings and a credit to Cash. Select the correct response: S1 is False; S2 is True S1 & S2 are True O s1 & S2 are False O S1 is True; S2 is Falsearrow_forwardPlease answer fast please arjent help please answerarrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardX Your answer is incorrect. The effect of a stock dividend is to O change the composition of stockholders' equity. O decrease total assets and stockholders' equity. O increase the book value per share of common stock. O decrease total assets and total liabilities. eTextbook and Media Assistance Us Save for Later Attempts: 1 of 2 used Submit Answ @ %23 %24 8 4. u e d n m Carrow_forwardWhich of the following dividends does not reduce total stockholders' equity? O Liquidating dividends. O Cash dividends. O Stock dividends. O All of these answer choices reduce total stockholders' equity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...FinanceISBN:9781305635937Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...

Accounting

ISBN:9781337619455

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:Cengage Learning

Fundamentals of Financial Management, Concise Edi...

Finance

ISBN:9781305635937

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning