FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

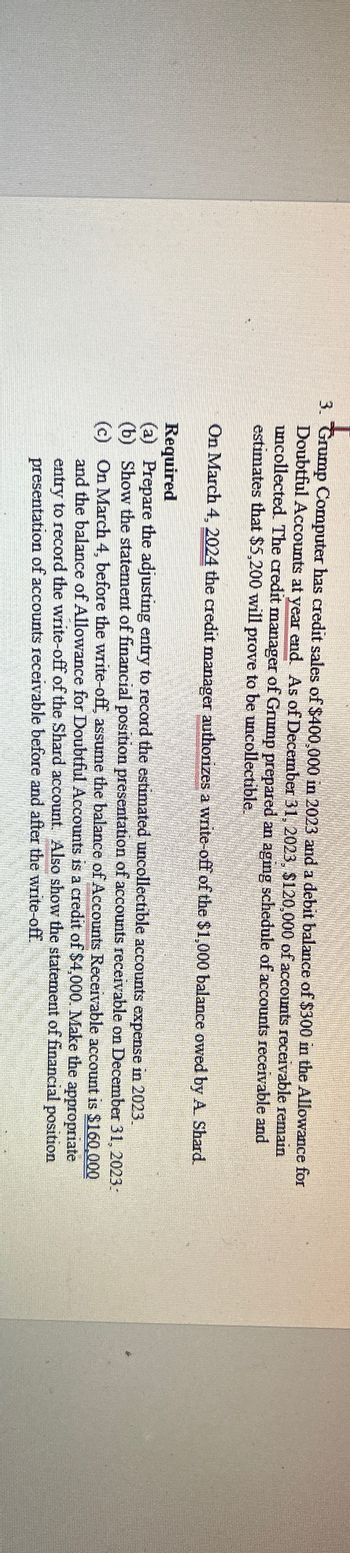

Transcribed Image Text:3. Grump Computer has credit sales of $400,000 in 2023 and a debit balance of $300 in the Allowance for

Doubtful Accounts at year end. As of December 31, 2023, $120,000 of accounts receivable remain

uncollected. The credit manager of Grump prepared an aging schedule of accounts receivable and

estimates that $5,200 will prove to be uncollectible.

On March 4, 2024 the credit manager authorizes a write-off of the $1,000 balance owed by A. Shard.

Required

(a) Prepare the adjusting entry to record the estimated uncollectible accounts expense in 2023.

(b) Show the statement of financial position presentation of accounts receivable on December 31, 2023:

(c) On March 4, before the write-off, assume the balance of Accounts Receivable account is $160,000

and the balance of Allowance for Doubtful Accounts is a credit of $4,000. Make the appropriate

entry to record the write-off of the Shard account. Also show the statement of financial position

presentation of accounts receivable before and after the write-off.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define Accounting related to allowance for uncollectable debts

VIEW Step 2: Prepare journal entry to record allowance for uncollectible accounts

VIEW Step 3: Present Accounts receivable in financial position/financial statement

VIEW Step 4: Journal entry to record write off & Accounts receivable in financial position after write off

VIEW Solution

VIEW Step by stepSolved in 5 steps with 12 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Winfrey Designs had an unadjusted credit balance in its Allowance for Doubtful Accounts at December 31, 2023, of $2,200 Required: a. Prepare the adjusting entry assuming that Winfrey estimates uncollectible accounts based on an aging analysis as follows. December 31, 2023 Accounts Receivable $148,000 43,000 10,000 2,400 View transaction list Journal entry worksheet < 1 Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due Over 60 days past due Record the estimate for uncollectible accounts. Note: Enter debits before credits. Date December 31, 3332 General Journal Expected Percentage Debit Uncollectible 1% 4% 10% 60% Credit ☆arrow_forward18. Tangier Company had a January 1, 2022, balance in Allowance for Doubtful Accounts of $7,000 Cr. The following events required journal entries during 2022: Apr. 15 Diya’s account receivable of $5,700 was deemed uncollectible. July 1 Nitosa paid the full amount of her previously written-off account receivable. The receivable of $2,300 had been written off in 2021. Dec. 31 Bad debts expense was estimated to be 2.0 percent of net credit sales, which had amounted to $375,000. What amount of Allowance for Doubtful Accounts should appear in the December 31, 2022 balance sheet? a. $6,500 b. $11,100 c. $22,500 d. $17,900 e. None of the above. 19. Nguyen Company had $250,000 of Accounts Receivable and a $7,500 credit balance in its Allowance for Doubtful Accounts account just prior to writing off a $2,000 uncollectible account of a customer. After the write-off, the carrying amount (NRV-Net Realizable…arrow_forwardNeed Answerarrow_forward

- Analysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $670,000; Allowance for Doubtful Accounts has a debit balance of $6,000; and sales for the year total $3,020,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $29,400. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable. %24 %24 %24 %24 %24arrow_forwardSpring Garden Flowers had the following balances at December 31, 2024, before the year-end adjustments: E (Click the icon to view the balances.) The aging of accounts receivable yields the following data: E (Click the icon to view the accounts receivable aging schedule.) Requirements Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. 1. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Debit Credit Dec. 31 Data Table Accounts Receivable Allowance for Bad Debts 66,000 1,615 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts Print Done Data Table Age of Accounts Receivable 0-60 Days Over 60 Days Total…arrow_forwardPlease do not give image format and solve with explanationarrow_forward

- At December 31, 2022, the trial balance of Concord Corporation contained the following amounts before adjustment. Accounts Receivable Allowance for Doubtful Accounts Sales Revenue Debit (b) (c) $189,800 Credit $ 1,570 871,700 (a) Prepare the adjusting entry at December 31, 2022, to record bad debt expense, assuming that the aging schedule indicates that $11,020 of accounts receivable will be uncollectible. Repeat part (a), assuming that instead of a credit balance there is a $1,570 debit balance in Allowance for Doubtful Accounts. During the next month, January 2023, a $2,050 account receivable is written off as uncollectible. Prepare the journal entry to record the write-off. (d) Repeat part (c), assuming that Concord Corporation uses the direct write-off method instead of the allowance method in accounting for uncollectible accounts receivable. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)arrow_forwardAn aging-of-accounts-receivable indicates that the amount of uncollectible accounts is $3,910. The Allowance for Uncollectible Accounts prior to adjustment has a debit balance of $600. The Accounts Receivable balance is $44,620. The amount of the adjusting entry for uncollectible accounts should be for: A) $600. B) $3,310. C) $3,910. D) $4,510.arrow_forwardCAN SOMEONE HELP ME FIGURE OUT THE TOTAL ESTIMATED UNCOLLECTIBIES AND THE BAD DEBIT EXPENSE ? Skysong Company has accounts receivable of $112,400 at March 31, 2020. Credit terms are 2/10, n/30. At March 31, 2020, there is a $1,500 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimate of bad debts is shown below.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education