FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

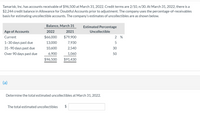

Transcribed Image Text:Tamarisk, Inc. has accounts receivable of $96,500 at March 31, 2022. Credit terms are 2/10, n/30. At March 31, 2022, there is a

$2,244 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables

basis for estimating uncollectible accounts. The company's estimates of uncollectibles are as shown below.

Balance, March 31

Estimated Percentage

Age of Accounts

2022

2021

Uncollectible

Current

$66,000

$79,900

2 %

1-30 days past due

13,000

7,930

5

31-90 days past due

10,600

2,540

30

Over 90 days past due

6,900

1,060

50

$96,500

$91,430

(a)

Determine the total estimated uncollectibles at March 31, 2022.

The total estimated uncollectibles

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Jars Plus recorded $865,430 in credit sales for the year and $493,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,670, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 To record bad debt, income statement method B. Dec. 31…arrow_forwardCoronet Suppliers uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $80,500, and it estimates that 3% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Account has: (a) a $1,369 credit balance before the adjustment. (b) a $403 debit balance before the adjustment. View transaction list Journal entry worksheet 1 2 Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has a $1,369 credit balance before the adjustment. ansaction (a) te: Enter debits before credits. General Journal Debit Creditarrow_forwardPina Colada Corp. uses the percentage of receivables method for recording bad debts expense. The accounts receivable balance is $270000 and credit sales are $2710000. Management estimates that 3% of accounts receivable will be uncollectible. What adjusting entry will Pina Colada Corp. make if the Allowance for Doubtful Accounts has a credit balance of $2700 before adjustment?arrow_forward

- The balance sheet at the end of 2018 reported Accounts Receivable of $785,500 and Allowance for Doubtful Accounts of $11,783 (credit balance). The company’s total sales during 2019 were $8,350,200. Of these, $1,252,530 were cash sales the rest were credit sales. By the end of the year, the company had collected $6,291,700 of accounts receivable. It also wrote off an account for $10,380. Prepare the journal entry for collections. Account Names DR CR Blank 1. Fill in the blank, read surrounding text. Blank 2. Fill in the blank, read surrounding text. Blank 3. Fill in the blank, read surrounding text. Blank 4. Fill in the blank, read surrounding text. Blank 5. Fill in the blank, read surrounding text. Blank 6. Fill in the blank, read surrounding text. Blank 7. Fill in the blank, read surrounding text. Blank 8. Fill in the blank, read surrounding text. Blank 9. Fill in the blank, read surrounding text. Blank 10. Fill in the blank, read surrounding text. Blank 11.…arrow_forwardJars Plus recorded $862,430 in credit sales for the year and $489,000 in accounts receivable. The uncollectible percentage is 2.3% for the income statement method, and 3.0% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous debit balance in Allowance for Doubtful Accounts of $10,220, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. D. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $5,470, record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. If required, round final answers to two decimal places. A. Dec. 31 Bad Debt Expense 88 88 88 38 88 88 Allowance for…arrow_forwardFunnel Direct recorded $1,341,780 in credit sales for the year and $699,455 in accounts receivable. The uncollectible percentage is 4.4% for the income statement method and 4% for the balance sheet method. A. Record the year-end adjusting entry for 2018 bad debt using the income statement method. B. Record the year-end adjusting entry for 2018 bad debt using the balance sheet method. C. Assume there was a previous credit balance in Allowance for Doubtful Accounts of $13,588; record the year-end entry for bad debt using the income statement method, and then the entry using the balance sheet method. If an amount box does not require an entry, leave it blank. Round your answers to two decimal places. A. Dec. 31 - Select - - Select - - Select - - Select - To record bad debt, income statement method B. Dec. 31 - Select - - Select - - Select - - Select - To record bad debt, balance sheet method C. Dec. 31 - Select - - Select -…arrow_forward

- Gregg company uses the allowance method for recording its expected credit losses. It estimates credit losses at 3% of credit sales, which were $900,000 during the year. On December 31 the accounts receivable balance was 150,000, and the allowance for doubtful accounts had a credit balance of 12,200 before adjustment. A. Prepare the adjusting entry to record the credit losses for the year. B. Show how accounts receivable and the allowance for doubtful accounts would appear in the December 31 balance sheet. The top 2 shaded blanks have the options of Bad debts expense, allowance for doubtful accounts. The bottom 2 shaded blanks have the options of accounts receivable, less: allowance for doubtful accounts.arrow_forwardRCM Company has $55,000 in accounts receivable and a debit balance of $800 in the Allowance for Doubtful Accounts on December 31, 2019. Which of the following is part of the journal entry to estimate the bad debt expense and allowance for doubtful accounts assuming that RCM estimates that 4.5% of accounts receivable will be uncollectible? O Debit $1,675 Credit $1,675 O Debit $3,275 O None of the choices are correct. O Credit $3,275arrow_forwardAt the beginning of the current period, Sunland company had balances in accounts receivables of $201,900 and in Allowance for Doubtful Accounts of $9,590 (credit). During the period, it had credit sales of $875,700 and collections of $796,820. It was written off as uncollectible accounts receivable of $7,410. However, a $2,808 account previously written off as uncollectible was recovered before the end of the current period. Uncollectible accounts are estimated to total $25,830 at the end of the period (Omit the cost of goods sold entries). a) Determine the ending balances in Accounts Receivable and Allowance for Doubtful Accounts. b) What is the net realizable value of the receivables at the end of the period?arrow_forward

- At the beginning of the current period, Asare Company had balances in Accounts Receivable of $200,092 and in Allowance for Doubtful Accounts of $9,996 (credit). During the period, it had net credit sales of $717,375 and collections of $778,839. It wrote off as uncollectible accounts receivable of $7,233. However, a $3,013 account previously written off as uncollectible was recovered before the end of the current period. What is the ending balance in the accounts receivable account? Your Answer: Answerarrow_forwardAt the end of the current year, Accounts Receivable has a balance of $947,700; Allowance for Doubtful Accounts has a credit balance of $7,201; and credit sales for the year total $3,040,000. Bad debt expense is estimated at 1/2 of 1% of credit sales. a. Determine the amount of the adjusting entry for bad debt expense. $ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Adjusted Balance Bad Debt Expense c. Determine the net realizable value of accounts receivable. $arrow_forwardCAN SOMEONE HELP ME FIGURE OUT THE TOTAL ESTIMATED UNCOLLECTIBIES AND THE BAD DEBIT EXPENSE ? Skysong Company has accounts receivable of $112,400 at March 31, 2020. Credit terms are 2/10, n/30. At March 31, 2020, there is a $1,500 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimate of bad debts is shown below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education