FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

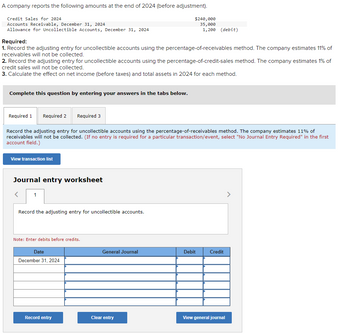

Transcribed Image Text:A company reports the following amounts at the end of 2024 (before adjustment).

Credit Sales for 2024

Accounts Receivable, December 31, 2024

Allowance for Uncollectible Accounts, December 31, 2024

Required:

1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. The company estimates 11% of

receivables will not be collected.

2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. The company estimates 1% of

credit sales will not be collected.

3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2 Required 3

Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. The company estimates 11% of

receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first

account field.)

View transaction list

Journal entry worksheet

<

1

Record the adjusting entry for uncollectible accounts.

Note: Enter debits before credits.

Date

December 31, 2024

$240,000

35,000

1,200 (debit)

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

>

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Define Accounts Receivable

VIEW Step 2: 1. Calculation of the bad debt and recording of adjusting journal entry, as follows:

VIEW Step 3: 2. Calculation of the bad debt and recording of adjusting journal entry, as follows:

VIEW Step 4: 3. Effect on net income and total assets:

VIEW Solution

VIEW Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At the end of the year, a company has a balance in Allowance for Uncollectible Accounts of $220 (credit) before any year-end adjustment. The balance of Accounts Receivable is $15,900. The company estimates that 14% of accounts receivable will not be collected over the next year. Record the adjustment for uncollectible accounts. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 1 Record the adjustment for uncollectible accounts. Note: Enter debits before credits. Event General Journal Debit Credit 30 F3 888 F7 F9 F10 # 2$ % & 3 4 6 7 8 9. E R Y P { F K L < ? C V alt command option + || .. .. | Harrow_forwardAllowance for Doubtful Accounts has a credit balance of $670 at the end of the year (before adjustment), and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $16,220. Based on this estimate, which of the following adjusting entries should be made? Select the correct answer. debit Allowance for Doubtful Accounts, $670; credit Bad Debt Expense, $670 debit Bad Debt Expense, $670; credit Allowance for Doubtful Accounts, $670 debit Bad Debt Expense, $15,550; credit Allowance for Doubtful Accounts, $15,550 debit Allowance for Doubtful Accounts, $16,890; credit Bad Debt Expense, $16,890arrow_forwardAllowance for Doubtful Accounts has a credit balance of $667 at the end of the year (before adjustment), and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $17,457. Based on this estimate, which of the following adjusting entries should be made? Select the correct answer. debit Bad Debt Expense, $16,790; credit Allowance for Doubtful Accounts, $16,790 debit Allowance for Doubtful Accounts, $667; credit Bad Debt Expense, $667 debit Allowance for Doubtful Accounts, $18,124; credit Bad Debt Expense, $18,124 debit Bad Debt Expense, $667; credit Allowance for Doubtful Accounts, $667arrow_forward

- Blossom Company has accounts receivable of $92,000 at March 31, 2025. Credit terms are 2/10, n/30. At March 31, 2025, there is a $2,200 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Balance, March 31 Estimated Percentage Age of Accounts 2025 2024 Uncollectible Current $61,600 $78,910 2 % 1-30 days past due 14,100 7,420 5 31-90 days past due 9,500 2,280 31 Over 90 days past due 6,800 1,200 52 $92,000 $89,810 Determine the total estimated uncollectibles at March 31, 2025. Total estimated uncollectibles Toutharrow_forwardDogarrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $660,000, Allowance for Doubtful Accounts has a credit balance of $6,000, and sales for the year total $2,.970,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $25.200. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forward

- Suzuki Supply reports the following amounts at the end of 2021 (before adjustment). Credit Sales for 2021 $ 251,000 Accounts Receivable, December 31, 2021 46,000 Allowance for Uncollectible Accounts, December 31, 2021 1,100 (Credit) Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardWinfrey Designs had an unadjusted credit balance in its Allowance for Doubtful Accounts at December 31, 2023, of $2,200 Required: a. Prepare the adjusting entry assuming that Winfrey estimates uncollectible accounts based on an aging analysis as follows. December 31, 2023 Accounts Receivable $148,000 43,000 10,000 2,400 View transaction list Journal entry worksheet < 1 Age of Accounts Receivable Not due (under 30 days) 1 to 30 days past due 31 to 60 days past due Over 60 days past due Record the estimate for uncollectible accounts. Note: Enter debits before credits. Date December 31, 3332 General Journal Expected Percentage Debit Uncollectible 1% 4% 10% 60% Credit ☆arrow_forwardThe following information is available for Sheridan Company: Allowance for Expected Credit Losses at December 31, 2023 Credit Sales during 2024 Accounts Receivable deemed worthless and written off during 2024 $7980 O $4788 $3762 $8550 O $84360 307800 3192 As a result of a review and aging of Accounts Receivable in early January 2025, it was determined that an Allowance for Expected Credit Losses balance of $8550 is required at December 31, 2024. What amount should Sheridan record as loss on impairment for calendar 2024?arrow_forward

- Johnson Company calculates its allowance for uncollectible accounts as 20% of its ending balance in gross accounts receivable. The allowance for uncollectible accounts had a credit balance of $21,000 at the beginning of 2021. No previously written-off accounts receivable were reinstated during 2021. At 12/31/2021, gross accounts receivable totaled $350,200, and prior to recording the adjusting entry to recognize bad debts expense for 2021, the allowance for uncollectible accounts had a debit balance of 38,400 Required: 1. What was the balance in gross accounts receivable as of 12/31/2020? 2. What journal entry should Johnson record to recognize bad debt expense for 2021? 3. Assume Johnson made no other adjustment of the allowance for uncollectible accounts during 2021. Determine the amount of accounts receivable written off during 2021. 4. If Johnson instead used the direct write-off method, what would bad debt expense be for 2021? Required 1 Required 2 Required 3 Required 4 What was…arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $950,000, Allowance for Doubtful Accounts has a credit balance of $8,500, and sales for the year total $4,280,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $29,800. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardCoronet Suppliers uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $80,500, and it estimates that 3% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Account has: (a) a $1,369 credit balance before the adjustment. (b) a $403 debit balance before the adjustment. View transaction list Journal entry worksheet 1 2 Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has a $1,369 credit balance before the adjustment. ansaction (a) te: Enter debits before credits. General Journal Debit Creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education