FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

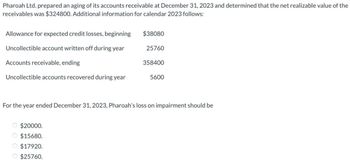

Transcribed Image Text:Pharoah Ltd. prepared an aging of its accounts receivable at December 31, 2023 and determined that the net realizable value of the

receivables was $324800. Additional information for calendar 2023 follows:

Allowance for expected credit losses, beginning

$38080

Uncollectible account written off during year

25760

Accounts receivable, ending

358400

Uncollectible accounts recovered during year

5600

For the year ended December 31, 2023, Pharoah's loss on impairment should be

$20000.

$15680.

○ $17920.

$25760.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Analysis of Receivables Method At the end of the current year, Accounts Recelvable has a balance of $465,000; Allowance for Doubtful Accounts has a debit balance of $4,000; and sales for the year total $2,090,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $18,400. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense C. Determine the net realizable value of accounts receivable.arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $870,000, Allowance for Doubtful Accounts has a debit balance of $8,000, and sales for the year total $3,920,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $43,200. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $420,000; Allowance for Doubtful Accounts has a debit balance of $4,000; and sales for the year total $1,890,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $20,800. a. Determine the amount of the adjusting entry for uncollectible accounts.$ b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $ Allowance for Doubtful Accounts $ Bad Debt Expense $ c. Determine the net realizable value of accounts receivable.$arrow_forward

- Fernández Company uses the allowance method of accounting for uncollectible accounts. The following summary schedule was prepared from an aging of accounts receivable outstanding on December 31 of the current year. Number of Days Outstanding 0-31 days 31-60 days Over 60 days Amount $500,000 200,000 100,000 The following additional information is available for the current year: Net credit sales for the year Loss allowance: Balance, January 1 Balance before adjustment, December 31 Probability of Collection 0.98 0.90 0.80 A. $752,000 B. $48,000 C. $50,000 D. $748,000 $4,000,000 45,000 (cr.) 2,000 (cr.) B If Fernández bases its estimate of uncollectible accounts on the aging of accounts receivable, Expected Credit Loss for the current year ending December 31 isarrow_forwardA company reports the following amounts at the end of 2024 (before adjustment). Credit Sales for 2024 Accounts Receivable, December 31, 2024 Allowance for Uncollectible Accounts, December 31, 2024 Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. The company estimates 11% of receivables will not be collected. 2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. The company estimates 1% of credit sales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. The company estimates 11% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the…arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $660,000, Allowance for Doubtful Accounts has a credit balance of $6,000, and sales for the year total $2,.970,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $25.200. a. Determine the amount of the adjusting entry for uncollectible accounts. b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable Allowance for Doubtful Accounts Bad Debt Expense c. Determine the net realizable value of accounts receivable.arrow_forward

- After the accounts are adjusted and closed at the end of the fiscal year, Accounts Receivable has a balance of $450,000 and Allowance for Doubtful Accounts has a balance of $25,000. What is the net expected realizable value of the accounts receivable? $25,000 O $450,000 O $455,000 $425,000arrow_forwardThe following information is available for Sheridan Company: Allowance for Expected Credit Losses at December 31, 2023 Credit Sales during 2024 Accounts Receivable deemed worthless and written off during 2024 $7980 O $4788 $3762 $8550 O $84360 307800 3192 As a result of a review and aging of Accounts Receivable in early January 2025, it was determined that an Allowance for Expected Credit Losses balance of $8550 is required at December 31, 2024. What amount should Sheridan record as loss on impairment for calendar 2024?arrow_forwardDomino Company uses the aging of accounts receivable method to estimate uncollectible accounts expense. Domino began Year 2 with balances in Accounts Receivable and Allowance for Doubtful Accounts of $46,310 and $3,650, respectively. During the year, the company wrote off $2,740 in uncollectible accounts. In preparation for the company's Year 2 estimate, Domino prepared the following aging schedule: Number of days past due Receivables amount % Likely to be uncollectible Current $77,000 1% 0-30 28,400 5% 31-60 7,460 10% 61-90 3,920 25% Over 90 3,600 50% Total $120,380 What will Domino record as Uncollectible Accounts Expense for Year 2?arrow_forward

- At the end of the current year, using the aging of receivable method, management estimated that $24,750 of the accounts receivable balance would be uncollectible. Prior to any year-end adjustments, the Allowance for Doubtful Accounts had a credit balance of $465. What adjusting entry should the company make at the end of the current year to record its estimated bad debts expense?arrow_forwardAn analysis and aging of Marigold Corp.’s accounts receivable at December 31, 2020, disclosed the following: Amounts estimated to be uncollectible $156,000 Accounts receivable 1,810,000 Allowance for doubtful accounts (per books) 140,000 What is the net realizable value of Marigold Corp.’s receivables at December 31, 2020? Net realizable valarrow_forwardThe following selected transactions were taken from the records of Rustic Tables Company for the year ending December 31: June 8. Wrote off account of Kathy Quantel, $8,150. Aug. 14. Received $5,790 as partial payment on the $14,590 account of Rosalie Oakes. Wrote off the remaining balance as uncollectible. Oct. 16. Received the $8,150 from Kathy Quantel, whose account had been written off on June 8. Reinstated the account and recorded the cash receipt. Dec. 31. Wrote off the following accounts as uncollectible (record as one journal entry): Wade Dolan $2,360 Greg Gagne 1,470 Amber Kisko 5,620 Shannon Poole 3,260 Niki Spence 900 Dec. 31. If necessary, record the year-end adjusting entry for uncollectible accounts. If no entry is required, select "No entry" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. a. Journalize the transactions under the direct write-off method. June 8 Bad Debt Expense Accounts Receivable-Kathy Quantel Aug. 14 Cash…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education