FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

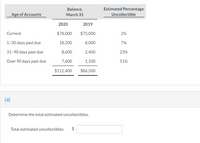

CAN SOMEONE HELP ME FIGURE OUT THE TOTAL ESTIMATED UNCOLLECTIBIES AND THE BAD DEBIT EXPENSE ?

Skysong Company has

Transcribed Image Text:Balance,

Estimated Percentage

Age of Accounts

March 31

Uncollectible

2020

2019

Current

$78,000

$75,000

2%

1-30 days past due

18,200

8,000

7%

31-90 days past due

8,600

2,400

23%

Over 90 days past due

7,600

1,100

51%

$112,400

$86,500

(a)

Determine the total estimated uncollectibles.

Total estimated uncollectibles

%24

Transcribed Image Text:Prepare the adjusting entry at March 31, 2020, to record bad debt expense. (Credit account titles are automatically indented when

amount is entered. Do not indent manually.)

Date

Account Titles and Explanation

Debit

Credit

Mar.

31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Allowance for Doubtful Accounts has a credit balance of $670 at the end of the year (before adjustment), and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $16,220. Based on this estimate, which of the following adjusting entries should be made? Select the correct answer. debit Allowance for Doubtful Accounts, $670; credit Bad Debt Expense, $670 debit Bad Debt Expense, $670; credit Allowance for Doubtful Accounts, $670 debit Bad Debt Expense, $15,550; credit Allowance for Doubtful Accounts, $15,550 debit Allowance for Doubtful Accounts, $16,890; credit Bad Debt Expense, $16,890arrow_forwardAllowance for Doubtful Accounts has a credit balance of $667 at the end of the year (before adjustment), and an analysis of accounts in the customer ledger indicates the estimated amount of uncollectible accounts should be $17,457. Based on this estimate, which of the following adjusting entries should be made? Select the correct answer. debit Bad Debt Expense, $16,790; credit Allowance for Doubtful Accounts, $16,790 debit Allowance for Doubtful Accounts, $667; credit Bad Debt Expense, $667 debit Allowance for Doubtful Accounts, $18,124; credit Bad Debt Expense, $18,124 debit Bad Debt Expense, $667; credit Allowance for Doubtful Accounts, $667arrow_forwardCrane Company had a 1/1/20 balance in the Allowance for Doubtful Accounts of $33500. During 2020, it wrote off $22000 of accounts and collected $6620 on accounts previously written off. The balance in Accounts Receivable was $630000 at 1/1 and $730000 at 12/31. At 12/31/20, Crane estimates that 5% of accounts receivable will prove to be uncollectible. What is Bad Debt Expense for 2020? $18380. $25000. $3000. $36500.arrow_forward

- Blossom Company has accounts receivable of $92,000 at March 31, 2025. Credit terms are 2/10, n/30. At March 31, 2025, there is a $2,200 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Balance, March 31 Estimated Percentage Age of Accounts 2025 2024 Uncollectible Current $61,600 $78,910 2 % 1-30 days past due 14,100 7,420 5 31-90 days past due 9,500 2,280 31 Over 90 days past due 6,800 1,200 52 $92,000 $89,810 Determine the total estimated uncollectibles at March 31, 2025. Total estimated uncollectibles Toutharrow_forwardA company reports the following amounts at the end of 2024 (before adjustment). Credit Sales for 2024 Accounts Receivable, December 31, 2024 Allowance for Uncollectible Accounts, December 31, 2024 Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. The company estimates 11% of receivables will not be collected. 2. Record the adjusting entry for uncollectible accounts using the percentage-of-credit-sales method. The company estimates 1% of credit sales will not be collected. 3. Calculate the effect on net income (before taxes) and total assets in 2024 for each method. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. The company estimates 11% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the…arrow_forwardDogarrow_forward

- One company has estimated that $3150 of its accounts receiable will be uncollectible. If allownace for doubtful accounts already has a credit balance of $1102, and the percentage of receivables method is used, it sadjustment to recrod for the period will require a debit to what for what amount?arrow_forwardSuzuki Supply reports the following amounts at the end of 2021 (before adjustment). Credit Sales for 2021 $ 251,000 Accounts Receivable, December 31, 2021 46,000 Allowance for Uncollectible Accounts, December 31, 2021 1,100 (Credit) Required: 1. Record the adjusting entry for uncollectible accounts using the percentage-of-receivables method. Suzuki estimates 12% of receivables will not be collected. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardThe Phillips Company gathered the following information pertaining to its year ended December 31, 2020 prior to any adjustments: Net Sales for the Year $780,000 Accounts Receivable, 12/31 165,000 Allowance for Uncollectible Accounts, 12/31 2,200 Debit Assume that Phillips uses the percentage of outstanding accounts receivable method for uncollectible amounts. An aging of accounts receivable indicates that $9,550 will be uncollectible. Phillips will report the following amounts in its 2020 financial statements: Select one: a. Bad debts expense $11,750; Net accounts receivable $155,450 b. Bad debts expense $9,550; Net accounts receivable $155,450 c. Bad debts expense $9,550; Net accounts receivable $157,650 d. Bad debts expense $1,750; Net accounts receivable $157,650 e. Bad debts expense $7,350; Net accounts receivable $157,650arrow_forward

- At December 31, Gill Co. reported accounts receivable of $236,000 and an allowance for uncollectible accounts of $1,450 (credit) before any adjustments. An analysis of accounts receivable suggests that the allowance for uncollectible accounts should be 2% of accounts receivable. The amount of the adjustment for uncollectible accounts would be: Multiple Choice $1,450 $4.980 $3,270. $4,720arrow_forwardCoronet Suppliers uses the percent of accounts receivable method. On December 31, it has outstanding accounts receivable of $80,500, and it estimates that 3% will be uncollectible. Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Account has: (a) a $1,369 credit balance before the adjustment. (b) a $403 debit balance before the adjustment. View transaction list Journal entry worksheet 1 2 Prepare the year-end adjusting entry to record bad debts expense under the assumption that the Allowance for Doubtful Accounts has a $1,369 credit balance before the adjustment. ansaction (a) te: Enter debits before credits. General Journal Debit Creditarrow_forwardLiam Wallace is general manager of Worldwide Salons. During 2018Wallace worked for the company all 18, 1 year at a $ 12,900 monthly salary. He also earned a year-end bonus equal to 15% of his annual salary Wallace's federal income tax withheld during 2018 was $1,161 per month, plus $2,322 on his bonus check. State income tax withheld came to $170 per month , plus $110 on the bonus . FICA tax was withheld on the annual earnings . Wallace authorized the following payroll deductions : Charity Fund contribution of 4% of total earnings and life insurance of $35 per month Worldwide incurred payroll tax expense on Wallace for FICA tax . The company also paid state unemployment tax and federal unemployment tax . Requirement 4. Make the journal entry to record the accrual of Worldwide's payroll tax expense for Wallace's total earnings.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education