FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

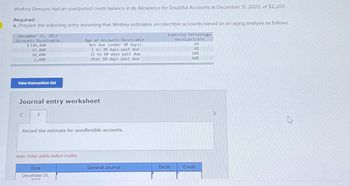

Transcribed Image Text:Winfrey Designs had an unadjusted credit balance in its Allowance for Doubtful Accounts at December 31, 2023, of $2,200

Required:

a. Prepare the adjusting entry assuming that Winfrey estimates uncollectible accounts based on an aging analysis as follows.

December 31, 2023

Accounts Receivable

$148,000

43,000

10,000

2,400

View transaction list

Journal entry worksheet

< 1

Age of Accounts Receivable

Not due (under 30 days)

1 to 30 days past due

31 to 60 days past due

Over 60 days past due

Record the estimate for uncollectible accounts.

Note: Enter debits before credits.

Date

December 31,

3332

General Journal

Expected Percentage

Debit

Uncollectible

1%

4%

10%

60%

Credit

☆

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwardAnswer only please.arrow_forwardAnalysis of Receivables Method At the end of the current year, Accounts Receivable has a balance of $400,000; Allowance for Doubtful Accounts has a debit balance of $3,500; and sales for the year total $1,800,000. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $15,800. a. Determine the amount of the adjusting entry for uncollectible accounts.$fill in the blank 1 b. Determine the adjusted balances of Accounts Receivable, Allowance for Doubtful Accounts, and Bad Debt Expense. Accounts Receivable $fill in the blank 2 Allowance for Doubtful Accounts $fill in the blank 3 Bad Debt Expense $fill in the blank 4 c. Determine the net realizable value of accounts receivable.arrow_forward

- Subject:arrow_forwardDetermine the amount to be added to Allowance for Doubtful Accounts in each of the following cases and indicate the ending balance in each case. a. Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Using the aging method, the balance of Allowance for Doubtful Accounts is estimated as $8,710. Line Item Description Amount Amount added $fill in the blank 1 Ending balance $fill in the blank 2 b. Credit balance of $400 in Allowance for Doubtful Accounts just prior to adjustment. Bad debt expense is estimated at 2% of credit sales, which totaled $973,000 for the year. Line Item Description Amount Amount added $fill in the blank 3 Ending balance $fill in the blank 4arrow_forwardThe Garware Company uses allowance method to recognize uncollectible accounts expense. It provides you the following selected information Accounts receivable on December 31 2020 RO 280000 Required balance in Allowance for Doubtful Accounts account on December 31 2020 RO 4000 Existing balance in Allowance for Doubtful Accounts account on December 31 2019 RO 3500 The journal entry to recognize uncollectible accounts expense on December 31 2017 is a. Dr Uncollectible Accounts Expense 4000 and Cr Allowance for Doubtful Accounts 4000 b. Dr Uncollectible Accounts Expense 500 and Cr Allowance for Doubtful Accounts 500 c. Dr Accounts Receivable 3500 Cr Allowance for Uncollectible Accounts Expense 3500 d. Dr Accounts Receivable 3500 Cr Uncollectible Accounts Expense 3500arrow_forward

- Current Attempt in Progress Wildhorse Company has accounts receivable of $101,200 at March 31, 2022 Credit terms are 2/10, n/30. At March 31, 2022, there is a $1,300 credit balance in Allowance for Doubtful Accounts prior to adjustment. The company uses the percentage-of-receivables basis for estimating uncollectible accounts. The company's estimates of bad debts are as shown below. Age of Accounts Current 1-30 days past due 31-90 days past due Over 90 days past due Transcribed Text (a) 2022 Balance, March 31 $61,600 22,100 8,600 8,900 2021 $75,000 Total estimated uncollectibles 8,000 2,400 1,100 $101.200 $86,500 Estimated Percentage Uncollectible 3% 5% 23% 50% c Determine the total estimated uncollectibles at March 31, 2022.arrow_forwardPlease do not give image format and solve with explanationarrow_forwardNonearrow_forward

- Please do not give solution in image format thankuarrow_forwardQuestion Content Area Estimating Allowance for Doubtful Accounts Kirchhoff Industries has a past history of uncollectible accounts, as shown below. Age Class PercentUncollectible Not past due 1% 1-30 days past due 5 31-60 days past due 25 61-90 days past due 35 Over 90 days past due 50 Estimate the allowance for doubtful accounts, based on the aging of receivables schedule below. Kirchhoff IndustriesAging of Receivables Scheduleblank Customer Balance Not PastDue 1-30 DaysPast Due 31-60 DaysPast Due 61-90 DaysPast Due Over 90 DaysPast Due Subtotals 840,000 495,600 184,800 75,600 42,000 42,000 Conover Industries 18,100 18,100 Keystone Company 18,200 18,200 Moxie Creek Inc. 6,600 6,600 Rainbow Company 10,000 10,000 Swanson Company 23,100 23,100 Total receivables 916,000 518,700 194,800 82,200 60,200 60,100 Percentage uncollectible 1% 5% 25% 35% 50% Allowance for Doubtful…arrow_forwardDo not give answer in image formatearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education