Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN: 9781305654174

Author: Gary A. Porter, Curtis L. Norton

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

None

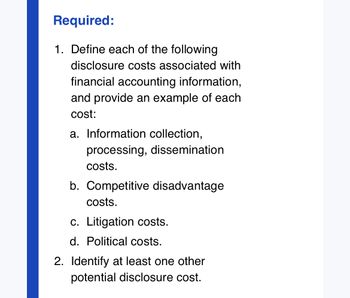

Transcribed Image Text:Required:

1. Define each of the following

disclosure costs associated with

financial accounting information,

and provide an example of each

cost:

a. Information collection,

processing, dissemination

costs.

b. Competitive disadvantage

costs.

c. Litigation costs.

d. Political costs.

2. Identify at least one other

potential disclosure cost.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- In conducting a B/C analysis, (a) why is it usually necessary to take a specific viewpoint in categorizing cost, benefit, disbenefit estimates; and (b) what are two specific viewpoints that you can identify if the situation is a financial transaction between you and another person? Between your company and an international customer?arrow_forwardWhich of the following costs would not be included in accounting financial statements? O A. opportunity costs O B. sunk costs O C. historical costs O D. All of the above would be included in accounting financial statementsarrow_forwardIndicate the proper accounting for the following items.(a) Organization costs. (c) Operating losses.(b) Advertising costs.arrow_forward

- Which of the following accounting principles or conventions is contradictory to the GAAP requirement to expense R&D costs immediately? matching principle historical cost principle comparability conservatismarrow_forward1-Explain the meanings of (1) cost, (2) expense, (3) loss as used for financial reporting in conformity with GAAP. In your explanation, discuss the distinguishing characteristics of the terms and their similarities and interrelationships.arrow_forwardAn analyst must be familiar with the determination of income. Income reported for a business entity depends on proper recognition of revenues and expenses. In certain cases, costs are recog- nized as expenses at the time of product sale; in other situations, guidelines are applied in capi- talizing costs and recognizing them as expenses in future periods. Required: a. Under what circumstances is it appropriate to capitalize a cost as an asset instead of expensing it? Explain. b. Certain expenses are assigned to specific accounting periods on the basis of systematic and rational allocation of asset cost. Explain the rationale for recognizing expenses on such a basis.arrow_forward

- 3. Listed are the possible answersarrow_forwardWhat qualitative characteristic defines, the underlying influence in the preparation of financial statements is the weighing of costs and benefits regarding the presentation of information A) Materiality Cost constraints Faithful representation D Going concernarrow_forwardExplain Prorations, Escrow Costs, and Payments to Third Parties?arrow_forward

- Contrast a revenue/expense approach and an asset/liability approach to accounting standard setting.arrow_forwardIs the matching of costs and revenue a basic accounting principle?arrow_forwardAnswer the following questions in multiple-choice answers: 1. The book value of the equipment currently owned by a firm is an example of a(n): a. future cost. b. differential cost. c. comparative cost. d. opportunity cost. e. sunk cost. 2. An accounting information system should be designed to provide information that is useful. To be useful the information must be: a. qualitative rather than quantitative. b. unique and unavailable through other sources. c. historical in nature and not purport to predict the future. d. marginal between two alternatives. e. relevant, accurate, and timely. 3. Factors in a decision problem that cannot be expressed in numerical terms are: a. qualitative in nature. b. quantitative in nature. c. predictive in nature. d. sensitive in nature. e. uncertain in nature. 4. An opportunity cost may be described as: a. a foregone benefit. b. a historical cost. c. a specialized…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College