Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide correct solution

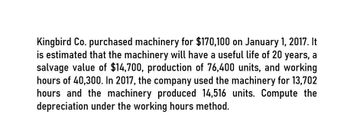

Transcribed Image Text:Kingbird Co. purchased machinery for $170,100 on January 1, 2017. It

is estimated that the machinery will have a useful life of 20 years, a

salvage value of $14,700, production of 76,400 units, and working

hours of 40,300. In 2017, the company used the machinery for 13,702

hours and the machinery produced 14,516 units. Compute the

depreciation under the working hours method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.arrow_forwardKingbird Co. purchased machinery for $170,100 on January 1, 2017. It is estimated that the machinery will have a useful life of 20 years, a salvage value of $14,700, production of 76,400 units, and working hours of 40,300. In 2017, the company used the machinery for 13,702 hours and the machinery produced 14,516 units. Compute the depreciation under the working hours method.arrow_forwardSilverman Company purchased machinery for $162,000 on January 1, 2017. It is estimated that the machinery will have a useful life of 20 years, salvage value of $15,000, production of 84,000 units, and working hours of 42,000. During 2017, the company uses the machinery for 14,300 hours, and the machinery produces 20,000 units. Compute depreciation under the straight-line, units-of-output, working hours, sum-of-the-years’-digits, and double-declining-balance methods.arrow_forward

- Telimos purchased a machinery for 315,000 on May 1,2017. It is estimated that it will have a useful life of 10 years,salvage value of 15,000, production of 240,000 units, and workinghours of 25,000. During 2018 it uses the machinery for 2,650 hours, and the machinery produces 25,500 units. From the information given, compute the depreciation charge for 2018 under each of the following methods. (Round to the nearest dollar.) as per units of output, working hours and declining balance method with 20% as annual rate.arrow_forwardOn April 1, 2017, Mills Company acquired equipment for $125,000. The estimated useful life is six years, and the estimated residual value is $5,000. Mills estimates that the equipment can produce 25,000 unts of product. During 2017 and 2018, respectively, 3,000 units and 4,200 units were produced. Mills reports on a calendar year basis. Required: Calculate depreciation expense for 2017 and 2018 under each of the following methods (ssume that Mills calculates depreciation to the nearest month in the year of acquisition): 1. Straight-line method. 2. Production method (units of output).arrow_forwardOn January 1, 2017, Bushong Company purchased equipment at a cost of $12,600. The equipment had an estimated useful life of 6 years or 30,000 hours. The equipment will have a $1,200 salvage value at the end of its life. The equipment was used 6,500 hours in 2017. The depreciation expense for the year ending December 31, 2017, using the units-of-production method would be a.$2,470. b.$2,730. c.$3,800. d.$6,500.arrow_forward

- On January 1, 2015, Mogul company acquired equipment to be used in the manufacturing operations. The equipment has an estimated useful life of 10 years and an estimated residual value of 50,000. The depreciation applicable to this equipment was 240,000 for 2017 computed under the sum of year’s digit method. What was the acquisition cost of the equipment?arrow_forwardWynn Furnance Corp. purchased machinery for $345,000 on May 1, 2014. It is estimated that it will have a useful life of 10 years, scrap value of $45,000-production of 120,000 units and working hours of 12,500. During 2015 Wynn uses the machinery for 2,000 hours and the machinery produces 25,000 units. INSTRUCTION: From the information given, compute the depreciation charge for 2015 under each of the following methods (round to three decimal places) A). Straight-Line B). Units-of-output C). Working Hours D). Sum-of-the-years-digits E.) Declining-balance (use 20% as the annual rate)arrow_forwardOn December 31, 2017, Ayayai Inc. has a machine with a book value of $1,297,200. The original cost and related accumulated depreciation at this date are as follows. Machine $1,794,000 Less: Accumulated depreciation 496,800 Book value I $1,297,200 Depreciation is computed at $82,800 per year on a straight-line basis. For the following situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. A fire completely destroys the machine on August 31, 2018. An insurance settlement of $593,400 was received for this casualty. Assume the settlement was received immediately.arrow_forward

- On December 31, 2017, Swifty Inc. has a machine with a book value of $1,015,200. The original cost and related accumulated depreciation at this date are as follows. Machine $1,404,000 Less: Accumulated depreciation 388,800 Book value $1,015,200 Depreciation is computed at $64,800 per year on a straight-line basis.Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. A fire completely destroys the machine on August 31, 2018. An insurance settlement of $464,400 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for…arrow_forwardNeed answerarrow_forward(Depreciation Computations—Five Methods, Partial Periods) Muggsy Bogues Company purchased equipment for $212,000 on October 1, 2017. It is estimated that the equipment will have a useful life of 8 years and a salvage value of $12,000. Estimated production is 40,000 units and estimated working hours are 20,000. During 2017, Bogues uses the equipment for 525 hours and the equipment produces 1,000 units.InstructionsCompute depreciation expense under each of the following methods. Bogues is on a calendar-year basis ending December 31.(a) Straight-line method for 2017.(b) Activity method (units of output) for 2017.(c) Activity method (working hours) for 2017.(d) Sum-of-the-years’-digits method for 2019.(e) Double-declining-balance method for 2018.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning