Principles of Cost Accounting

17th Edition

ISBN: 9781305087408

Author: Edward J. Vanderbeck, Maria R. Mitchell

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

I want to answer this question

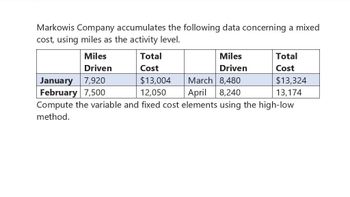

Transcribed Image Text:Markowis Company accumulates the following data concerning a mixed

cost, using miles as the activity level.

Miles

Total

Miles

Total

Driven

Cost

Driven

Cost

January 7,920

$13,004

March 8,480

$13,324

February 7,500

12,050

13,174

Compute the variable and fixed cost elements using the high-low

April 8,240

method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- :On the cost-volume-profit graph, the intersection between the total cost line and (Y) axis represents The profit area a O The fixed cost amount b O The loss area .c O The contribution margin per unit .d O The variable cost amount eeV@hdows Go to Settings to activate Wil 081 ENG hp 19 11 inprt sc delete home end & num 6 8 9. backspace = lock V { Y U 7 V 8. home H. K enter pause N 1 shift 上 end alt ctrl Pm 近arrow_forwardChoose the correct letter of answer On a scattergrap, the diagonal line cuts across two sets of observations, namely: 600:200, and 900:500 which refer to costs and units, respectively. The fixed costs is plotted in the graph at P400. In this case, the variable cost per unit is equal to: a. P1.00b. P1.25c. P1.50d. P1.12arrow_forwardIN EXCEKL FORMATarrow_forward

- 1. You have been provided with the following data regarding shipments and costs for Brighton Boutiques: Number of Shipments Received Cost per Receiving Report $202 185 120 105 70 80 87 115 100 $300 $200 $100 $- 0 142 154 20 162 Required: Plot the data points on a scatter graph, and then using the high-low method, determine the cost function of the line that will connect the high and low points on the graph. Does the cost function appear to be linear in nature? 200 175 Graph Template 40 80 60 Number of Shipments 100 120 140arrow_forwardQ3. ADLG Company has two support departments, SS1 and SS2, and two operating departments, OD1 and OD2. The company has decided to use the direct method and allocate variable SS1 dept. costs based on the number of transactions and fixed SS1 dept. costs based on the number of employees. SS2 dept. variable costs will be allocated based on the number of service requests and fixed costs will be allocated based on the number of computers. The following values have been extracted for the allocation | Total Department variable costs Total department fixed costs Number of transactions Number of employees Number of service requests Number of computers Support Departments SS1 16,000 19,500 50 18 37 20 SS2 19,000 34,000 You are required to allocate variable and fixed costs. 55 24 22 25 Operating Departments OD1 105,000 120,000 250 47 26 31 OD2 68,000 55,000 140 38 32 37arrow_forwardThe Frame Shoppe reported the following information:Contribution margin per unit TL 90Contribution margin TL 3,500Operating income TL 1,500 Compute the degree of operating leverage at the Frame Shoppe.arrow_forward

- The graphs below represent cost behavior patterns that might occur in acompany's cost structure. The vertical axis represents total cost, and thehorizontal axis represents activity output. Required:For each of the following situations, choose the graph from the group a-1 that best illustrates the cost pattern involved. Also, for each situation,identify the driver that measures activity output. 1. The cost of power when a fixed fee of $500 per month is chargedplus an additional charge of $0.12 per kilowatt-hour used2. Commissions paid to sales representatives. Commissions arepaid at the rate of 5 percent of sales made up to total annual salesof $500,000, and 7 percent of sales above $500,000.3. A part purchased from an outside supplier costs $12 per part for the first 3,000 parts and $10 per part for all parts purchased inexcess of 3,000 units.4. The cost of surgical gloves, which are purchased in incrementsof 100 units (gloves come in boxes of 100 pairs).5. The cost of tuition at a…arrow_forwardNewport, Inc. used Excel to run a least-squares regression analysis, which resulted in the following output: Regression Statistics Multiple R R Square Observations 0.7225 0.8500 30 Coefficients Standard Error T Stat P-Value 0.021 Intercept Production (X) 31,000 5.87 3,493 2.86 0.4640 14.30 0.000 a. What is Newport's total fixed cost? Total Fixed Cost b. What is Newport's variable cost per unit? (Round your intermediate calculations to 2 decimal places.) Variable Cost per unit c. What total cost would Newport predict for a month in which they sold 5,000 units? Total Costs d. What proportion of variation in Newport's cost is explained by variation in production? (Round your intermediate calculations to 2 decimal places.) Proportion of Variationarrow_forwardAn analyst has started preparing a spreadsheet as shown below. Column A contains the headings for various parameters and Column B contains the analyst's range names to be used in Excel. A 1 Price per Unit 2 Cost per Unit 3 Profit per Unit Price_per_Unit Cost per Unit Profit$_per_Unit 4. 5 Fixed Costs 6 Variable Costs Fixed Costs VariableCosts Label each of the following range names as "Correct" if is a valid range name in Excel or "Incorrect" if the range name is not valid for use in Excel. Proposed Range Name Price_per_Unit Cost per Unit Profit$_per_Unit Fixed Costs VariableCostsarrow_forward

- High-low method Evander Inc. has decided to use the high-low method to estimate the total cost and the fixed and variable cost components of the t cost. The data for various levels of production are as follows: Units Produced Total Costs 2,100 3,770 5,600 $245,700 332,790 382,200 This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input answers in the questions below. X Open spreadsheet a. Determine the variable cost per unit and the total fixed cost. Variable cost $ Total fixed cost $ 36 X b. Based on part (a), estimate the total cost for 2,770 units of production. Total cost for 2,770 unitsarrow_forwardBased on the following sensitivity report, what would be the impact of changing the objective function coefficient for Product 1 to 18 and changing the objective function coefficient for Product_3 to 13? Variable Cells Cell $B$2 $B$3 $B$4 Constraints Cell $H$9 $H$10 $H$11 Name Product 1 Product 2 Product 3 Name Resource A Resource_B Resource C Applying the 100% rule, Final Value 0 175 Final Value 1 0 525 700 Reduced Cost -2 0 -1.5 Shadow Price 0 1.75 Objective Coefficient Constraint R.H.Side 13 14 10 HELSI 100 800 700 Allowable Increase 3 1E+30 5 Allowable Increase 1E+30 1E+30 366.6666667 Allowable Decrease 1E+30 9 1E+30 Allowable Decrease 100 275 700 because the total change in the objective function coefficients 100%.arrow_forwardQ2. PPLC Company has two support departments, SD1 and SD2, and two operating departments, ODI and OD2. The company decided to use the direct method and allocate variable SD1 dept. costs based on the number of transactions and fixed SD1 dept. costs based on the number of employees. SD2 dept. variable costs will be allocated based on the number of service requests, and fixed costs will be allocated based on the number of computers. The following information is provided: (4 Marks) (Chapter 8, Week 10) Support Departments Operating Departments SD1 SD2 ODI OD2 Total Department variable costs 18,000 19,000 51,000 35,000 Total department fixed costs 20,000 24,000 56,000 30,000 Number of transactions 30 40 200 100 Number of employees 14 18 35 30 Number of service requests 28 18 35 25 Number of computers 15 20 24 28 You are required to allocate variable and fixed costs using direct method.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning